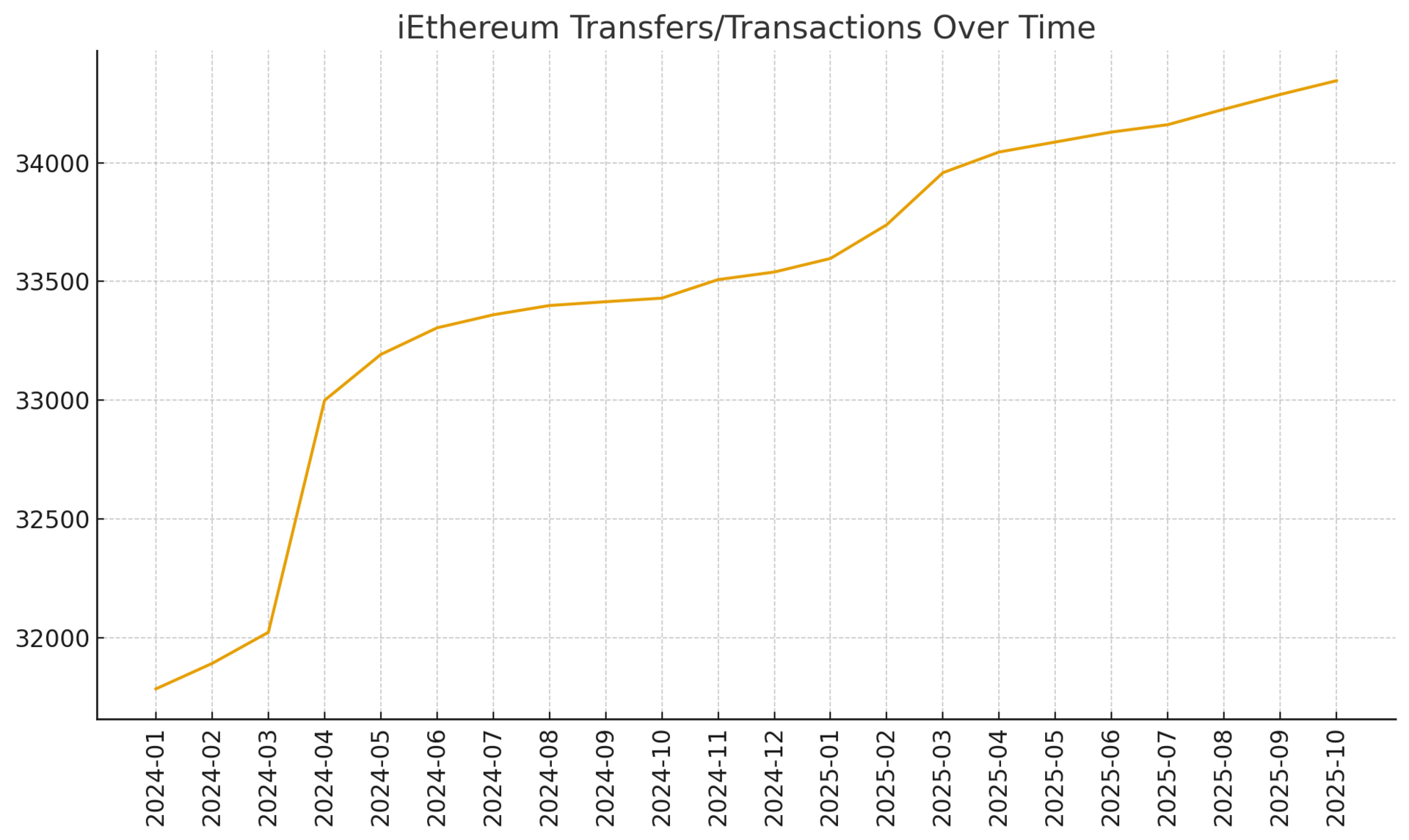

The total number of transfers and transactions has always served as one of the most understated but structurally revealing indicators within the iEthereum Digital Commodity Index Report. While price action, liquidity depth, and exchange routing often dominate weekly market narratives, the cumulative transfer count behaves more like a slow-moving ledger of economic sentiment—capturing not the noise of individual trades but the directionality of long-term holder behavior. This week’s data, taken from the 2024 full-year progression and the 2025 year-to-date trajectory through October, presents a continuation of a pattern that has become foundational to understanding iEthereum’s commodity-like character: a durable, low-volatility ascent in confirmed ledger activity that mirrors the circulation profile of scarce physical commodities rather than the churn of high-velocity tokens.

