Editor’s Summary

Every digital commodity aspires to the status of “store of value,” yet few possess the structural, historical, or economic grounding necessary to justify the claim. Bitcoin’s narrative hinges on metaphor, comparing a synthetic digital output to gold through a valuation model that stretches the limits of economic analogy. But metaphors do not monetize themselves. In contrast, iEthereum’s Store of Value framework emerges not from imitation, but from an alignment between scarcity, design intent, and a plausible industrial-metals anchor. This week’s brief examines that distinction—and why the iEthereum Advocacy Trust’s proprietary Store of Value model offers a more coherent and analytically grounded approach than the industry’s prevailing BTC benchmarks.

Technical Brief: The iEthereum Store of Value Valuation Model and Its Commodity Foundations

The Store of Value model occupies a unique place within the iEthereum valuation suite because it does not attempt to forecast price from transactional demand, network effects, or user adoption. Instead, it investigates the long-range value floor implied by a neutral, finite, and industrially relevant digital commodity. Unlike Bitcoin’s gold-comparison method—which requires assuming Bitcoin “replaces” or “captures a percentage of” global gold markets—iEthereum’s Store of Value thesis emerges from a materially different foundation: a commodity that, if speculation surrounding Apple’s involvement holds even partially true, would be cemented in a real-world metals ecosystem with annual throughput, defined scarcity, and vertically integrated supply-chain properties. When interpreted through a commodity lens, this distinction is profound. Bitcoin’s store-of-value narrative is aspirational; iEthereum’s model is structural.

