Editor’s Letter

This week’s brief examines total monthly and quarterly USD-denominated transfer volume for iEthereum across 2024 and 2025, with the objective of situating observed activity within a commodity-measurement framework rather than a speculative trading narrative. Volume, when treated carefully, offers insight into settlement usage, episodic liquidity, and market engagement without asserting demand forecasts or price implications. The analysis below is intended to clarify what this metric reveals about iEthereum’s economic behavior—and just as importantly, what it does not—when observed longitudinally.

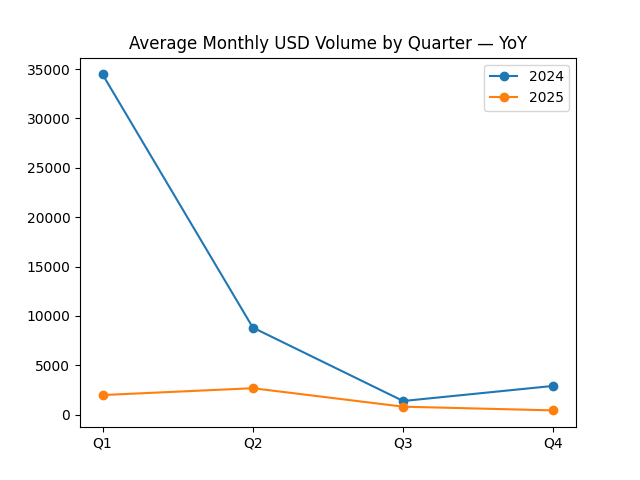

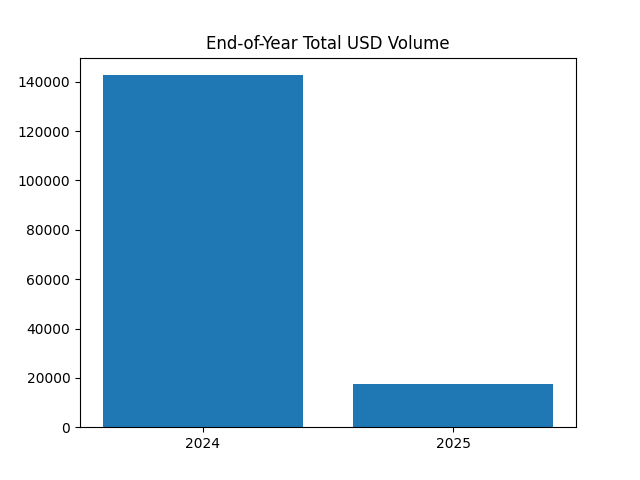

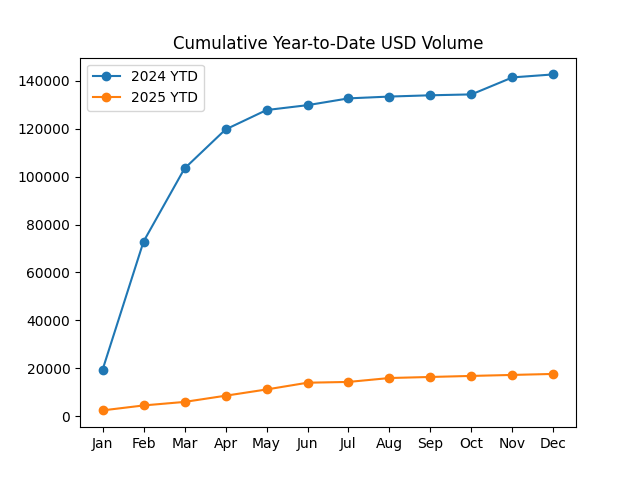

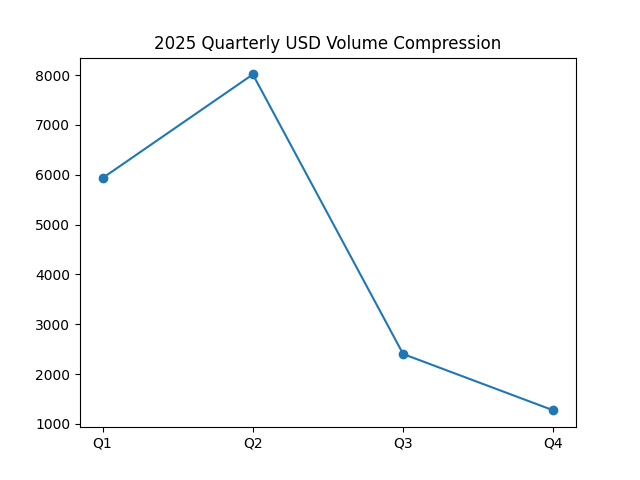

The total monthly USD volume metric captures the notional dollar value of iEthereum transferred during a given period, aggregated from on-chain activity and expressed in USD terms for cross-period comparability. In 2025, total end-of-year volume reached $17,620.48, distributed unevenly across quarters, with Q1 contributing $5,933.34, Q2 $8,014.81, Q3 $2,401.99, and Q4 $1,270.35. Monthly activity during the first half of the year was comparatively stable, with January through June ranging between roughly $1,476 and $2,818 per month, before a marked contraction in Q3 and a further compression into Q4. Average monthly volume followed a similar pattern, declining from $1,977.78 in Q1 to $2,671.60 in Q2, then falling sharply to $800.66 in Q3 and $423.45 in Q4, culminating in a 2025 full-year average of $702.12 per month.

