Editor’s Letter

This week’s brief examines iEthereum’s total market capitalization expressed in ETH terms, a measurement that removes USD price distortion and instead observes the commodity’s relative capital presence within its native settlement environment. When viewed longitudinally, market capitalization in ETH terms provides a structural lens into capital rotation, liquidity compression, and supply stability across market cycles. The objective is not to interpret directionality as signal, but to observe structural persistence and behavior through time.

Full Technical Brief

Total market capitalization measured in ETH terms provides a distinct analytical lens compared to USD-denominated measures. By denominating iEthereum’s total market value relative to ETH, the metric removes dollar-based inflation effects and isolates the asset’s relative capital footprint within the Ethereum settlement layer. This framing is particularly relevant when evaluating a fixed-supply digital commodity whose issuance parameters are immutable and whose total supply remains structurally capped at 18,000,000 units.

Beginning in January 2024, iEthereum’s total market capitalization in ETH terms registered 115.8408 ETH, holding nearly constant through February and March 2024 and closing Q1 2024 at 115.8413 ETH. This early-year stability reflected a period of relative equilibrium within the ETH-denominated frame. In April 2024, the metric expanded to 126.0000 ETH before compressing through May and June to 110.3832 ETH at the close of Q2 2024. Taken together, Q2 demonstrated modest contraction following an April expansion, yet remained within a narrow structural band relative to Q1 levels.

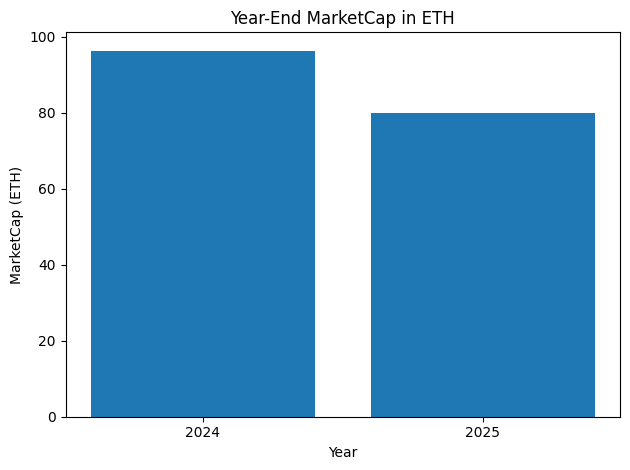

Q3 2024 exhibited a rebound, with July and August printing 119.6910 and 119.0340 ETH respectively, before moderating into September and closing Q3 at 115.0614 ETH. By contrast, Q4 2024 introduced a sharper compression phase, falling to 114.4368 ETH in October and then declining materially to 91.3554 ETH in November, before stabilizing into December at 96.3702 ETH. The 2024 year-end figure of 96.3702 ETH marked a notable contraction from the first-half equilibrium range near 115 ETH.

The 2025 series extended this contractionary profile. January 2025 opened at 101.5758 ETH before February temporarily expanded to 118.2600 ETH. However, by Q1 2025 close, the metric settled at 111.0150 ETH. Q2 2025 reflected a significant compression regime: April at 106.2000 ETH, May at 93.0366 ETH, and June collapsing to 52.3746 ETH. The Q2 close at 52.3746 ETH represented a structural inflection relative to prior quarterly ranges. Q3 2025 remained within this lower band, closing at 54.0900 ETH, and Q4 2025 ultimately rebounded to 79.9290 ETH by year-end. While still below 2024’s equilibrium range, the Q4 2025 figure suggested partial capital re-entry within the ETH frame.

January 2026 printed 83.7054 ETH, continuing the post-2025 recovery trajectory but remaining below early 2024 levels. Month-over-month expansion from December 2025 (79.9290 ETH) to January 2026 (83.7054 ETH) reflects modest relative capital strengthening within the ETH frame. When interpreted through a commodity lens, this movement does not imply directional price forecasting, but rather indicates changes in relative capital allocation measured against Ethereum itself.

It is important to clarify what this metric does and does not capture. Total market capitalization in ETH terms reflects the product of circulating supply and price, denominated in ETH. Because iEthereum’s supply is fixed and fully issued, changes in this metric are entirely price-driven within the ETH pair. The metric does not reveal volume depth, liquidity resilience, holder dispersion, or exchange concentration directly. Nor does it account for off-chain bilateral transactions. It is a structural footprint measure, not a liquidity stress indicator.

Exchange wallet concentration and custody structure remain relevant contextually. A material share of supply held on exchanges can amplify volatility in ETH-denominated market capitalization due to thinner on-chain liquidity depth. Conversely, conviction-weighted distribution across self-custodied wallets can dampen short-term fluctuations. Thus, while the ETH-denominated market capitalization series illustrates compression and recovery phases, it must be interpreted alongside liquidity concentration metrics rather than in isolation.