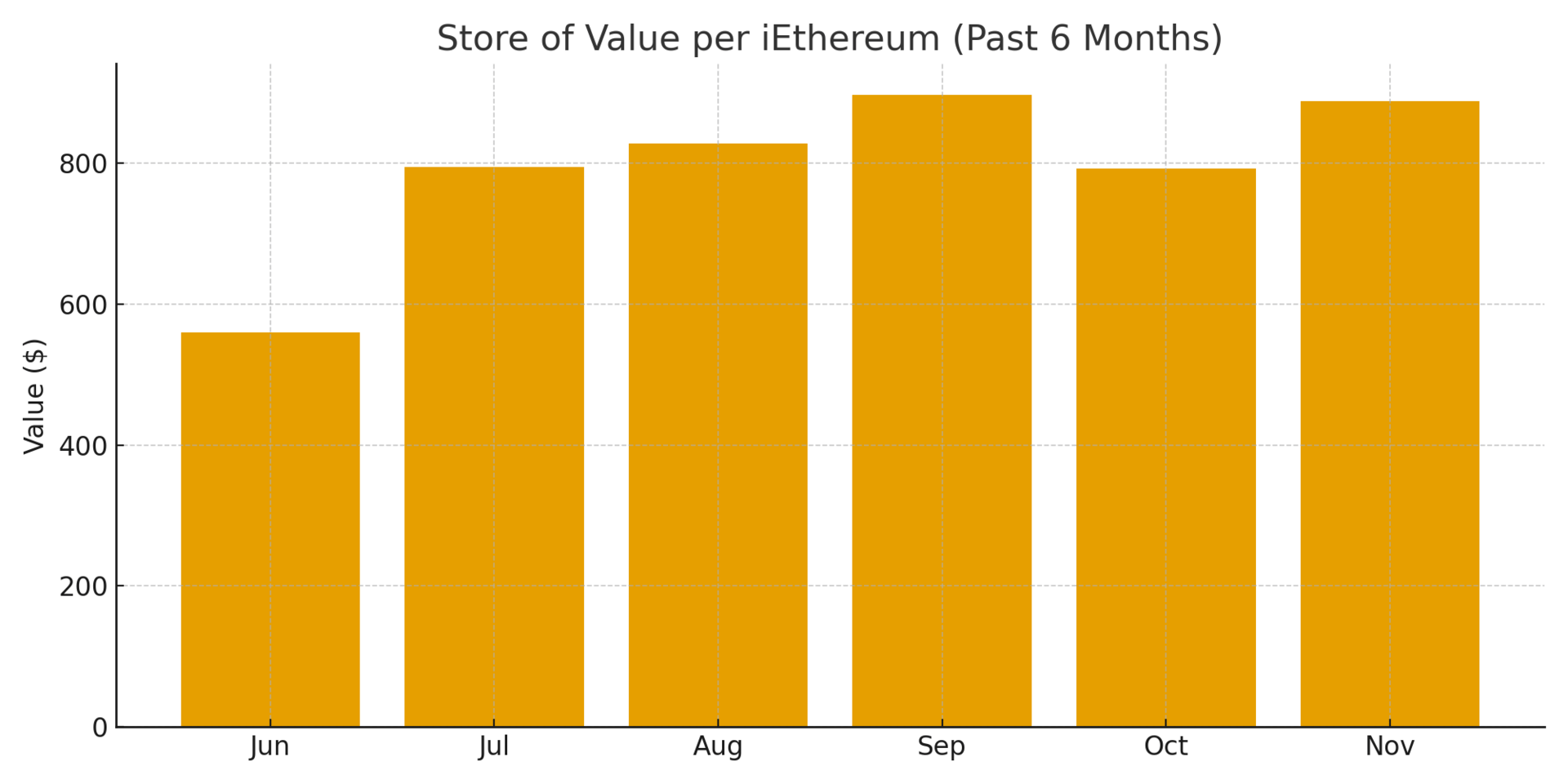

The 2025 valuation data illustrates this clearly. From January through June, the Store of Value Model registers a consistent valuation of $559.56 per token, not because the intrinsic assumptions were static during that period, but because the methodology itself was developed later in the year and then back-applied for continuity. Rather than retro-engineering historical inputs month by month—an exercise that would add noise without improving interpretive value—we elected to standardize the earlier months to reflect the model’s baseline parameters. This produces a coherent, methodologically consistent time series that allows the mid-year revaluation to be analyzed on its own merits, uninfluenced by artificial variability or incomplete historical reconstruction.

This pattern reflects a model driven by structural parameters rather than short-term sentiment. It is only when the model incorporates updated industrial metals assumptions, supply-demand harmonics, and the maturing Apple-adjacent thesis that we see a meaningful shift beginning in July, when the valuation rose to $794.04, followed by $827.70 in August and $896.47 in September. Although the October figure contracted to $792.47, November recovered sharply, rising to $887.57. Taken together, this sequence forms not an erratic spike, but a valuation channel consistent with commodities experiencing tightening supply, rising industrial relevance, or both.

The accompanying market cap trajectory strengthens the point. For the first six months of 2025, the total Store of Value marketcap of iEthereum remained fixed at $10.07 billion, mirroring the stable per-token valuation. But in July, the market cap surged to $14.29 billion, continued upward to $14.89 billion in August and $16.13 billion in September, before retracing to $14.26 billion in October and rising again to $15.97 billion in November. This behavior mirrors long-cycle commodity revaluation patterns—where the fundamental valuation anchor does not float with spot price but re-rates when underlying structural assumptions change. By contrast, speculative assets tend to oscillate violently without establishing new valuation floors. iEthereum’s Store of Value model, however, suggests the emergence of an anchored revaluation range.

This is precisely why the BTC store-of-value comparison to gold remains analytically fragile. As detailed in the Crypto.com methodology, Bitcoin’s comparison model attempts to derive value by mapping BTC share-of-gold-market-capture percentages to BTC’s circulating supply. This requires the assumption that an intangible digital asset with no industrial use becomes a monetary metal equivalent. Even if one accepts the metaphor, the economic apparatus beneath it is thin. Gold’s value is not solely monetary; it is industrial, ornamental, and deeply embedded in centuries of global trust structures. Bitcoin’s model bypasses these dynamics entirely and jumps straight to equivalence.

