Editor’s Letter

In any emerging commodity ecosystem, breadth of geographical engagement functions as an early leading indicator of latent demand, cultural resonance, and long-term distributional reach. Digital commodities, unlike traditional extractives, do not require shipping lanes, customs corridors, or refinery proximity; instead, they diffuse through attention networks, curiosity markets, and information channels that quietly establish the contours of future economic participation. This week’s brief examines one of the earliest, yet most revealing signals of iEthereum’s global trajectory: the count and growth rate of countries represented in active readership across iEthereum.org. While not a price metric or an on-chain datapoint, this diffusion pattern offers a discrete view into how the iEthereum thesis is propagating internationally—and what this expanding global footprint may imply for future liquidity, demand, and narrative alignment.

Technical Brief

The number of countries represented in active readership offers an unconventional yet increasingly relevant metric in understanding how a neutral digital commodity gains traction across distinct socio-economic environments. Unlike exchange volume or wallet distributions, which reflect realized market actions, readership by country captures the pre-transactional phase: the cognitive adoption curve. It reveals where interest first emerges, where macro conditions may be catalyzing exploration, and where early intellectual adoption precedes capital allocation. When assessing this indicator through the lens of iEthereum—a finite-supply baseline commodity operating atop a globally distributed settlement network—the global diffusion of readership serves as a valuable proxy for the breadth of the underlying addressable market.

