This week’s technical brief addresses a foundational but often misunderstood dimension of digital commodity analysis: supply. As iEthereum enters 2026 with an expanded dataset and a more mature analytical posture, the Index is formally refining its supply taxonomy to better reflect economic reality rather than market convention. The distinction between circulating supply and liquid supply is not merely semantic; it directly influences how scarcity, liquidity risk, and price behavior are interpreted by institutions evaluating iEthereum as a neutral digital commodity rather than a speculative token.

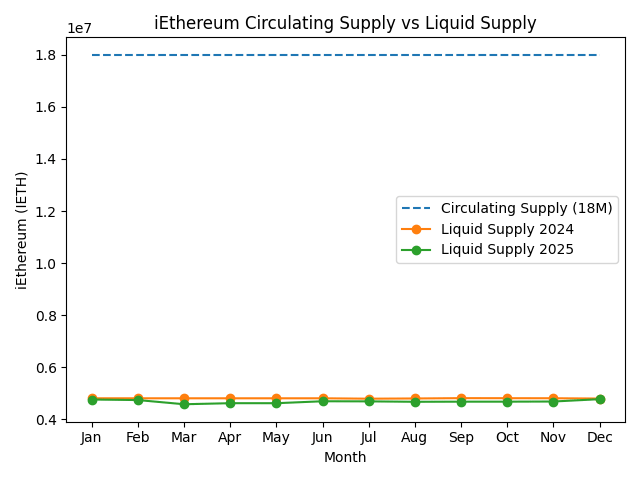

From its inception, iEthereum has been fully premined with a fixed supply of 18,000,000 units, eliminating issuance uncertainty entirely. However, the economic meaning of “circulation” in digital assets has historically been muddled by inconsistent definitions across indices, protocols, and data providers. Over 2024 and 2025, the iEthereum Digital Commodity Index adopted a conservative, market-oriented approach by treating exchange-held balances as circulating supply, implicitly equating circulation with immediate tradability. While analytically useful during early market formation, that framing increasingly conflates accessibility with existence. Beginning in 2026, the Index resolves this tension by separating economic circulation from market liquidity, aligning iEthereum’s supply analysis with commodity-grade reasoning.

Circulating supply is now defined as total premined supply minus economically unredeemable units, while exchange-held balances are explicitly classified as total liquid supply. Taken together, this shift improves conceptual clarity, enhances comparability across time, and strengthens iEthereum’s positioning within a commodity-first analytical framework.

Full Technical Brief

At the protocol level, iEthereum’s circulating supply is structurally immutable. The full 18,000,000 iEthereum units were created at genesis, with no inflation schedule, issuance curve, or discretionary minting authority. Unlike proof-of-work or proof-of-stake networks that continuously alter effective supply through issuance, staking locks, or governance actions, iEthereum’s supply exists in a static state from inception. What changes over time is not supply itself, but accessibility. The distinction between what exists and what is economically available is therefore central to understanding iEthereum’s market behavior.

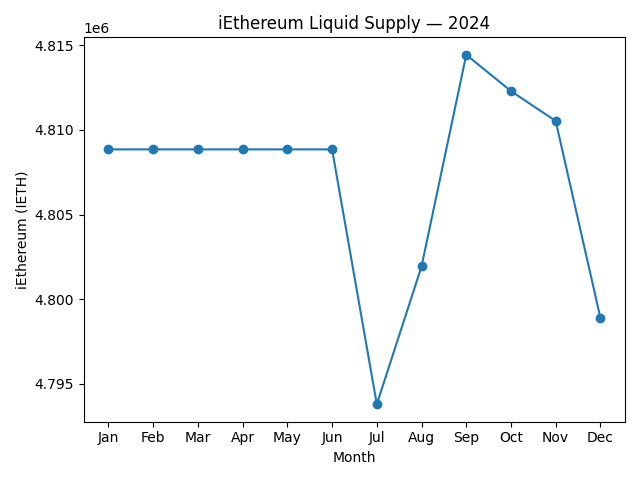

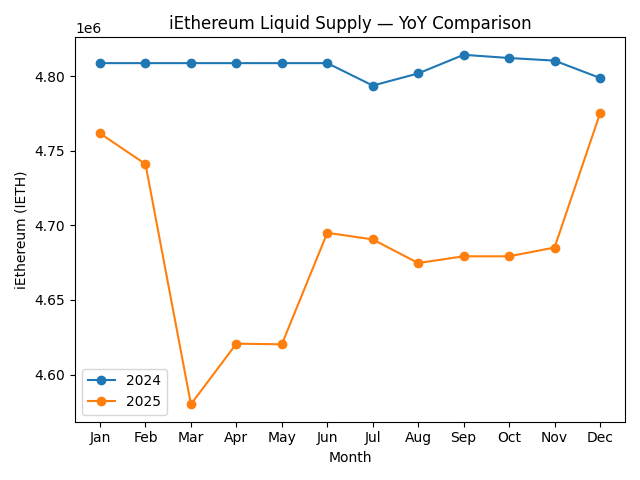

Throughout 2024, the Index recorded what was then labeled “circulating supply” in a narrow band between approximately 4.79 and 4.81 million iEthereum. Month-to-month movements were minimal, reflecting modest shifts of tokens between exchange wallets and self-custody rather than any structural supply change. By contrast, 2025 exhibited more pronounced dynamics. Exchange-held balances declined materially in the first quarter, falling from 4.76 million in January to approximately 4.58 million by March, representing a cumulative contraction exceeding four percent. This drawdown coincided with broader holder consolidation and declining speculative turnover, indicating that market participants were increasingly removing iEthereum from immediate trading venues.