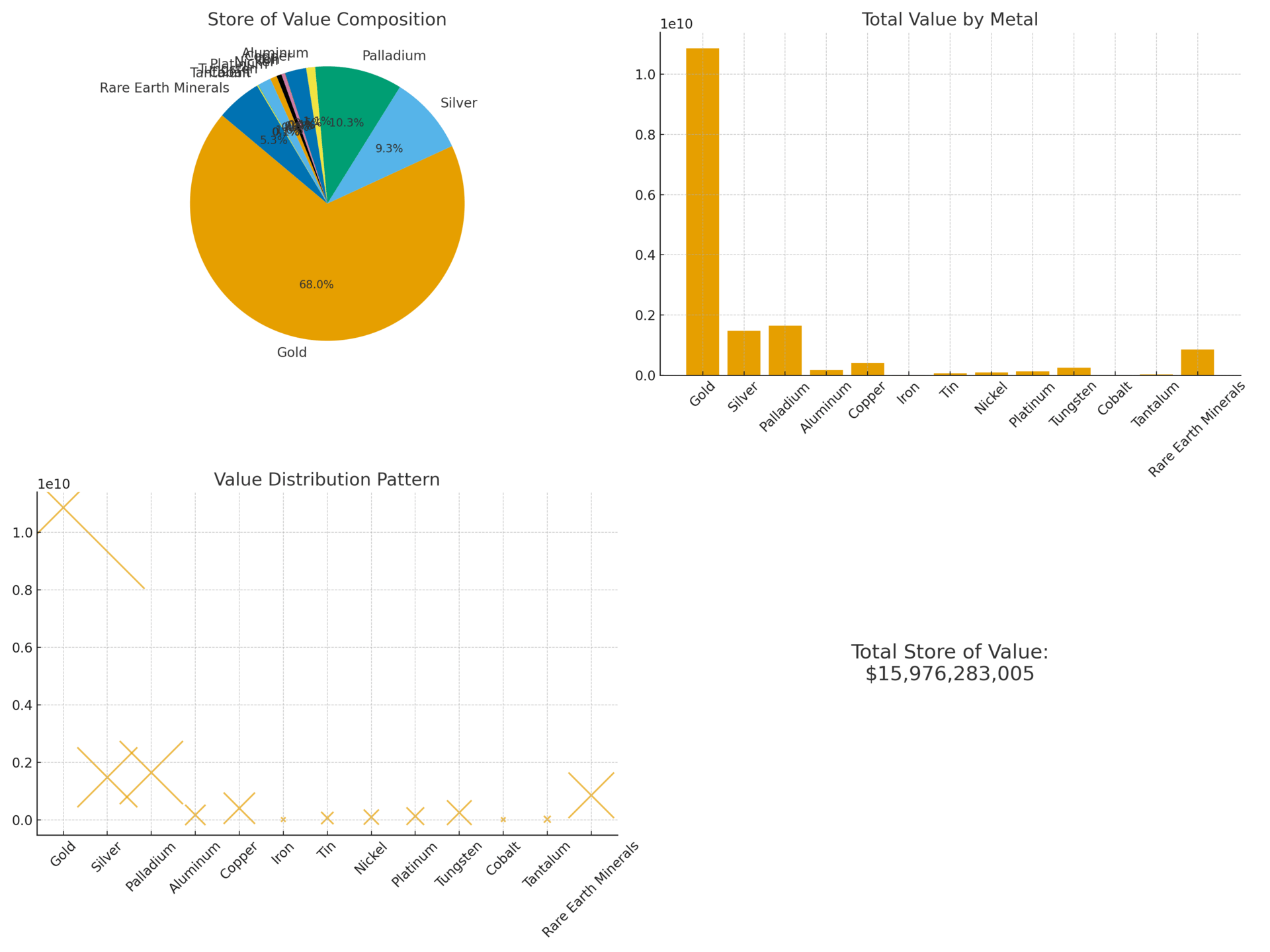

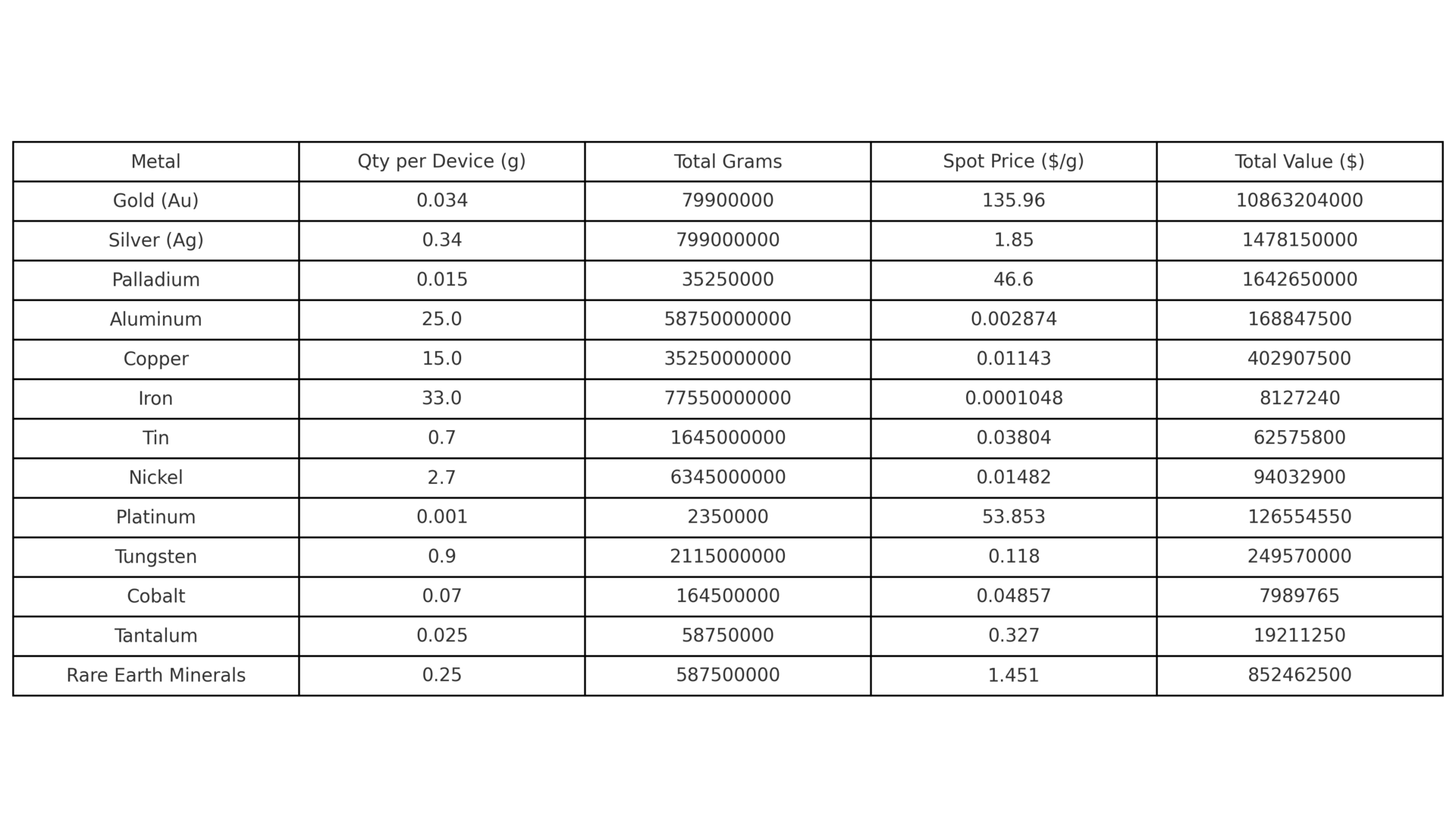

iEthereum’s Store of Value thesis, as articulated in the iEthereum Advocacy Trust’s paper, does not require such metaphoric substitution. Instead of borrowing the monetary gravity of an unrelated asset class—as Bitcoin does when it anchors its valuation to gold’s total market capitalization—our methodology grounds itself in observable industrial reality. We take publicly disclosed figures on active Apple devices, identify the metals embedded within those devices, apply spot prices for those metals, and derive what we call the market-cap assumption: the aggregate notional value of the metallic footprint circulating through Apple’s global ecosystem. This sets a materially coherent valuation anchor. Once established, that assumption is divided by iEthereum’s finite 18 million token supply to derive a per-unit valuation that reflects scarcity, industrial scale, and technological integration, rather than metaphor.