When viewed longitudinally across 2024–2026, the data reveals three structural regimes: an early equilibrium band near 115 ETH (Q1–Q3 2024), a compression phase culminating in the Q2 2025 trough near 52 ETH, and a partial recovery phase through late 2025 and early 2026. This pattern reflects capital rotation within the Ethereum ecosystem rather than supply alteration, as iEthereum’s issuance remains constant. The fixed-supply architecture ensures that all variability in ETH-denominated market capitalization emerges from market valuation dynamics rather than protocol-level intervention.

In summary, total market capitalization in ETH terms serves as a relative capital allocation barometer within Ethereum’s native unit of account. The metric demonstrates contraction and recovery cycles without altering the underlying supply structure. By isolating valuation from USD-based distortion, it reinforces the measurement consistency of iEthereum as a neutral, fixed-supply digital commodity under observation. The structural stability of issuance combined with observable capital rotation through ETH terms provides a durable longitudinal framework for institutional analysis.

Commodity Behavior Interpretation

Measured in ETH terms, iEthereum’s total market capitalization reinforces several commodity-like characteristics. First, scarcity is structurally embedded; the supply remains fixed, and all variation in market capitalization emerges from price discovery rather than issuance expansion. Second, neutrality is preserved; no administrative intervention alters supply or redistributes units. Third, durability is evident in the metric’s longitudinal consistency—despite compression and expansion phases, the underlying unit count remains unchanged. Finally, the non-consumptive settlement nature of iEthereum is highlighted: its valuation fluctuates, but its functional capacity as a transferable settlement unit persists independent of price regimes. The ETH-denominated lens emphasizes structural constancy beneath cyclical valuation dynamics.

Editorial Independence Statement

The iEthereum Commodity Technical Briefs are produced as independent analytical and interpretive research notes. While they are informed by empirical data and observations published in the iEthereum Digital Commodity Index (DCI), the briefs do not reproduce, excerpt, or substitute for the DCI reports themselves. All analysis, framing, and interpretation reflect independent editorial judgment and are intended to provide contextual insight rather than licensed research deliverables.

This weekly iEthereum Commodity Technical Brief is an independent interpretive analysis informed by the iEthereum Digital Commodity Index (DCI), a longitudinal, institutional-grade research framework tracking the structure and behavior of a neutral, fixed-supply digital commodity. The brief reflects analytical interpretation and synthesis and is not itself an excerpt from the DCI reports.

The iEthereum Digital Commodity Index is offered under formal institutional license. Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, commodity-focused market structure analysis, longitudinal continuity across publications, and access to the underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit https://www.iethereum.org/iethereum-dci-reports or request a DCI license directly with Knive Spiel at [email protected].

Note: iEthereum is a 2017 MIT open-source licensed project. We are not the founders and have no direct or official affiliation with the iEthereum project or team. We are independent analysts and investors publishing our own research and interpretations.

If you see value in our weekly writing and independent public work, please subscribe to our free newsletter and/or share this article on social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

Retail Reader Access (Newsletter + Membership)

Our public writing is designed for retail readers and independent thinkers who want to explore iEthereum through weekly analysis, technical commentary, speculative thought and narrative-based iEtherean Tales.

We offer subscription access for readers who want to support the work and receive expanded content:

Free — introductory iEthereum articles and public updates

iEthereum Advocate — full access to premium essays & content, private telegram group and subscriber-only content (excluding institutional DCI reports)

Receive free iEthereum with an annual iEthereum Advocate subscription.

(Subscriptions are designed for public readership and community support, not institutional research licensing.)

Institutional Research (DCI Licensed Access)

The iEthereum Digital Commodity Index (DCI) is a separate institutional-grade research product offered under licensed access (not public subscription tiers).

The iEthereum Digital Commodity Index (DCI) is a longitudinal research archive documenting the observed structure and behavior of a neutral, fixed-supply digital commodity. It is published monthly and quarterly to preserve analytical continuity independent of narratives, governance influence, or promotional activity. The DCI does not predict outcomes or promote adoption; it maintains measurement consistency across time.

Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, market structure analysis, and access to underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit iEthereum.org or request a DCI license directly with Knive Spiel at [email protected].

Donations / Sponsorship

For those inspired to support the work via donation or sponsorship, the iEthereum Advocacy Trust provides a simple avenue — a wallet address ready to receive Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, other EVM-compatible network assets, and ERC tokens (including iEthereum).

Ethereum address: 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

Contact / Consulting

For inquiries, tips, corrections, collaborations, or consultation requests:

[email protected]

Do your own research. We are not financial or investment advisors!