Editor’s Letter

This week’s brief examines a valuation framework that has quietly shaped how many macro-oriented investors think about early-stage digital assets, even if it is rarely discussed with precision. The Adoption Growth Valuation Model—previously referred to as the Raoul Pal Valuation Model—offers a lens that connects transactional activity and holder growth to implied value, without relying on cash flows, protocol revenues, or speculative narratives. In revisiting this model through a commodity-native lens, the objective is not to assert price targets, but to understand what the model reveals about iEthereum’s evolving structural behavior across 2024 and 2025.

Full Technical Brief (Institutional Research Note)

The Adoption Growth Valuation Model sits at the intersection of usage and distribution, expressing value as a function of average daily volume multiplied by the number of wallet holders, normalized by circulating supply. At its core, the model attempts to approximate how broadly and how actively a fixed-supply asset is being used, and then asks what that activity implies when spread across an immutable base. In the case of iEthereum, the denominator has historically been set at the full 18 million supply, reflecting the asset’s genesis-level issuance and absence of protocol-level locks. Beginning in 2026, however, methodological refinement allows for a more precise circulating supply definition by excluding economically inaccessible units—specifically, the 20,098 iEthereum sent irretrievably to the contract itself—resulting in an adjusted circulating supply of 17,979,902. While this adjustment does not materially alter historical interpretation, it improves forward accuracy and aligns the model with institutional commodity accounting standards.

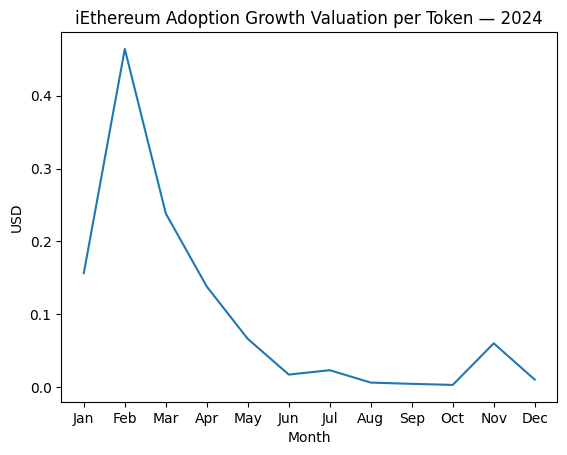

Taken together, the 2024 data illustrates the model’s sensitivity to episodic adoption bursts. Valuation per token peaked sharply in early 2024, with February reaching approximately $0.46 and an implied total market capitalization exceeding $8.3 million, before declining steadily through the remainder of the year. This pattern reflects a period in which wallet growth and transactional activity briefly outpaced the depth and durability of liquidity, producing elevated implied values that were not structurally sustained. By contrast, the latter half of 2024 shows a pronounced compression, with per-token valuations falling into the low-single-cent range by year-end. Rather than signaling failure, this compression is characteristic of early commodity monetization phases, where initial discovery gives way to consolidation as speculative activity subsides and only persistent usage remains.

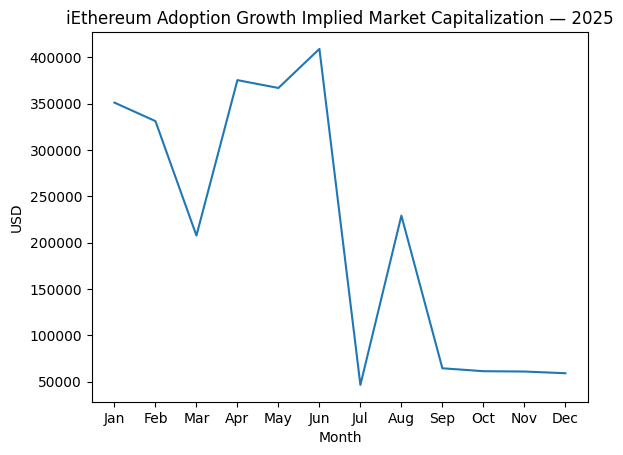

When interpreted through a commodity lens, the 2025 figures reinforce this maturation narrative. Quarterly averages declined meaningfully year-over-year, with Q1 2025 averaging roughly $0.016 per token compared to Q1 2024’s $0.287. Subsequent quarters continued this contraction, culminating in a Q4 2025 per-token valuation near $0.0034 and an implied total market capitalization of approximately $60,000. Month-to-month volatility remained present—particularly during mid-year, where July and September registered notably low implied values—but the amplitude of these moves narrowed relative to 2024. This pattern reflects a transition from episodic adoption spikes toward a thinner, but more stable, base of holders and activity.