By contrast, 2024 presents a substantially higher and more volatile volume profile. Total USD volume for the year reached $142,664.47, nearly an order of magnitude greater than 2025, with pronounced concentration in Q1 2024 alone at $103,385.24. January, February, and March 2024 registered exceptionally elevated volumes—$19,318.74, $53,557.56, and $30,508.95 respectively—before activity normalized significantly in subsequent quarters. Average monthly volume declined from $34,461.75 in Q1 to $8,811.86 in Q2, $1,374.60 in Q3, and $2,906.61 in Q4, yielding a full-year average of $5,690.05. The year-over-year comparison therefore reflects not a gradual decay but a structural transition from episodic, high-intensity activity toward lower, more consistent settlement usage.

Taken together, these patterns indicate that USD volume in iEthereum is highly sensitive to discrete events, liquidity conditions, and holder behavior rather than continuous transactional throughput. The sharp contrast between early-2024 volumes and the subdued profile of late-2025 does not imply a loss of economic relevance; rather, it underscores the importance of interpreting volume through a commodity lens. Unlike payment networks or application tokens, iEthereum does not require persistent transactional churn to justify its role. Periods of low volume may simply reflect extended holding behavior, reduced exchange intermediation, or the absence of large balance reallocations during stable market phases.

When interpreted through a commodity framework, declining or uneven volume is often consistent with maturation rather than abandonment. Physical commodities frequently exhibit bursts of turnover around inventory rebalancing, hedging cycles, or macro-driven repricing events, followed by extended intervals of relative quiet. iEthereum’s 2025 profile—particularly the compression of activity in Q3 and Q4—aligns with this pattern, suggesting reduced speculative circulation and a higher proportion of dormant or reserve-oriented balances. Volume, in this context, functions as a settlement signal rather than a proxy for adoption velocity.

Exchange wallet dynamics further nuance this interpretation. A meaningful portion of USD-denominated volume historically originates from transfers involving custodial or exchange-associated wallets, where a small number of large transactions can dominate monthly aggregates. The absence of such events in late-2025 materially lowers reported volume without necessarily altering underlying ownership distribution or long-term holder conviction. Thin liquidity environments amplify this effect, making volume a lumpy and discontinuous metric that must be read alongside custody concentration and market access constraints.

In summary, total monthly and quarterly USD volume provides a useful but limited window into iEthereum’s observed economic behavior. The data confirms a transition away from episodic, high-intensity activity toward quieter settlement patterns consistent with a neutral, fixed-supply digital commodity held across longer horizons. While volume alone cannot diagnose adoption or value, its longitudinal behavior reinforces the importance of treating iEthereum as a durable settlement asset whose relevance is not contingent on constant transactional flow.

Commodity Behavior Interpretation

The observed volume profile demonstrates commodity-like characteristics through episodic turnover, durability of supply, and non-consumptive settlement use. iEthereum’s fixed issuance ensures that changes in USD volume reflect holder behavior and liquidity structure rather than protocol-driven supply dynamics. Periods of low activity are consistent with reserve holding and neutrality, reinforcing its classification as a digital commodity rather than a transactional utility token.

This weekly iEthereum Commodity Technical Brief is an independent interpretive analysis informed by the iEthereum Digital Commodity Index (DCI), a longitudinal, institutional-grade research framework tracking the structure and behavior of a neutral, fixed-supply digital commodity. The brief reflects analytical interpretation and synthesis and is not itself an excerpt from the DCI reports.

The iEthereum Digital Commodity Index is offered under formal institutional license. Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, commodity-focused market structure analysis, longitudinal continuity across publications, and access to the underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit https://www.iethereum.org/iethereum-dci-reports or request a DCI license directly with Knive Spiel at [email protected].

Note: iEthereum is a 2017 MIT open-source licensed project. We are not the founders and have no direct or official affiliation with the iEthereum project or team. We are independent analysts and investors publishing our own research and interpretations.

If you see value in our weekly writing and independent public work, please subscribe to our free newsletter and/or share this article on social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

Retail Reader Access (Newsletter + Membership)

Our public writing is designed for retail readers and independent thinkers who want to explore iEthereum through weekly analysis, technical commentary, speculative thought and narrative-based iEtherean Tales.

We offer subscription access for readers who want to support the work and receive expanded content:

Free — introductory iEthereum articles and public updates

iEthereum Advocate — full access to premium essays & content, private telegram group and subscriber-only content (excluding institutional DCI reports)

Receive free iEthereum with an annual iEthereum Advocate subscription.

(Subscriptions are designed for public readership and community support, not institutional research licensing.)

Institutional Research (DCI Licensed Access)

The iEthereum Digital Commodity Index (DCI) is a separate institutional-grade research product offered under licensed access (not public subscription tiers).

The iEthereum Digital Commodity Index (DCI) is a longitudinal research archive documenting the observed structure and behavior of a neutral, fixed-supply digital commodity. It is published monthly and quarterly to preserve analytical continuity independent of narratives, governance influence, or promotional activity. The DCI does not predict outcomes or promote adoption; it maintains measurement consistency across time.

Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, market structure analysis, and access to underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit iEthereum.org or request a DCI license directly with Knive Spiel at [email protected].

Donations / Sponsorship

For those inspired to support the work via donation or sponsorship, the iEthereum Advocacy Trust provides a simple avenue — a wallet address ready to receive Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, other EVM-compatible network assets, and ERC tokens (including iEthereum).

Ethereum address: 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

Contact / Consulting

For inquiries, tips, corrections, collaborations, or consultation requests:

[email protected]

Do your own research. We are not financial or investment advisors!