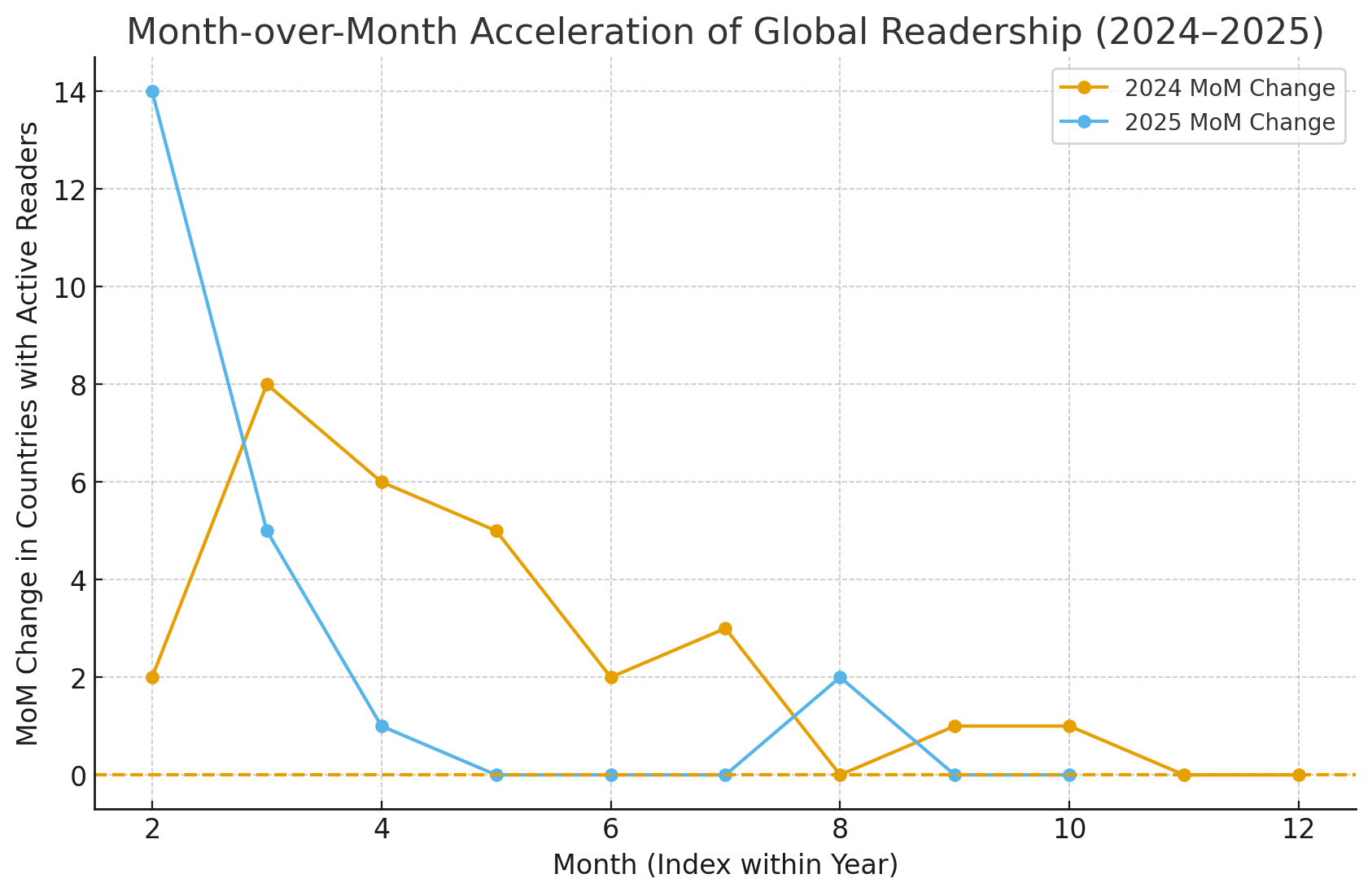

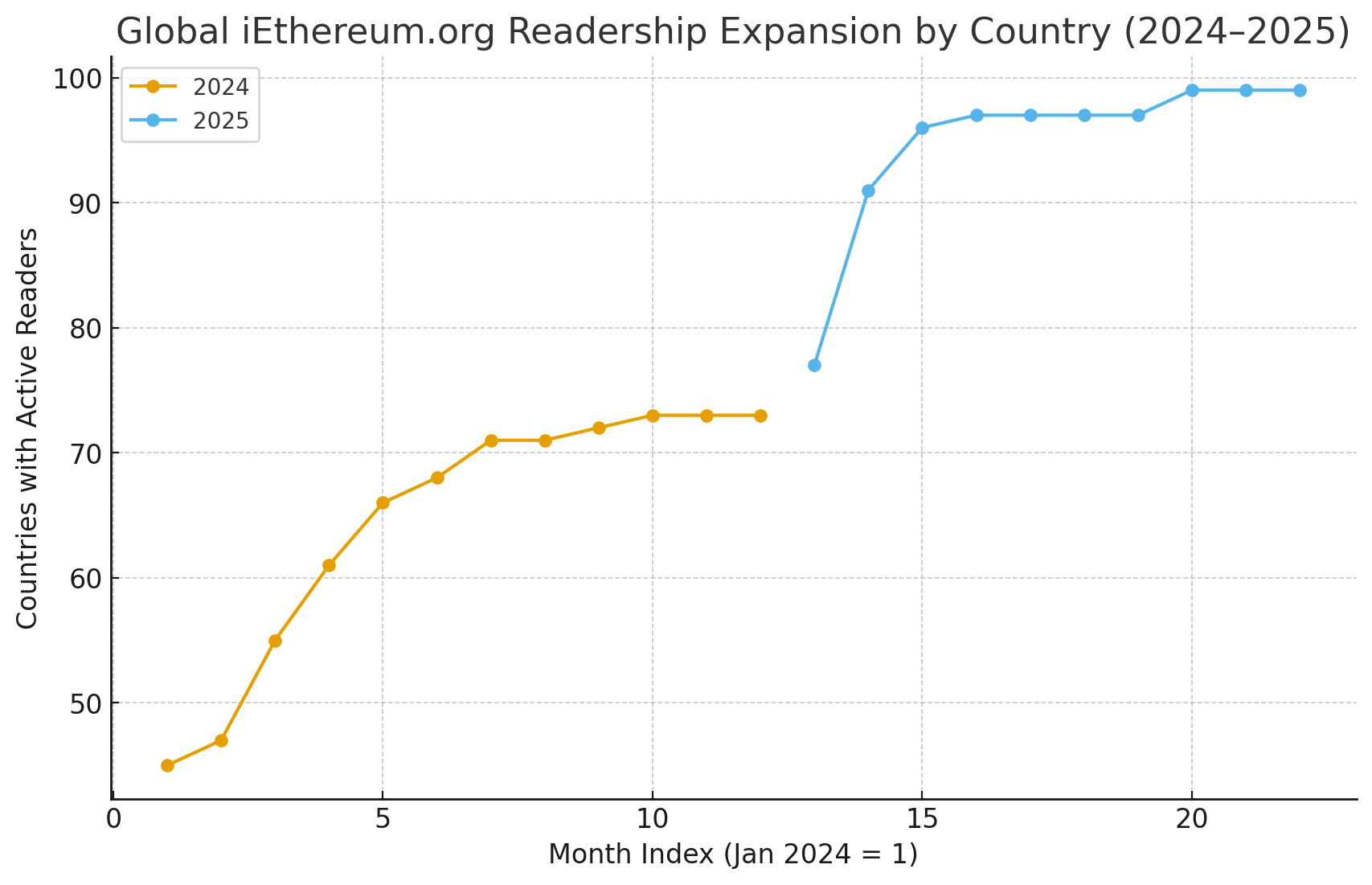

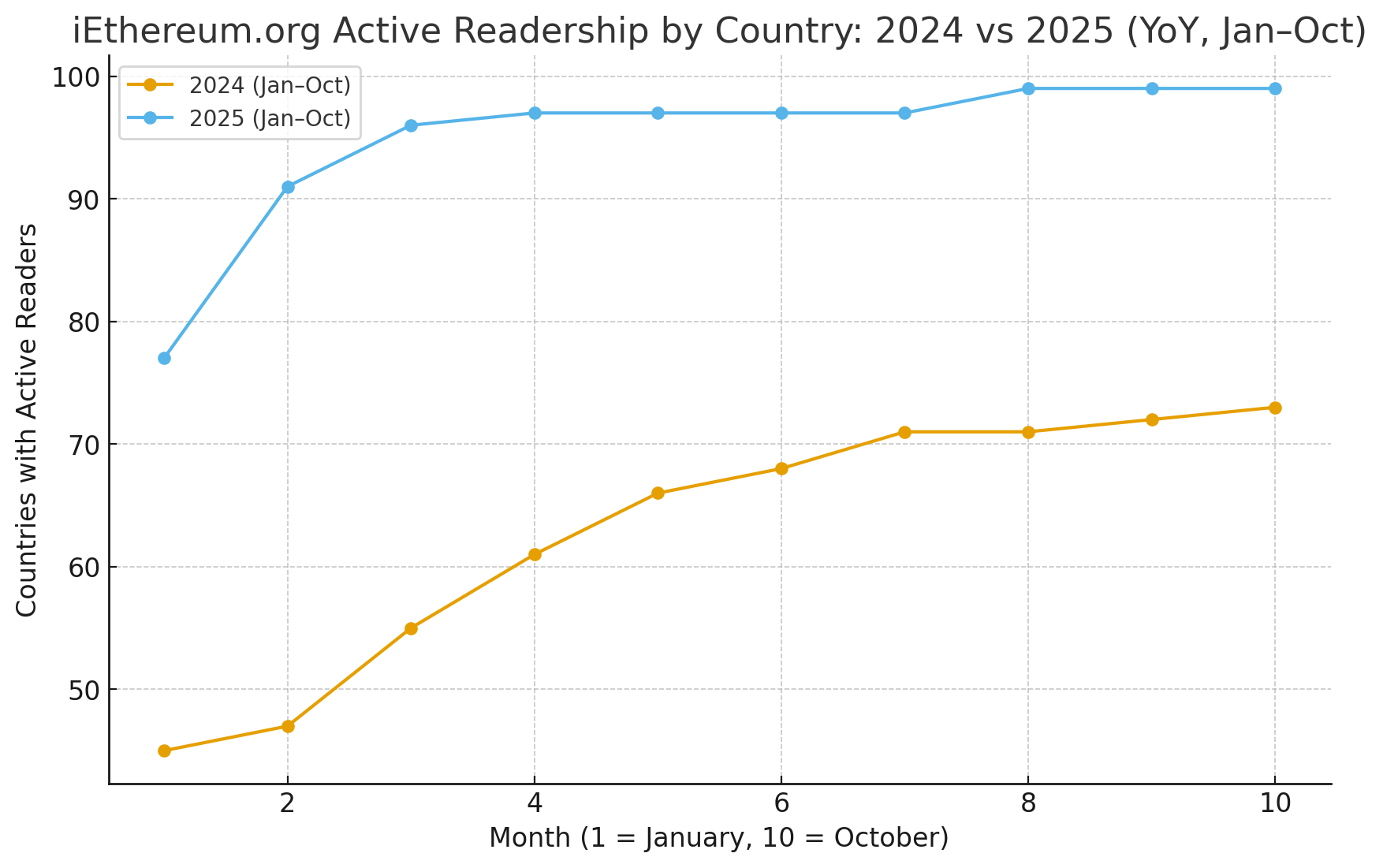

The dataset begins in 2024, the first full year in which tracking occurred. Over that twelve-month period, the number of countries represented in active readership climbed steadily from 45 in January to 73 by December. This progression, while modest in absolute scale, demonstrated disciplined month-over-month expansion, with no reversals and only minimal plateaus. The early months showed slower, almost linear growth, but the back half of the year—particularly from April to August—displayed a sharper slope, suggesting a period where geopolitical instability, global remittance concerns, or a shift in sentiment toward immutable digital commodities may have accelerated interest. Taken together, 2024 forms the baseline year of iEthereum’s informational spread, marking the transition from a concentrated curiosity to a distributed, broadening global footprint.

