Editor’s Summary

In markets where transparency is scarce and narratives often outpace fundamentals, sometimes the strongest sentiment signal is found not on-chain but in the quiet behavior of those who choose to seek information. New website visitors—those who arrive without prompt, without marketing, and without algorithmic shepherding—offer a rare, unfiltered window into genuine curiosity. For iEthereum, a commodity whose awareness grows through persistence rather than promotion, these visitors form an important early-market pulse. This week’s technical brief examines that pulse and what it reveals about demand formation, attention cycles, and the gradual widening of iEthereum’s discovery funnel.

Technical Brief: New Website Visitors as a Sentiment Metric and Early-Market Demand Indicator

Among all the sentiment indicators we evaluate, new website visitors stand apart not because the numbers are large—as befits an emerging digital commodity, they are modest—but because they reflect a type of intent that cannot be faked. To arrive at www.iethereum.org, one must first know the name, then deliberately type it, search it, or follow a reference link. There is no viral content engine driving traffic, no exchange campaign drawing users in, and no ad platform pushing impressions. In this sense, every new visitor represents a behavioral signal: a human being choosing to step outside the algorithmic parrot cage and into a niche, technically dense, and hype-free domain. This makes new visitors a rare proxy for early-market curiosity—one of the clearest sentiment markers during the pre-distribution phase of a neutral digital commodity.