Whether speculative or ultimately confirmed, the linkage positions iEthereum as a digital abstraction—or ledger-coordinated output—of Apple’s immense metals flow: gold, silver, platinum-group metals, rare earth elements, aluminum, and copper moving through a vertically integrated supply chain defined by manufacturing, logistics, and closed-loop recycling. When interpreted through a commodity lens, this framework aligns iEthereum’s valuation logic with industrial throughput, scarcity curves, and long-cycle revaluation behavior, grounding the model in real economic structures rather than symbolic parallels. It is an approach fundamentally more coherent than BTC’s gold-replacement thesis because it maps digital scarcity to a physical counterpart with industrial, technological, and economic relevance, not merely narrative convenience.

One nuance that matters for institutional readers is the non-impact of wallet concentration on this valuation model. The Store of Value thesis is independent of exchange wallet clustering or top-holder balance distribution. Concentration affects liquidity pathways and diffusion, not fundamental commodity valuation. Even if a large portion of supply resides in a limited number of wallets, the Store of Value model assumes the same underlying scarcity and commodity characteristics. By contrast, value-dilution risks in inflationary or upgradeable systems can distort store-of-value projections; iEthereum’s immutability eliminates this layer of uncertainty. Supply will not change. The valuation anchor, therefore, rests entirely on commodity-grade scarcity and the credibility of its industrial thesis—not governance risk or consensus assumptions.

In summary, the iEthereum Store of Value valuation model does what Bitcoin’s cannot: it establishes a rational, commodity-oriented valuation foundation without relying on metaphor, substitution, or monetary wish-casting. It incorporates scarcity, industrial plausibility, network immutability, and long-cycle revaluation behavior into a single coherent framework. And as the 2025 data shows, the model is beginning to reflect a slow upward repricing consistent with tightening commodity narratives. iEthereum may still be early in its diffusion curve, but its Store of Value valuation model is already behaving like an asset preparing for monetary seriousness.

Commodity Behavior Interpretation

The Store of Value model demonstrates commodity-like behavior by anchoring valuation in scarcity, industrial plausibility, and long-range revaluation cycles rather than speculative trading. Like metals, whose prices re-rate when structural supply-demand assumptions shift, iEthereum’s Store of Value valuation channel reflects a predictable, non-speculative floor—suggesting that the asset is moving into the phase where market perception begins converging with commodity fundamentals.

This weekly brief is a preview from the full iEthereum Digital Commodity Index Report. Premium Investor Tier members receive complete Monthly and Quarterly Reports, valuation models, commodity research, and full datasets. Upgrade today or sign up for an Annual Investor Subscription to receive free iEthereum, a discounted rate and immediate premium access.

Note: We are not the founders. We have no direct or official affiliation with the iEthereum project or team. We are independent investors.

iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

If you are currently an iEthereum investor and believe in the future of this open-source value transfer technology, please consider upgrading to one of our paid subscription tiers.

We offer 3 tiers to fit your interests:

Free: Enjoy basic and elementary articles that introduce iEthereum and initiate curiosity and conversation.

iEthereum Advocate: Stay connected with access to all premium articles and content (excluding detailed monthly and quarterly technical iEthereum Digital Commodity Index Reports).

iEthereum Investor: Access in-depth reports and market analyses tailored for serious investors.

With subscriptions ranging from free to $500 per year, there’s a tier for everyone to help shape the future of the iEthereum ecosystem.

Receive free iEthereum with a subscription tier of an annual iEthereum Advocate or iEthereum Investor.

For those inspired to support the cause via donation, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, and all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the free newsletter, upgrade to our iEthereum Advocate subscription tier or higher, and send me an email to discuss price and schedule appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Do your own research. We are not financial or investment advisors!