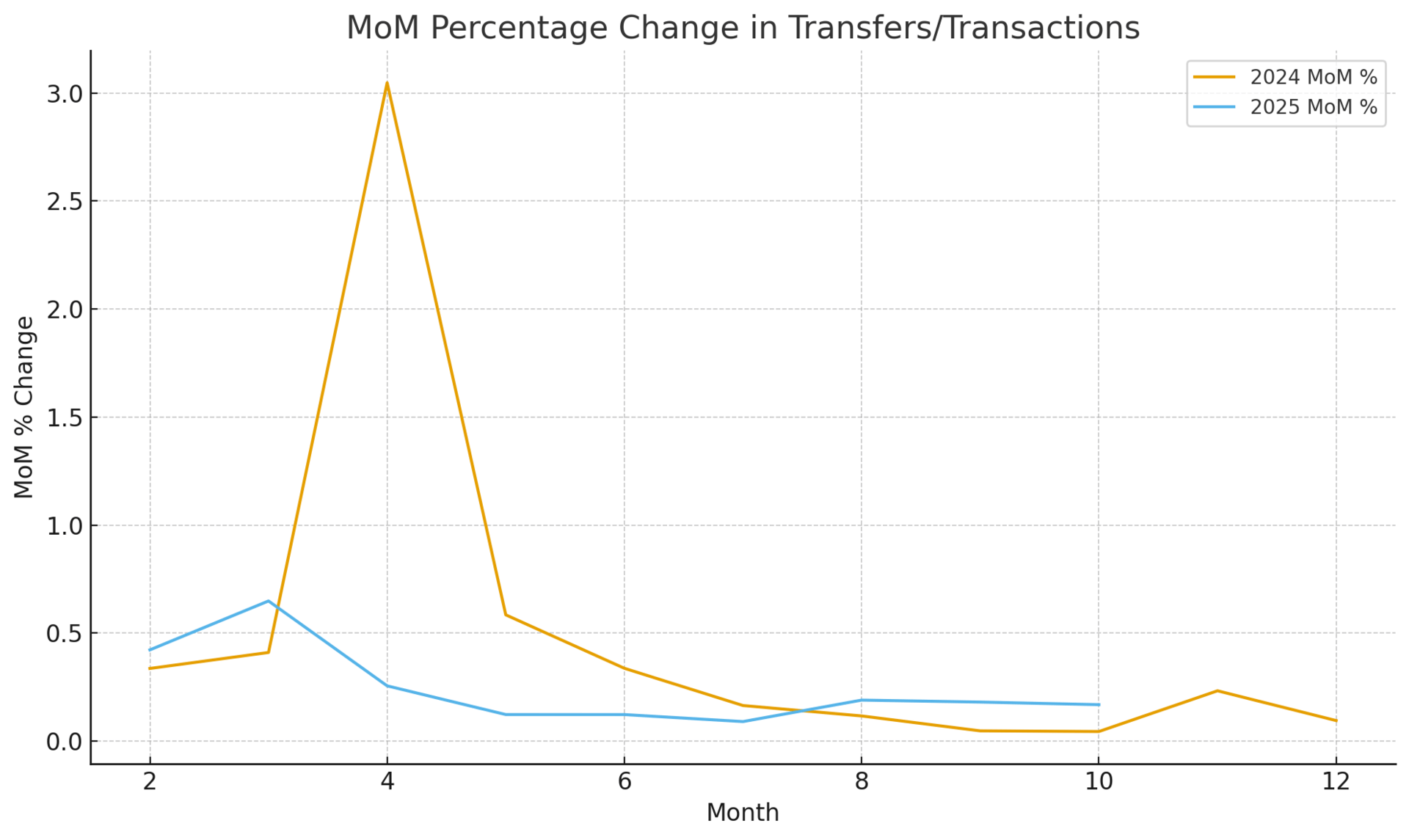

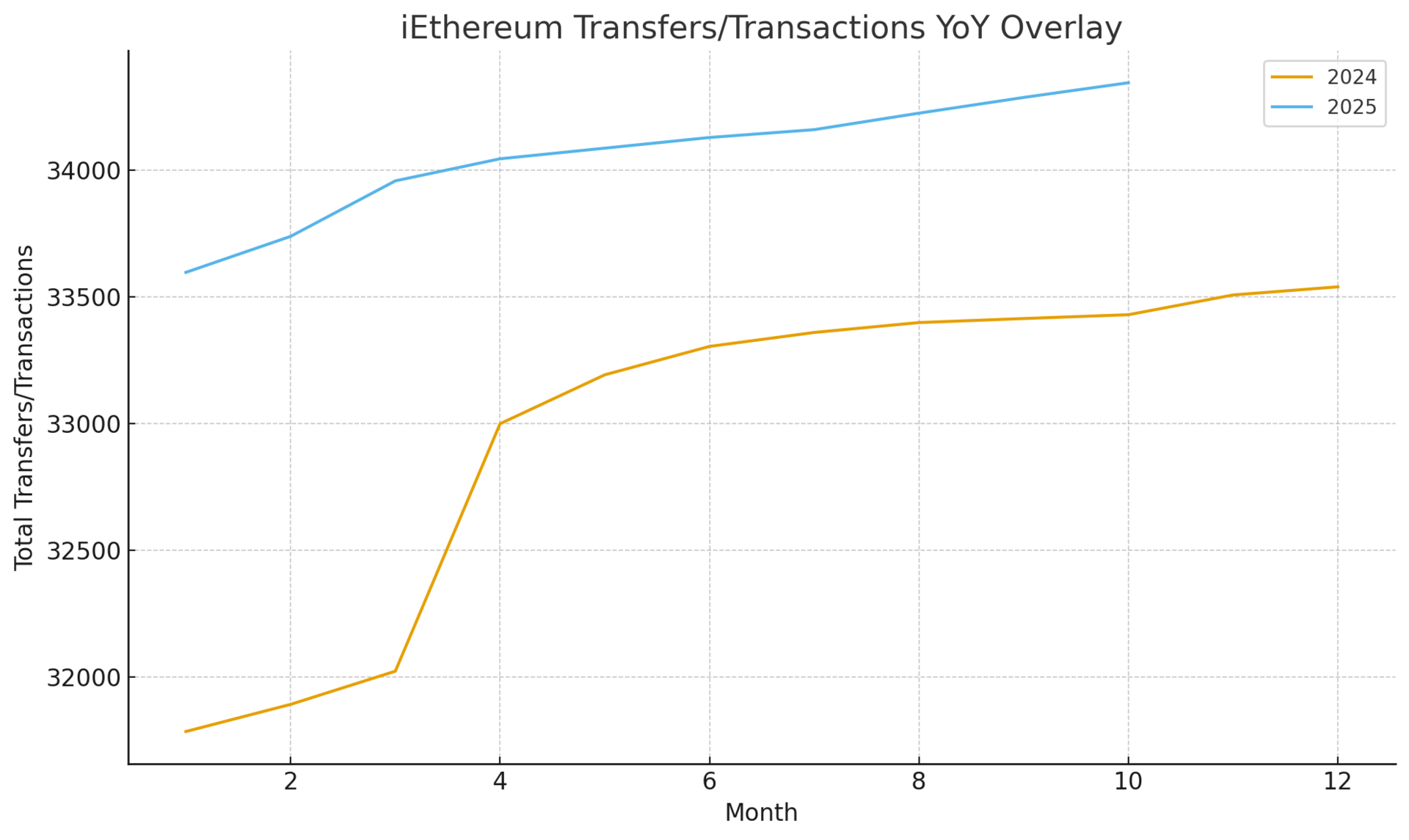

Viewed month-over-month, the 2024 data traces a consistent upward glide from 31,786 transfers in January to 33,540 by December, with the most notable inflection point emerging between March and April as the count accelerated from 32,024 to 33,000. This step-change marked a transition from routine settlement traffic to a higher equilibrium of baseline usage, a shift that has persisted into 2025. By contrast, the 2025 progression, beginning at 33,597 in January and rising to 34,345 by October, reflects an even smoother ascent—fewer abrupt month-to-month dislocations and a more measured curve, suggesting that the earlier structural repricing of network activity has now stabilized into a predictable circulation cadence. When interpreted through a commodity lens, this pattern reflects the familiar behavior of resource-backed markets where supply is fixed, holders accumulate strategically, and transaction channels serve operational settlement rather than speculative rotation.

