As the calendar turns, price becomes the most instinctively referenced beacon—yet for emerging commodities, price often tells the least complete story when viewed in isolation. This week’s brief focuses on the USD / iEthereum trading pair, not as a speculative scoreboard, but as a structural lens into liquidity conditions, market maturation, and how a neutral digital commodity behaves as it transitions from discovery toward durability. When interpreted correctly, price is not a verdict; it is a trace—an imprint left by market structure, participant composition, and time.

Technical Brief: USD / iEthereum Price Behavior Across Two Market Cycles

The USD / iEthereum trading pair, derived exclusively from decentralized exchange activity on Uniswap and reconstructed monthly via Web3 scraping using Moralis APIs and Python-based analytics, provides a clean view of price formation absent centralized exchange incentives. This distinction matters. Unlike centrally listed assets—where market makers, leverage, and off-chain settlement distort price signals—the USD / iEthereum pair reflects on-chain liquidity conditions, wallet behavior, and organic demand. When interpreted through a commodity lens, it functions less like a speculative ticker and more like a thermodynamic readout of market equilibrium.

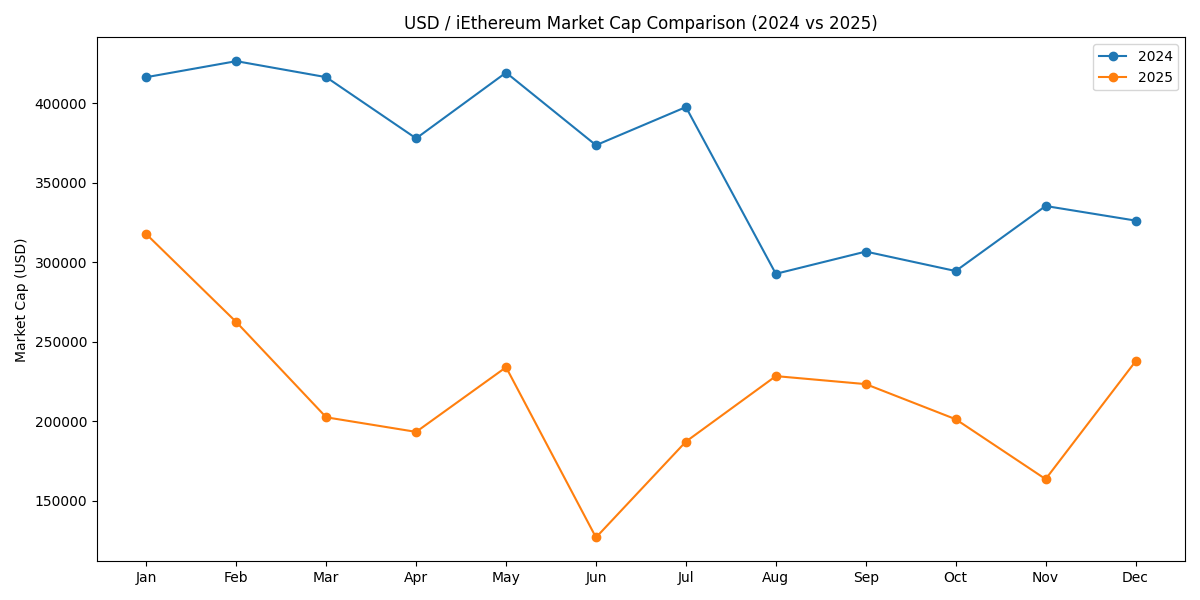

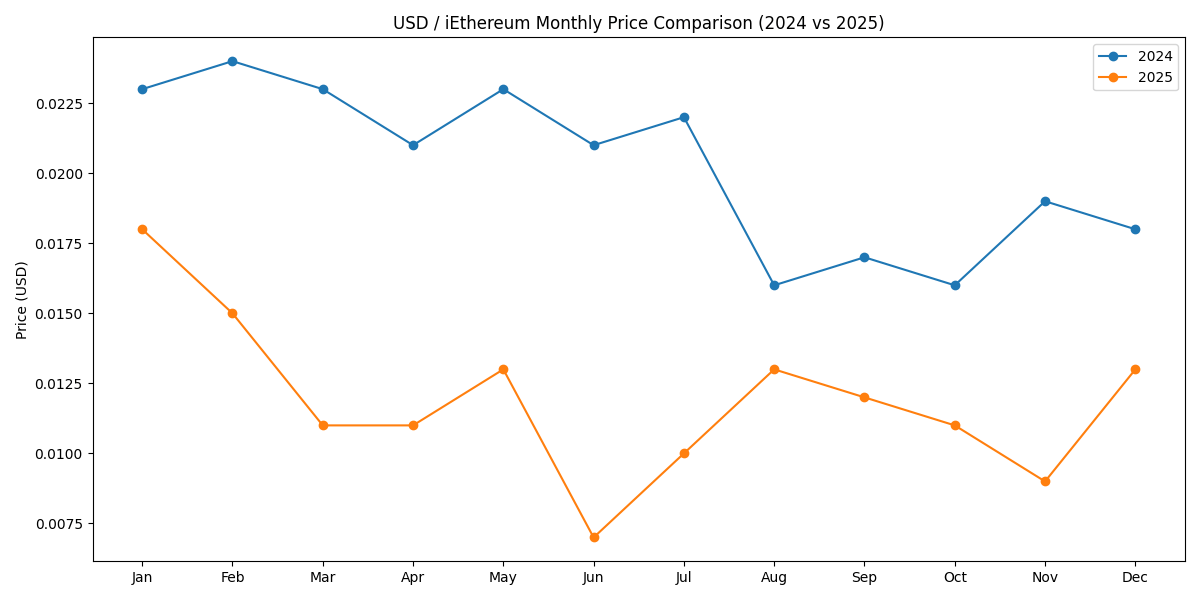

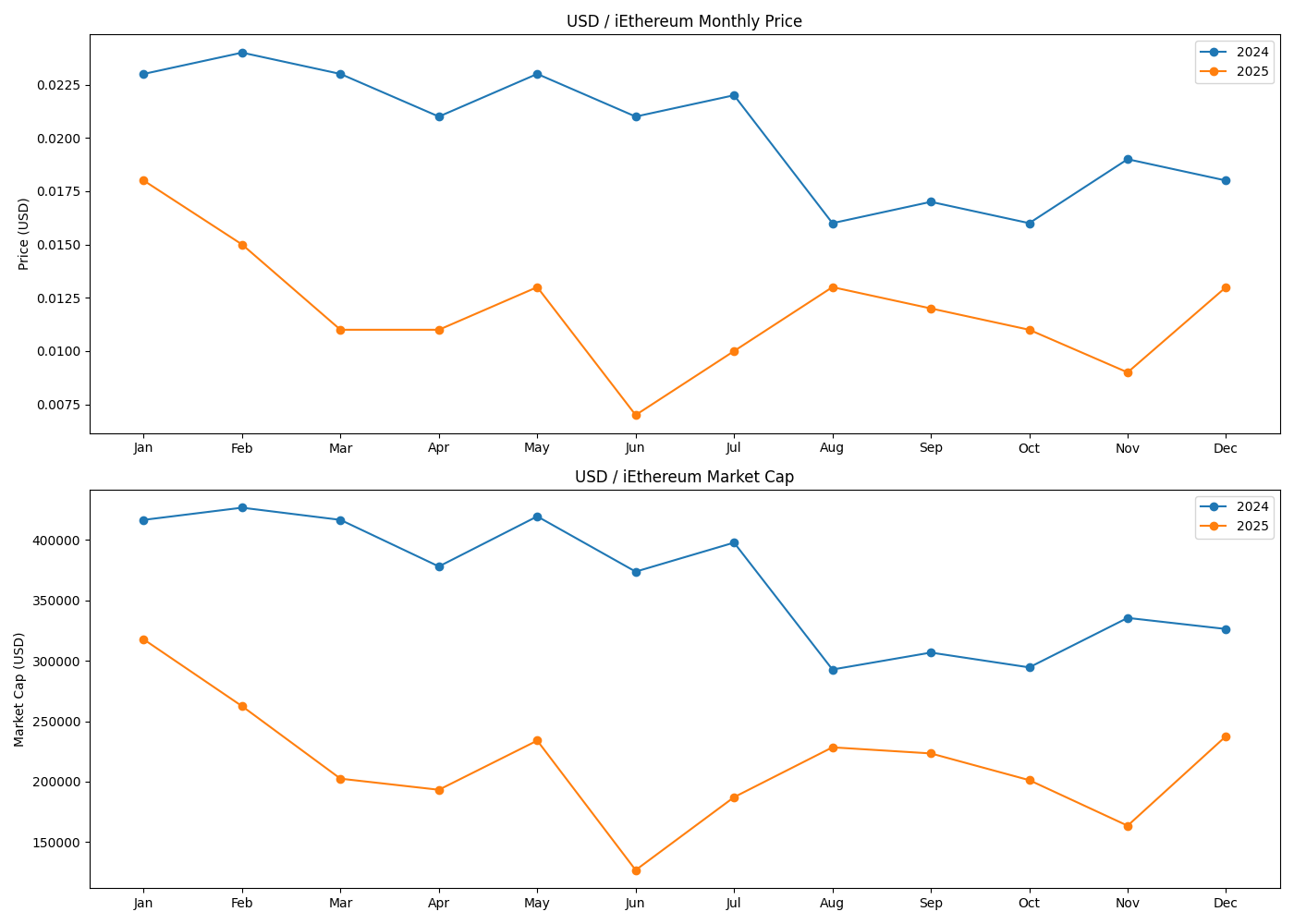

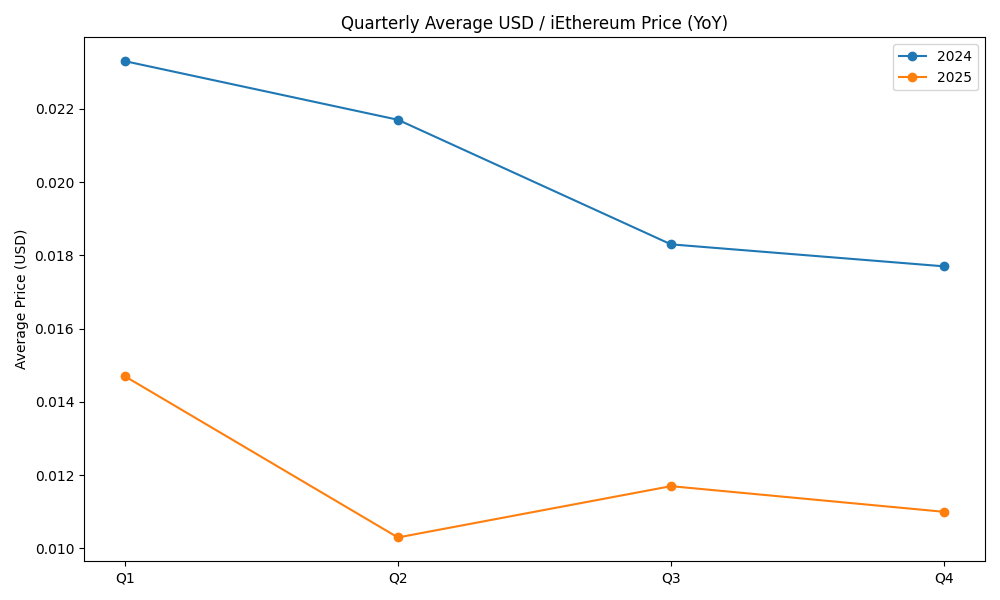

Across 2024, iEthereum traded within a relatively narrow band, with monthly prices ranging from $0.016 to $0.024, producing a full-year average of $0.0203. This period was characterized by shallow but stable liquidity, modest transaction sizes, and a holder base still consolidating early positions. Total USD market capitalization during 2024 followed this stability, oscillating between approximately $292,000 and $426,000, with an average quarterly market cap of $383,282.76. Taken together, these figures describe a market in price discovery rather than price expansion—a hallmark of commodities in their pre-distribution phase.

By contrast, 2025 introduced a clear structural shift. The average USD price declined to $0.0119, nearly a 41% reduction year-over-year, while monthly prices compressed into a lower range between $0.007 and $0.018. On the surface, this appears as weakness. Yet when paired with on-chain activity metrics published elsewhere in the Index—rising transaction counts, increasing velocity, and growing wallet participation—the interpretation changes materially. This pattern reflects dilution of early speculative premiums rather than erosion of underlying utility. In commodity markets, such repricing often accompanies the transition from thin, discovery-driven pricing toward broader, more distributed participation.

Market capitalization data reinforces this reading. In 2025, total USD market cap declined alongside price, ranging from $126,890 to $317,700, with an average quarterly market cap of $201,861.61—roughly half of 2024’s average. By contrast, volumes and transactional frequency did not collapse in parallel. This divergence between valuation and usage is not anomalous; it is consistent with commodities whose unit prices fall as liquidity deepens and access broadens. Early holders surrender premium positioning as new participants enter at lower price points, redistributing supply without destroying network function.

