Editor’s Letter

This week’s analysis examines monthly transaction counts across the iEthereum ledger and compares January 2026 activity to the prior two operating years. Rather than interpreting the network through valuation or price, the brief studies the observable settlement layer directly. Transfer counts are among the few measurements that cannot be inferred — they either occur on-chain or they do not. By comparing the January observation to historical baselines, the objective is to understand whether the ledger is structurally changing or simply repeating an established behavioral pattern.

Full Technical Brief

In January 2026 the iEthereum network recorded 114 monthly transactions. This figure immediately becomes meaningful when placed against the prior two years of observations.

January 2025 recorded 57 transactions, and January 2024 recorded 107 transactions. The current observation therefore represents a +100% year-over-year increase relative to 2025 and a +6.5% increase relative to 2024. The significance of this comparison is not growth; it is stability. The network has returned almost exactly to the activity range first observed two years earlier after passing through a low-activity period in 2025.

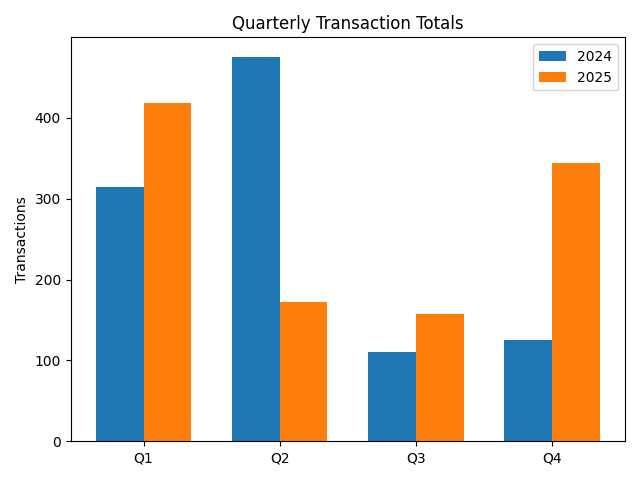

The 2025 operating year produced 1,092 total annual transactions, only slightly above the 1,025 transactions recorded in 2024. Despite this near-identical yearly total, the internal distribution of activity differed substantially. In 2024, transactions clustered early in the year, including 130 in February and 178 in April. By contrast, 2025 showed a back-weighted structure, culminating in 199 transactions in December 2025, the highest monthly reading in the entire dataset.

January 2026 follows that December spike with a sharp normalization to 114. This is analytically important. A speculative transaction system typically collapses following a peak month, but the iEthereum network instead returned to its historical median band rather than to inactivity. The post-December decline is therefore not a collapse but a reversion.

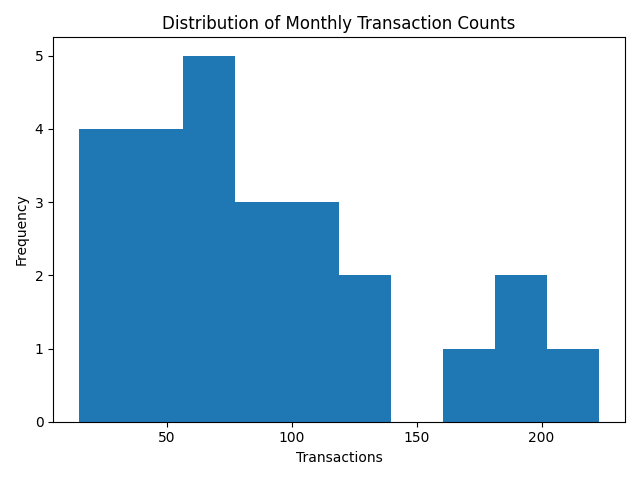

Across the full record, the network demonstrates a repeating operating range. Monthly transactions rarely remain below 40 for extended periods and rarely remain above 180. Most observations cluster between approximately 60 and 130 transactions per month. January 2026 falls directly within this central band. The ledger therefore shows cyclical settlement usage rather than expansion or contraction.

Quarterly structure further reinforces this behavior.

• Q1 2024: 314 transactions

• Q1 2025: 418 transactions

Despite a stronger first quarter in 2025, the full-year totals remained nearly identical, indicating redistribution rather than growth. Activity moves in time rather than accumulating across time.

When interpreted through a commodity lens, this pattern resembles custody movement rather than payment traffic. Payment networks scale continuously with user count; settlement commodities move intermittently when ownership changes. The data aligns with the latter. Months of elevated activity — February 2024, March 2025, and December 2025 — appear as custody transition periods. Months of low activity — August and September 2024 or July 2025 — resemble storage periods.

Exchange custody explains part of this structure. If a centralized venue holds balances on behalf of multiple users, participation can increase without generating on-chain transfers. Conversely, when a custodian reorganizes holdings or large holders change custody, transaction counts rise abruptly. Therefore, transaction totals measure settlement events, not user counts.