Taken together, the mid-2025 data reinforces an important observation: exchange balances behave cyclically, not structurally. Following the first-quarter contraction, liquid supply stabilized through the second and third quarters, oscillating narrowly around 4.68 to 4.70 million units. By the fourth quarter, exchange-held balances rose again, ending 2025 near 4.78 million iEthereum. The year-end recovery did not reverse the broader pattern of restraint; rather, it reflected episodic liquidity re-entry typical of thin, early-stage commodity markets responding to price discovery rather than speculative excess.

When interpreted through a commodity lens, these movements resemble warehouse flows rather than issuance dynamics. In physical commodity markets, inventory levels rise and fall in response to price signals, storage incentives, and hedging demand, while total supply remains governed by extraction constraints. iEthereum exhibits an analogous pattern. Tokens migrate between exchange custody and long-term wallets based on market conditions, but their existence remains fixed and auditable. This pattern reflects an emergent separation between ownership and liquidity that is characteristic of commodities transitioning from speculative novelty to held reserves.

The methodological refinement implemented in 2026 formalizes this distinction. Circulating supply is no longer defined by proximity to exchanges but by economic existence. All premined iEthereum is considered in circulation unless rendered economically unredeemable, such as tokens sent irreversibly to contracts without withdrawal mechanisms. By contrast, total liquid supply is explicitly defined as the subset of circulating supply currently held on exchanges and therefore immediately accessible for trading. This separation resolves a longstanding ambiguity common across digital asset indices, where “circulating supply” alternately denotes issued supply, unlocked supply, or exchange-available supply depending on the provider.

By contrast with prior years, the new framework allows exchange balances to be interpreted strictly as a liquidity indicator rather than a proxy for supply. Exchange wallets concentrate accessibility, not ownership, and their balances are inherently transient. Treating them as liquid supply aligns iEthereum analysis with institutional standards used in metals, energy, and agricultural markets, where free-float inventory is never conflated with total supply in existence.

From an analytical standpoint, this change enhances interpretive precision. Declines in liquid supply can now be read as voluntary withdrawal from market venues rather than artificial supply contraction. Increases can be understood as liquidity provisioning rather than dilution. This clarity is especially important for early-stage digital commodities like iEthereum, where thin markets amplify the signaling value of custody decisions. Exchange wallet behavior becomes a lens into market confidence and turnover, while circulating supply remains a stable anchor for valuation, velocity, and scarcity modeling.

In summary, the evolution from a blended supply concept toward a dual-layer framework marks a maturation of the iEthereum Digital Commodity Index. By explicitly distinguishing circulating supply from liquid supply, the Index improves transparency, aligns with commodity-grade analytical norms, and reduces interpretive noise for institutional readers. The result is a cleaner, more durable foundation for understanding iEthereum’s market structure as it continues to transition from speculative instrument to neutral digital commodity.

Commodity Behavior Interpretation

The separation of circulating supply and liquid supply demonstrates commodity-like behavior by emphasizing inventory mobility rather than issuance mechanics. iEthereum’s total supply is fixed and non-inflationary, while exchange-held balances fluctuate in response to price signals and market sentiment. This mirrors physical commodity markets, where warehouse inventories expand and contract independently of geological supply. The observed patterns reinforce iEthereum’s classification as a scarcity-based digital commodity rather than a dynamically issued network asset.

This weekly iEthereum Commodity Technical Brief is an independent interpretive analysis informed by the iEthereum Digital Commodity Index (DCI), a longitudinal, institutional-grade research framework tracking the structure and behavior of a neutral, fixed-supply digital commodity. The brief reflects analytical interpretation and synthesis and is not itself an excerpt from the DCI reports.

The iEthereum Digital Commodity Index is offered under formal institutional license. Licensed organizations receive full Monthly and Quarterly DCI Reports, complete valuation frameworks, commodity-focused market structure analysis, longitudinal continuity across publications, and access to the underlying datasets and methodology.

For licensing inquiries, institutional access terms, or research use cases, visit https://www.iethereum.org/iethereum-dci-reports or request a DCI license directly with Knive Spiel at [email protected].

Note: We are not the founders. We have no direct or official affiliation with the iEthereum project or team. We are independent investors.

iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

If you are currently an iEthereum investor and believe in the future of this open-source value transfer technology, please consider upgrading to one of our paid subscription tiers.

We offer 3 tiers to fit your interests:

Free: Enjoy basic and elementary articles that introduce iEthereum and initiate curiosity and conversation.

iEthereum Advocate: Stay connected with access to all premium articles and content (excluding detailed monthly and quarterly technical iEthereum Digital Commodity Index Reports).

iEthereum Investor: Access in-depth reports and market analyses tailored for serious investors.

With subscriptions ranging from free to $500 per year, there’s a tier for everyone to help shape the future of the iEthereum ecosystem.

Receive free iEthereum with a subscription tier of an annual iEthereum Advocate or iEthereum Investor.

For those inspired to support the cause via donation, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, and all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the free newsletter, upgrade to our iEthereum Advocate subscription tier or higher, and send me an email to discuss price and schedule appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Do your own research. We are not financial or investment advisors!