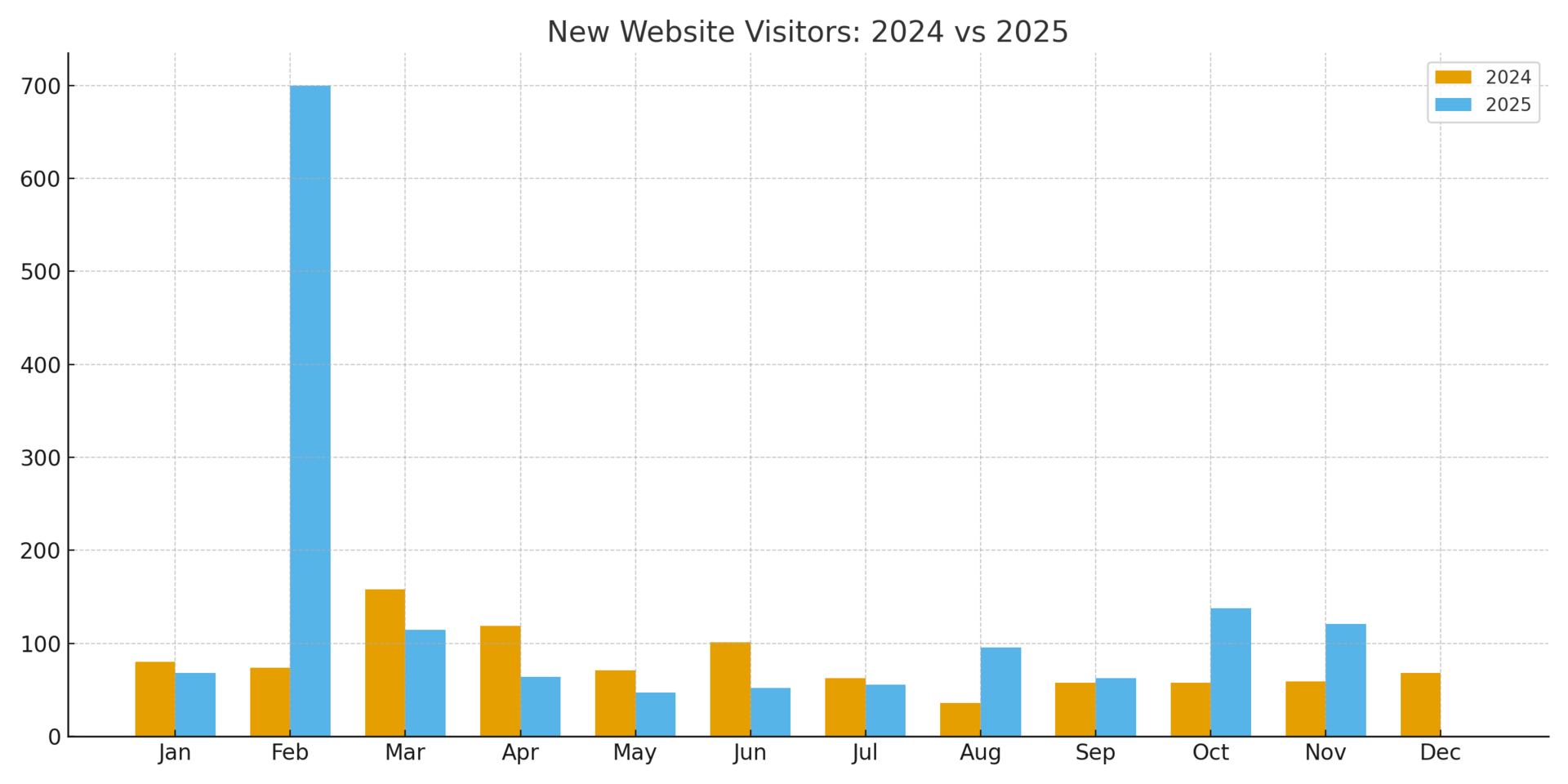

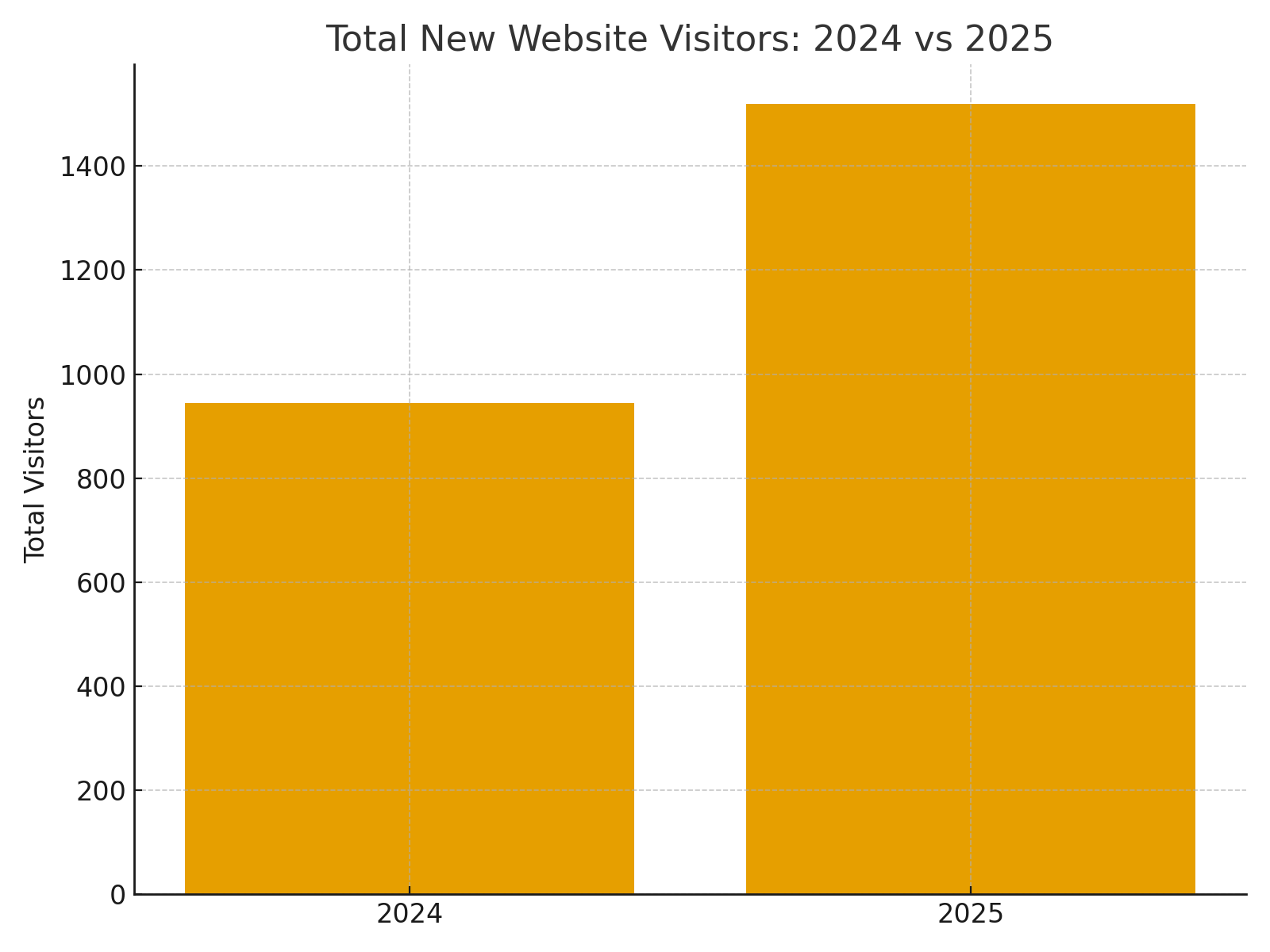

When we examine the 2024 baseline, the monthly pattern reflects the slow awareness curve characteristic of assets still buried beneath the broader market narrative. Monthly new visitors ranged from a low of 36 in August to a high of 158 in March, with quarterly totals of 312, 291, 157, and 185. The year closed with 945 total new visitors, a figure that tells a small story but one that set the stage for what came next. The real inflection arrived in 2025, driven not by marketing but by the natural accumulation of research, publications, and community inquiry surrounding iEthereum. New visitors in 2025 surged to 1,520 through November, already a 61% increase over the entire prior year. But the distribution of that traffic is even more revealing than the total.