Liquidity concentration strengthens this interpretation. The network does not show gradual monotonic increases in transfers that would imply retail transactional flow. Instead, it shows discrete clusters followed by quiet intervals. This behavior is characteristic of an asset that is primarily held and occasionally reassigned.

Importantly, the ledger does not enter dormancy even in its lowest periods. September 2024 still recorded 16 transactions, and July 2025 recorded 31 transactions. The system is therefore continuously used at some minimal level. Continuous minimal usage combined with episodic spikes indicates operational necessity rather than transactional throughput.

January 2026’s 114 transactions therefore function as a confirmation observation. The ledger continues to operate inside its long-standing behavioral envelope. The network is neither scaling transactionally nor disappearing operationally. Instead, it is repeatedly accessed when settlement is required.

In summary, the transaction series does not describe adoption, popularity, or valuation. It describes how often ownership is reassigned on-chain. The data indicates a fixed inventory asset held for extended periods and periodically transferred — a structure consistent with custody settlement rather than transactional payment activity.

Commodity Behavior Interpretation

The transaction history demonstrates commodity behavior in several technical ways.

The supply remains fixed while transfers occur, meaning all activity represents redistribution rather than issuance. This mirrors stored commodities whose ownership changes without production.

The network exhibits storage behavior: long holding periods punctuated by custody changes. This is consistent with reserves or warehouse assets rather than consumable goods.

The ledger’s neutrality is evident because transaction frequency is independent of price cycles and persists across low-activity periods.

Finally, the continuity of settlement across three years shows durability. Even the lowest-activity months still register transfers, indicating that the system functions as a settlement reference point rather than a usage-dependent network.

Editorial Independence Statement

Editorial Independence Statement

The iEthereum Commodity Technical Briefs are produced as independent analytical and interpretive research notes. While they are informed by empirical data and observations published in the iEthereum Digital Commodity Index (DCI), the briefs do not reproduce, excerpt, or substitute for the DCI reports themselves. All analysis, framing, and interpretation reflect independent editorial judgment and are intended to provide contextual insight rather than licensed research deliverables.

DCI Licensed Access

This weekly iEthereum Commodity Technical Brief is an independent interpretive analysis informed by the iEthereum Digital Commodity Index (DCI), a longitudinal, institutional-grade research framework tracking the structure and behavior of a neutral, fixed-supply digital commodity. The brief reflects analytical interpretation and synthesis and is not itself an excerpt from the DCI reports.

The iEthereum Digital Commodity Index is offered under formal institutional license. Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, commodity-focused market structure analysis, longitudinal continuity across publications, and access to the underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit https://www.iethereum.org/iethereum-dci-reports or request a DCI license directly with Knive Spiel at [email protected].

Note: iEthereum is a 2017 MIT open-source licensed project. We are not the founders and have no direct or official affiliation with the iEthereum project or team. We are independent analysts and investors publishing our own research and interpretations.

If you see value in our weekly writing and independent public work, please subscribe to our free newsletter and/or share this article on social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

Retail Reader Access (Newsletter + Membership)

Our public writing is designed for retail readers and independent thinkers who want to explore iEthereum through weekly analysis, technical commentary, speculative thought and narrative-based iEtherean Tales.

We offer subscription access for readers who want to support the work and receive expanded content:

Free — introductory iEthereum articles and public updates

iEthereum Advocate — full access to premium essays & content, private telegram group and subscriber-only content (excluding institutional DCI reports)

Receive free iEthereum with an annual iEthereum Advocate subscription.

(Subscriptions are designed for public readership and community support, not institutional research licensing.)

Institutional Research (DCI Licensed Access)

The iEthereum Digital Commodity Index (DCI) is a separate institutional-grade research product offered under licensed access (not public subscription tiers).

The iEthereum Digital Commodity Index (DCI) is a longitudinal research archive documenting the observed structure and behavior of a neutral, fixed-supply digital commodity. It is published monthly and quarterly to preserve analytical continuity independent of narratives, governance influence, or promotional activity. The DCI does not predict outcomes or promote adoption; it maintains measurement consistency across time.

Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, market structure analysis, and access to underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit iEthereum.org or request a DCI license directly with Knive Spiel at [email protected].

Donations / Sponsorship

For those inspired to support the work via donation or sponsorship, the iEthereum Advocacy Trust provides a simple avenue — a wallet address ready to receive Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, other EVM-compatible network assets, and ERC tokens (including iEthereum).

Ethereum address: 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

Contact / Consulting

For inquiries, tips, corrections, collaborations, or consultation requests:

[email protected]

Do your own research. We are not financial or investment advisors!