Editor’s Letter

This week’s technical brief focuses on ownership concentration as a structural attribute rather than a normative outcome. By examining the Gino Coefficient across 2025 and introducing the exchange-excluded lens now available in the v3.0 iEthereum Digital Commodity Index; the analysis highlights how custody infrastructure and economic ownership diverge in a fixed-supply digital commodity. The objective is not to judge distribution, but to clarify how iEthereum is held, intermediated, and stabilized through time.

Technical Brief

This week’s technical brief examines the Gino Coefficient as a longitudinal indicator of ownership concentration within iEthereum, interpreted explicitly through a commodity-structure lens rather than an equity or protocol governance framework. As a fixed-supply digital commodity with no issuance discretion, no yield mechanism, and no consumption function, iEthereum’s distribution metrics are best understood as descriptive signals of custody structure, settlement behavior, and participant persistence rather than outcomes to be optimized or engineered. The Gino Coefficient, when observed consistently through time, provides a compact but powerful summary of how supply is held across the address spectrum, while remaining agnostic to motive, identity, or future intent.

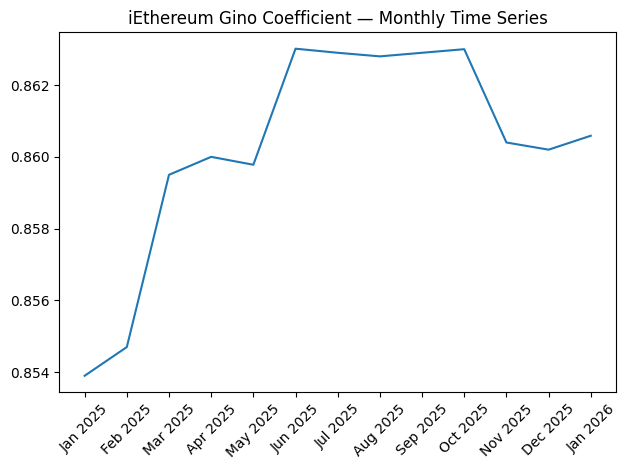

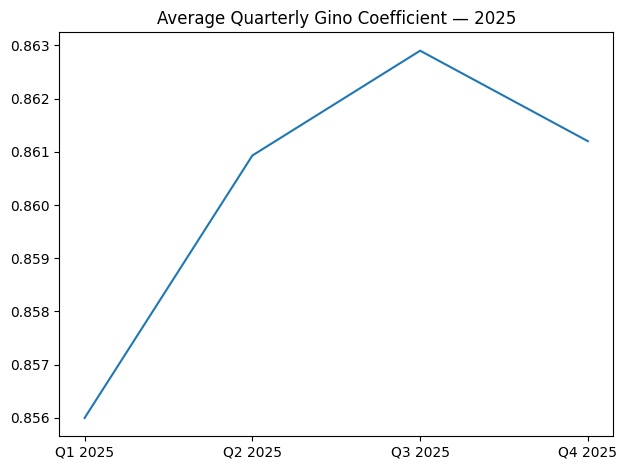

Across calendar year 2025, the headline Gino Coefficient remained elevated and structurally stable, beginning the 2025 year at 0.8539 in January and closing at 0.8612 by year-end. Quarter-level averages show a gradual upward drift from an average of 0.8560 in Q1 to 0.8609 in Q2, peaking at 0.8629 in Q3 before modestly easing to 0.8612 in Q4. Taken together, these movements indicate persistence rather than acceleration, with changes occurring incrementally rather than episodically. Month-to-month variation throughout the year remained narrow, with no abrupt inflections that would suggest redistribution events, issuance shocks, or structural regime change. When interpreted through a commodity lens, this pattern reflects durability of ownership rather than concentration risk in the equity sense.

By contrast with early-stage digital assets that experience rapid dispersion or consolidation cycles driven by emissions, incentives, or protocol-level interventions, iEthereum’s fixed and immutable supply introduces a different interpretive boundary. Changes in the Gino Coefficient are necessarily the result of secondary market transfers and custody decisions alone. The observed year-over-year increase of roughly 70 basis points from January to December 2025 therefore signals a slow accretion of holdings among larger addresses rather than an extraction of value from smaller participants. Importantly, the absence of volatility in this measure reinforces the interpretation that iEthereum behaves more like a settlement commodity accumulating into longer-horizon custody rather than a reflexive risk asset rotating rapidly between cohorts.