By contrast, the 2025 dataset reveals a materially different profile—one characterized not simply by steady diffusion but by sudden and pronounced acceleration. From January through October, represented countries expanded from 77 to 99, marking the largest single-year increase in global penetration since tracking began. The January–April interval alone grew from 77 to 96 countries, underscoring what appears to be a macro-driven inflection point. Whether driven by deteriorating trust in domestic monetary authorities, broader interest in digital commodity frameworks, or the increasing visibility of iEthereum.org as a source of institutional-quality research, the surge reflects a pattern common in commodity adoption cycles: long periods of relative quietness followed by abrupt upward re-rating in global attention.

When interpreted through a commodity lens, this acceleration resembles the early-stage discovery phase observed in physical markets—where a mineral deposit, once obscure, attracts multi-jurisdictional interest not because its properties have changed, but because the world has suddenly begun looking for alternatives that possess durability, neutrality, and supply constraints. The nearly 100-country distribution demonstrates that iEthereum’s readership—and, by implication, its conceptual reach—now spans not only developed markets but also regions historically underserved by conventional finance. The roster includes large population centers such as India, Indonesia, Nigeria, and Brazil; geopolitical flashpoints such as Ukraine, Iran, and Iraq; commodity-heavy nations including Kazakhstan, South Africa, UAE, Chile, and Australia; and developed financial hubs ranging from the United States and United Kingdom to Switzerland, Singapore, and Hong Kong. The breadth itself is the signal: iEthereum is no longer a narrative confined to Western crypto enclaves but has begun penetrating markets where digital commodities serve pragmatic, not speculative, functions.