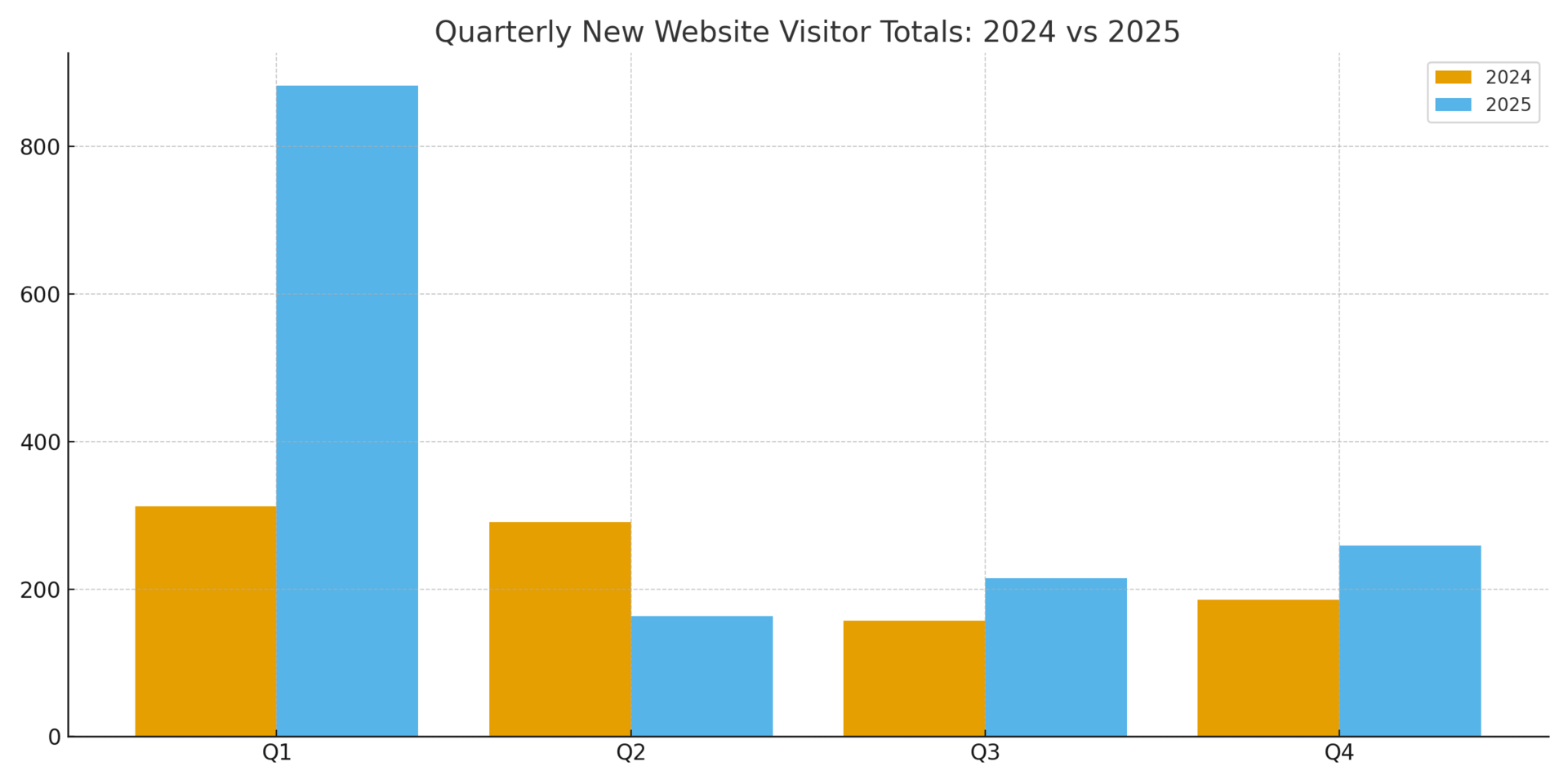

The first quarter of 2025 produced a staggering 883 new visitors, with February alone recording 700—an anomalous spike that appears to correlate with external discussions, social cross-pollination, and rising on-chain speculation surrounding immutable digital commodities. This early surge contrasts sharply with Q2, which retraced to 163 visitors, and Q3, which gradually recovered to 215, before Q4’s upward trend of 259 through November. Taken together, this forms a sentiment curve that mirrors early commodity awareness dynamics: an initial spike driven by discovery, followed by consolidation, normalization, and then the beginnings of organic growth as content, reports, and distribution channels mature.