This interpretation is further sharpened by the introduction, in the January 2026 iEthereum Digital Commodity Index v3.0 reports, of an exchange-excluded Gino Coefficient. For January 2026, the headline Gino Coefficient registered at 0.860588, while the exchange-excluded variant measured 0.813787. The magnitude of this differential is analytically significant. It demonstrates that a non-trivial portion of observed concentration in the headline metric is attributable to custodial aggregation rather than economic ownership concentration. In commodity markets, such aggregation is not anomalous; it is a structural byproduct of centralized warehousing, clearing venues, and settlement intermediaries. When exchange wallets are excluded, the resulting lower Gino value suggests a more distributed underlying ownership profile among economically distinct holders than the headline figure alone would imply.

When interpreted through a commodity lens, this divergence reinforces an important analytical boundary. The Gino Coefficient does not distinguish between custody and control, nor between settlement infrastructure and beneficial ownership. As such, the exchange-excluded series should not be viewed as a “corrected” metric, but rather as a complementary lens that isolates economic ownership from liquidity infrastructure. The coexistence of both series enables institutional observers to separate questions of counterparty concentration from questions of asset dispersion, without collapsing the two into a single narrative.

In summary, the Gino Coefficient across 2025 and into early 2026 reflects a neutral, durable, and structurally consistent ownership profile for iEthereum. Incremental increases over time align with commodity-like accumulation behavior rather than speculative redistribution, while the exchange-excluded metric clarifies that much of the observed concentration resides within liquidity and custody rails rather than among dominant economic actors. The metric is therefore most useful not as a signal of fairness or risk, but as a descriptive indicator of how a fixed-supply digital commodity is held, stored, and intermediated as it matures.

Commodity Behavior Interpretation

The observed Gino Coefficient behavior reinforces iEthereum’s classification as a neutral, fixed-supply digital commodity. Scarcity is preserved through immutable supply, while durability is reflected in the slow, monotonic evolution of ownership concentration rather than abrupt redistribution. The presence of custodial aggregation mirrors physical commodity warehousing and exchange settlement dynamics, underscoring non-consumptive, settlement-native behavior rather than productive or yield-driven use. Measurement consistency across months and quarters further supports the interpretation of iEthereum as an asset whose primary function is storage and transfer of value, not transformation or consumption.

Editorial Independence Statement

This weekly iEthereum Commodity Technical Brief is an independent interpretive analysis informed by the iEthereum Digital Commodity Index (DCI), a longitudinal, institutional-grade research framework tracking the structure and behavior of a neutral, fixed-supply digital commodity. The brief reflects analytical interpretation and synthesis and is not itself an excerpt from the DCI reports.

The iEthereum Digital Commodity Index is offered under formal institutional license. Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, commodity-focused market structure analysis, longitudinal continuity across publications, and access to the underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit https://www.iethereum.org/iethereum-dci-reports or request a DCI license directly with Knive Spiel at [email protected].

Note: iEthereum is a 2017 MIT open-source licensed project. We are not the founders and have no direct or official affiliation with the iEthereum project or team. We are independent analysts and investors publishing our own research and interpretations.

If you see value in our weekly writing and independent public work, please subscribe to our free newsletter and/or share this article on social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

Retail Reader Access (Newsletter + Membership)

Our public writing is designed for retail readers and independent thinkers who want to explore iEthereum through weekly analysis, technical commentary, speculative thought and narrative-based iEtherean Tales.

We offer subscription access for readers who want to support the work and receive expanded content:

Free — introductory iEthereum articles and public updates

iEthereum Advocate — full access to premium essays & content, private telegram group and subscriber-only content (excluding institutional DCI reports)

Receive free iEthereum with an annual iEthereum Advocate subscription.

(Subscriptions are designed for public readership and community support, not institutional research licensing.)

Institutional Research (DCI Licensed Access)

The iEthereum Digital Commodity Index (DCI) is a separate institutional-grade research product offered under licensed access (not public subscription tiers).

The iEthereum Digital Commodity Index (DCI) is a longitudinal research archive documenting the observed structure and behavior of a neutral, fixed-supply digital commodity. It is published monthly and quarterly to preserve analytical continuity independent of narratives, governance influence, or promotional activity. The DCI does not predict outcomes or promote adoption; it maintains measurement consistency across time.

Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, market structure analysis, and access to underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit iEthereum.org or request a DCI license directly with Knive Spiel at [email protected].

Donations / Sponsorship

For those inspired to support the work via donation or sponsorship, the iEthereum Advocacy Trust provides a simple avenue — a wallet address ready to receive Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, other EVM-compatible network assets, and ERC tokens (including iEthereum).

Ethereum address: 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

Contact / Consulting

For inquiries, tips, corrections, collaborations, or consultation requests:

[email protected]

Do your own research. We are not financial or investment advisors!