The year-over-year pattern reveals that readership growth expanded from 73 to 99 countries—an increase of 35.6% YoY. In traditional commodity frameworks, such a shift would resemble the broadening of off-take relationships or the establishment of new international demand corridors. For digital commodities, however, this spread is even more significant, as interest and education precede wallet creation, on-chain interaction, and liquidity dispersion. That said, it is important to acknowledge the metric’s limitations. Readership does not reflect volume or market depth, nor does it distinguish between institutional and retail engagement. It cannot identify exchange wallet clustering or determine whether readership correlates to real accumulation. Nonetheless, it identifies where future liquidity may emerge and which jurisdictions may become disproportionately influential in shaping iEthereum’s long-term price elasticity.

Exchange wallet dynamics introduce nuanced interpretation. Highly concentrated liquidity on centralized exchanges often indicates geographically concentrated trading behavior, yet the readership data suggests the opposite: decentralization of attention ahead of decentralization of capital flows. This asymmetry—broad global readership with relatively concentrated trading hubs—typically precedes commodity monetization phases wherein distributed cultural understanding lays the foundation for later distributed market participation. When mapped against historical digital asset cycles, this pattern aligns with phases in which narrative adoption expands before liquidity dispersion, often marking early stages of global demand formation.

In summary, this week’s metric demonstrates that iEthereum’s intellectual surface area is expanding well beyond early-adopter jurisdictions, and at a velocity exceeding the baseline established during the first year of measurement. The signal embedded in the diffusion of readership is that the iEthereum thesis is beginning to travel—not as a speculative trade, but as a conceptual commodity blueprint capable of resonating across diverse cultural, economic, and political environments. If this pattern persists, liquidity distribution is likely to follow, transforming what began as isolated interest into a geographically diversified market capable of supporting iEthereum’s emergence as a globally recognized digital commodity.

Commodity Behavior Interpretation

The global spread of readership mirrors the early signals observed when physical commodities transition from regional relevance to global demand. A commodity becomes a commodity only when multiple independent jurisdictions decide it is useful, scarce, or necessary. iEthereum’s expansion into nearly 100 countries demonstrates not transactional adoption but conceptual adoption—the necessary precursor to becoming a globally recognized neutral unit. Just as commodities like copper, oil, or gold gain universality through cross-border utility rather than centralized promotion, iEthereum’s readership pattern signals a naturally forming global demand curve independent of marketing, governance, or issuer-driven distribution. Its immutability and fixed supply allow sentiment diffusion to behave like commodity discovery rather than speculative hype: slow at first, then sudden, then structural.

This weekly brief is a preview from the full iEthereum Digital Commodity Index Report. Premium Investor Tier members receive complete Monthly and Quarterly Reports, valuation models, commodity research, and full datasets. Upgrade today and receive free iEthereum. Sign up for an Annual Investor Subscription to receive a discounted rate and immediate premium access.

Note: We are not the founders. We have no direct or official affiliation with the iEthereum project or team. We are independent investors.

iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

If you are currently an iEthereum investor and believe in the future of this open-source value transfer technology, please consider upgrading to one of our paid subscription tiers.

We offer 3 tiers to fit your interests:

Free: Enjoy basic and elementary articles that introduce iEthereum and initiate curiosity and conversation.

iEthereum Advocate: Stay connected with access to all premium articles and content (excluding detailed monthly and quarterly technical iEthereum Digital Commodity Index Reports).

iEthereum Investor: Access in-depth reports and market analyses tailored for serious investors.

With subscriptions ranging from free to $500 per year, there’s a tier for everyone to help shape the future of the iEthereum ecosystem.

Receive free iEthereum with a subscription tier of an annual iEthereum Advocate or iEthereum Investor.

For those inspired to support the cause via donation, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, and all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the free newsletter, upgrade to our iEthereum Advocate subscription tier or higher, and send me an email to discuss price and schedule appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Do your own research. We are not financial or investment advisors!