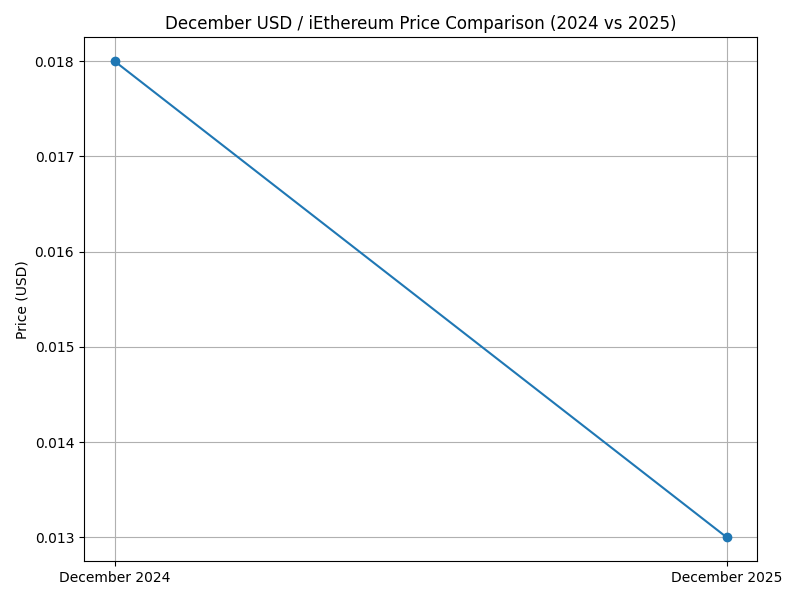

Taken together, the December-to-December comparison provides a clean year-over-year anchor for interpreting price behavior. From December 2024 to December 2025, the USD / iEthereum price declined from approximately $0.018 to $0.013, reinforcing the broader pattern of valuation compression observed throughout 2025. When interpreted through a commodity lens, this trendline reflects structural repricing as early scarcity premiums normalized, with supply consolidating into more economically active wallets and transactional usage increasing despite constrained liquidity conditions. This pattern reflects early-stage market maturation, where usage intensity and transactional relevance increase ahead of liquidity deepening and broader participation. Importantly, this comparison controls for seasonal effects, offering a clearer signal of how iEthereum’s market valuation evolved across full cycles rather than interim fluctuations.

When interpreted through a commodity lens, the USD / iEthereum trading pair begins to resemble physical commodity behavior more than speculative digital assets. Price compresses as supply becomes more accessible, not because demand vanishes, but because discovery gives way to distribution. Importantly, this behavior is amplified by iEthereum’s fixed supply and immutable contract. There is no issuance response to price changes, no protocol lever to stabilize valuation, and no governance mechanism to influence monetary policy. The USD price therefore absorbs all structural pressure directly, making it an unusually honest signal.

Exchange wallet nuance further sharpens this interpretation. Because iEthereum’s primary USD price discovery occurs on decentralized exchanges, liquidity concentration remains limited. There is no centralized order book absorbing volatility or smoothing price action. As a result, the USD / iEthereum pair is more sensitive to marginal flows, smaller trades, and incremental shifts in demand. While this increases short-term volatility, it also ensures that long-term pricing reflects real participant behavior rather than institutional balance sheet management. In this sense, price compression in 2025 should be viewed not as fragility, but as maturation under constrained liquidity conditions.

In summary, the USD / iEthereum trading pair over 2024 and 2025 illustrates a classic commodity transition. A higher-priced, thinner market gives way to a lower-priced, more actively used one. Market capitalization contracts even as network engagement persists. Early scarcity premiums unwind, allowing distribution to broaden. For a neutral digital commodity designed to exist without intervention, this is not a failure of price—it is evidence of structural honesty.

Commodity Behavior Interpretation

The USD / iEthereum trading pair demonstrates commodity-like behavior by reflecting distribution dynamics rather than speculative leverage. As access broadens and liquidity deepens, price compresses while usage stabilizes. This mirrors physical commodities, where price declines often accompany increased availability rather than reduced relevance. iEthereum’s immutable supply ensures that price is shaped entirely by market structure, reinforcing its classification as a neutral digital commodity rather than a managed financial instrument.

This weekly iEthereum Commodity Technical Brief is an independent interpretive analysis informed by the iEthereum Digital Commodity Index (DCI), a longitudinal, institutional-grade research framework tracking the structure and behavior of a neutral, fixed-supply digital commodity. The brief reflects analytical interpretation and synthesis and is not itself an excerpt from the DCI reports.

The iEthereum Digital Commodity Index is offered under formal institutional license. Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, commodity-focused market structure analysis, longitudinal continuity across publications, and access to the underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit https://www.iethereum.org/iethereum-dci-reports or request a DCI license directly with Knive Spiel at [email protected].

Note: We are not the founders. We have no direct or official affiliation with the iEthereum project or team. We are independent investors.

iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

If you are currently an iEthereum investor and believe in the future of this open-source value transfer technology, please consider upgrading to one of our paid subscription tiers.

We offer 3 tiers to fit your interests:

Free: Enjoy basic and elementary articles that introduce iEthereum and initiate curiosity and conversation.

iEthereum Advocate: Stay connected with access to all premium articles and content (excluding detailed monthly and quarterly technical iEthereum Digital Commodity Index Reports).

iEthereum Investor: Access in-depth reports and market analyses tailored for serious investors.

With subscriptions ranging from free to $500 per year, there’s a tier for everyone to help shape the future of the iEthereum ecosystem.

Receive free iEthereum with a subscription tier of an annual iEthereum Advocate or iEthereum Investor.

For those inspired to support the cause via donation, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, and all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the free newsletter, upgrade to our iEthereum Advocate subscription tier or higher, and send me an email to discuss price and schedule appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Do your own research. We are not financial or investment advisors!