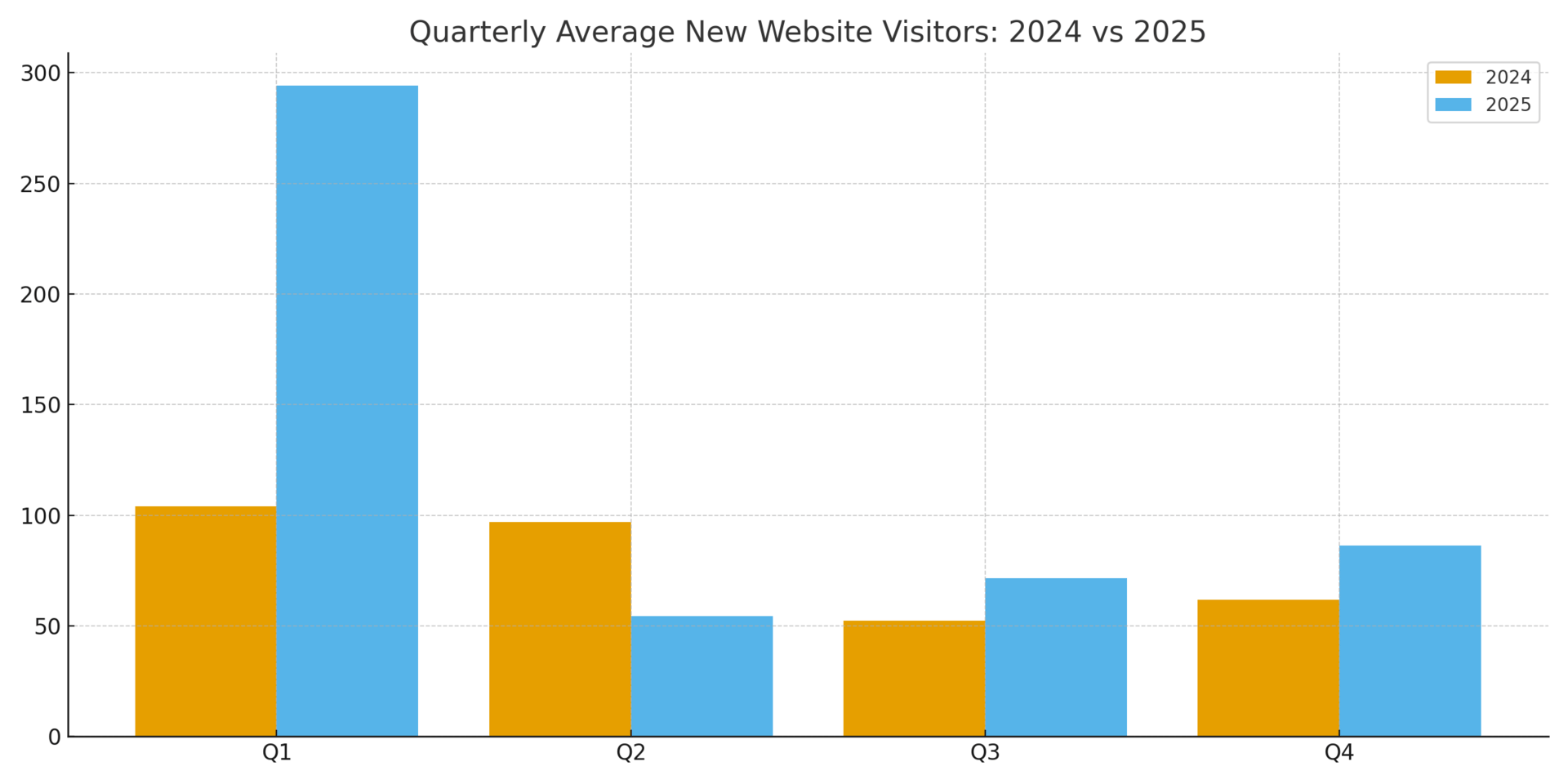

When interpreted through a commodity lens, the mid-year contraction does not signify declining interest but rather the end of a discovery shock followed by a stabilizing demand base. This pattern reflects what we observe in physical commodities when a new geological report, metallurgical breakthrough, or industry rumor briefly accelerates attention before the market returns to its structural equilibrium. iEthereum’s 2025 Q1 spike behaves analogously—an overreaction relative to long-term equilibrium—while 2025 Q2, Q3, and Q4 reveal the more durable strata of interest: 54.33 average monthly new visitors in Q2, rising to 71.66 in Q3 and 86.33 in Q4. This rising quarterly baseline suggests that the audience composition is shifting from speculative browsers to sustained information-seekers, a more important trend for long-term adoption than the raw magnitude of the 2025 Q1 anomaly.

Unlike on-chain datasets, sentiment metrics do not correlate to liquidity concentration or exchange wallet clustering, but they do offer indirect insight into distribution maturity and general interest. A commodity that becomes more widely known becomes more widely held. The relationship is not immediate—awareness precedes participation—but over time, these attention metrics contribute to the diffusion curve visible in wallet distribution reports. What is notable here is the asymmetry between concentration of supply and dispersion of attention. While a small number of wallets still hold a majority of circulating iEthereum, the audience discovering the asset is broadening month by month. In markets where supply is fixed and interest is rising, eventually attention, not liquidity, becomes the constraint. The widening discovery funnel seen in 2025 suggests iEthereum is approaching that transition, albeit this could take longer than thought.

In summary, new website visitors are not merely a traffic metric; they form one of the earliest sentiment signatures of an emerging commodity. Their behavior reveals the quiet expansion of a market narrative that has not yet broken into mainstream exchange listings or institutional research flows but is steadily maturing through organic demand formation. The 2025 data demonstrates a meaningful shift—a year in which curiosity translated not into hype but into a deeper, more sustained engagement cycle. As iEthereum continues to move from obscurity toward recognition, this sentiment indicator serves as an early barometer of the long-cycle attention economy that ultimately underpins commodity adoption.

Commodity Behavior Interpretation

New website visitors behave like an early-stage demand curve in commodity markets, where discovery precedes accumulation. Just as physical commodities experience rising inquiry before they experience rising price, iEthereum’s sentiment metrics reveal the first phase of market participation: the informational frontier. These visitors represent the widening awareness necessary for future distribution and functional use, mirroring how commodities gain value as more participants learn, inquire, and eventually transact.

This weekly brief is a preview from the full iEthereum Digital Commodity Index Report. Premium Investor Tier members receive complete Monthly and Quarterly Reports, valuation models, commodity research, and full datasets. Upgrade today or sign up for an Annual Investor Subscription to receive free iEthereum, a discounted rate, and immediate premium access.

Note: We are not the founders. We have no direct or official affiliation with the iEthereum project or team. We are independent investors.

iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

If you are currently an iEthereum investor and believe in the future of this open-source value transfer technology, please consider upgrading to one of our paid subscription tiers.

We offer 3 tiers to fit your interests:

Free: Enjoy basic and elementary articles that introduce iEthereum and initiate curiosity and conversation.

iEthereum Advocate: Stay connected with access to all premium articles and content (excluding detailed monthly and quarterly technical iEthereum Digital Commodity Index Reports).

iEthereum Investor: Access in-depth reports and market analyses tailored for serious investors.

With subscriptions ranging from free to $500 per year, there’s a tier for everyone to help shape the future of the iEthereum ecosystem.

Receive free iEthereum with a subscription tier of an annual iEthereum Advocate or iEthereum Investor.

For those inspired to support the cause via donation, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, and all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the free newsletter, upgrade to our iEthereum Advocate subscription tier or higher, and send me an email to discuss price and schedule appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Do your own research. We are not financial or investment advisors!