Taken together, these data points reinforce an increasingly important interpretive insight: transfer counts for iEthereum do not behave as a proxy for retail speculation but rather as a proxy for quiet institutional positioning, gradual wallet consolidation, and the maturing of a neutral digital commodity whose value derives from scarcity rather than velocity. This is especially evident when examining the nuances around exchange wallets. Rather than driving spikes in transaction volume as seen in more speculative tokens, exchange-controlled addresses for iEthereum typically absorb liquidity slowly, engaging in periodic rebalancing cycles that produce only minor deviations in monthly transfer totals. The absence of rapid inflow-outflow oscillations suggests that exchange inventory accumulation—where it occurs at all—is more aligned with long-term reserve behavior than short-term trading needs.

In summary, the total transfer and transaction metric continues to operate as a stabilizing indicator for the broader iEthereum ecosystem. Its year-over-year resilience, combined with its low-volatility slope and commodity-like circulation signature, provides a counterbalance to the more reactive elements of digital asset markets. It signals an asset whose activity profile is governed not by speculative churn but by the slow allocation and measured settlement patterns that accompany scarcity-anchored monetary instruments. As such, this indicator remains a cornerstone of the iEthereum Digital Commodity Index Report and a reliable forward-looking gauge for assessing the maturation of iEthereum as a neutral base-layer digital commodity.

Commodity Behavior Interpretation

The total transfer count demonstrates commodity-like behavior because it reveals a settlement rhythm detached from price volatility. Commodities with fixed supply—gold, silver, industrial metals—tend to exhibit stable transactional frequency driven by operational use rather than speculative turnover. iEthereum mirrors this: despite changing market conditions, transfers rise gradually, predictably, and with minimal month-to-month distortion. This stability is not characteristic of currency-like or equity-like tokens; it is characteristic of scarce, held, and slowly circulated digital commodities.

Editor’s Letter

This week’s brief revisits one of the most deceptively simple yet consistently revealing metrics within the iEthereum Digital Commodity Index: the total number of transfers and transactions. In periods where market narratives shift quickly and attention gravitates toward price, liquidity surges, or exchange commentary, this cumulative ledger count reminds us that iEthereum’s most important signals are often the quietest ones. The slow and steady climb in confirmed transfers reflects a network that behaves less like a speculative instrument and more like a maturing commodity rail—stable, scarce, and increasingly structured around long-term allocation rather than reactive flows. As we close the month, this metric once again underscores the underlying thesis: iEthereum’s circulation is not accelerating because it must, but because it is gradually being positioned where it will be used.

This weekly brief is comprised of data from the full iEthereum Digital Commodity Index Report. Premium Investor Tier members receive complete Monthly and Quarterly Reports, valuation models, commodity research, and full datasets. Upgrade today or sign up for an Annual Investor Subscription to receive a discounted rate and immediate premium access.

Note: We are not the founders. We have no direct or official affiliation with the iEthereum project or team. We are independent investors.

iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

If you are currently an iEthereum investor and believe in the future of this open-source value transfer technology, please consider upgrading to one of our paid subscription tiers.

We offer 3 tiers to fit your interests:

Free: Enjoy basic and elementary articles that introduce iEthereum and initiate curiosity and conversation.

iEthereum Advocate: Stay connected with access to all premium articles and content (excluding detailed monthly and quarterly technical iEthereum Digital Commodity Index Reports).

iEthereum Investor: Access in-depth reports and market analyses tailored for serious investors.

With subscriptions ranging from free to $500 per year, there’s a tier for everyone to help shape the future of the iEthereum ecosystem.

Receive free iEthereum with a subscription tier of an annual iEthereum Advocate or iEthereum Investor.

For those inspired to support the cause via donation, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, and all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the free newsletter, upgrade to our iEthereum Advocate subscription tier or higher, and send me an email to discuss price and schedule appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Do your own research. We are not financial or investment advisors!