By contrast with equity-style valuation models, the Adoption Growth Valuation Model does not reward narrative expansion or future promises. It responds mechanically to observed behavior. For iEthereum, declining implied valuations alongside a relatively stable holder base suggest that transactional intensity per holder has moderated, a common outcome as early adopters shift from exploratory transfers to longer-term holding behavior. Importantly, exchange wallet dynamics play a non-trivial role in this interpretation. Concentrated liquidity on a limited number of venues can amplify or suppress average daily volume without reflecting true end-user adoption. As such, periods of low implied valuation should not be read solely as declining interest, but as indicative of a market structure where off-exchange holding and thin exchange liquidity dampen observable flow metrics.

This pattern reflects a broader truth about commodity-like digital assets: valuation models anchored in activity will often understate long-term optionality during phases of accumulation and overstate it during bursts of speculative throughput. In summary, the Adoption Growth Valuation Model is most useful as a diagnostic tool rather than a pricing oracle. For iEthereum, it documents a clear arc from early, volatile adoption signals in 2024 toward a more subdued, structurally consistent profile in 2025—an outcome that aligns with the behavior of scarce settlement commodities rather than growth-oriented network equities.

Commodity Behavior Interpretation

The Adoption Growth Valuation Model demonstrates commodity-like behavior by anchoring value to observable usage and distribution across a fixed base, rather than to expectations of future cash flows or protocol expansion. As with physical commodities, periods of low throughput do not negate underlying scarcity; instead, they reflect phases of inventory holding and market digestion. For iEthereum, the declining implied valuations across 2025 mirror this dynamic, highlighting its role as a settlement asset whose economic significance may persist even when transactional velocity temporarily contracts.

DCI Licensed Access Call To Action

This weekly iEthereum Commodity Technical Brief is an independent interpretive analysis informed by the iEthereum Digital Commodity Index (DCI), a longitudinal, institutional-grade research framework tracking the structure and behavior of a neutral, fixed-supply digital commodity. The brief reflects analytical interpretation and synthesis and is not itself an excerpt from the DCI reports.

The iEthereum Digital Commodity Index is offered under formal institutional license. Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, commodity-focused market structure analysis, longitudinal continuity across publications, and access to the underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit https://www.iethereum.org/iethereum-dci-reports or request a DCI license directly with Knive Spiel at [email protected].

Note: iEthereum is a 2017 MIT open-source licensed project. We are not the founders and have no direct or official affiliation with the iEthereum project or team. We are independent analysts and investors publishing our own research and interpretations.

If you see value in our weekly writing and independent public work, please subscribe to our free newsletter and/or share this article on social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

Retail Reader Access (Newsletter + Membership)

Our public writing is designed for retail readers and independent thinkers who want to explore iEthereum through weekly analysis, technical commentary, speculative thought and narrative-based iEtherean Tales.

We offer subscription access for readers who want to support the work and receive expanded content:

Free — introductory iEthereum articles and public updates

iEthereum Advocate — full access to premium essays & content, private telegram group and subscriber-only content (excluding institutional DCI reports)

Receive free iEthereum with an annual iEthereum Advocate subscription.

(Subscriptions are designed for public readership and community support, not institutional research licensing.)

Institutional Research (DCI Licensed Access)

The iEthereum Digital Commodity Index (DCI) is a separate institutional-grade research product offered under licensed access (not public subscription tiers). Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, commodity-focused market structure analysis, and access to underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit iEthereum.org or request a DCI license directly with Knive Spiel at [email protected].

Donations / Sponsorship

For those inspired to support the work via donation or sponsorship, the iEthereum Advocacy Trust provides a simple avenue — a wallet address ready to receive Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, other EVM-compatible network assets, and ERC tokens (including iEthereum).

Ethereum address: 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

Contact / Consulting

For inquiries, tips, corrections, collaborations, or consultation requests:

[email protected]

Do your own research. We are not financial or investment advisors!