Digital assets may or may not be a good decision to hold in your portfolio as we navigate these times and look to the future. We are not financial advisors.

However, If you have already decided to hold digital assets to ride this storm out; many would prefer a cryptocurrency or token that has a finite supply. Such as Bitcoin.

Such as iEthereum!

In times where our monetary system is going crazy with unlimited money printing; what can we do to protect ourselves from decreased purchasing power?

What do I mean? Can you repeat the question?

Has your home price gone up the past decade? Or has your purchasing power gone down? Can you buy more or less for the $1 in your pocket today verses 20 years ago? Food for thought….

In our opinion, inflation through money printing is theft!

Please tell me what the difference between these two following scenarios end results is.

Scenario 1- If I have a $100 and a thief steals $5 from me; I can only buy 95% of what I could have bought before the thief stole from me.

Scenario 2- If I have a $100 and the fed creates 5% (this is generous) annual inflation through money printing; that first year I can only buy $95 worth of goods. If this were to continue, which it does, my purchasing power of $100 would be worth 0 in a matter of two +- decades.

Those printing the money can not be that obvious so they spread inflation out over generations. But the end result is the same. They are pickpockets. You do not realize that someone was in your pocket until you get to the gas station or grocery store.

According to Carbon Collective Investment, “$1 value in 1913 is worth $30.39 value in 2024.” If my math serves me, that is a 96.7% decrease in your dollars purchasing power since the federal reserve bank came into existence. Which I want to note to the readers, the fed is neither Federal nor has it any reserves.

Above I asked you to tell me the difference between the two scenarios. Let me save you some “time” by not having to explain to me the nitty gritty technical detailed jargon from a Harvard economist. The answer is time.

Time is the difference between those scenarios. If the government were to steal from you as quickly as the thief, you would be mad and angered. It would be a similar emotion to when you receive your paycheck and you realize the government took 10-30% of your hard earned wage in the form of income tax and spent it on everything other than what you would like your taxes to be spent on.

Understanding the populous does not like more tax, combined with their mismanagement of budgets and coupled with their ego of money and power; the fed prints more money into existence by deceiving us and to cover their shortfalls by allowing you to think your home has gone up in value. The home has gotten older every year that goes by. The sellers home has not gone up in value. The home buyers purchasing power has decreased.

In regards to cryptocurrency, of which there are many, all of which have specific “tokenomics.” Tokenomics is a play on the the word economics. In short, it means the economics of that particular tokens ecosystem. As described by Coin Desk, “Tokenomics determine the incentives that set out how the token will be distributed that influence its demand.”

Is your favorite cryptocurrency inflationary or deflationary tokenomics?

Is iEthereum inflationary or deflationary?

Not looking to call out specific projects, just making the point of what people want!

This will be the first of a series of articles highlighting the various iEthereum value propositions.

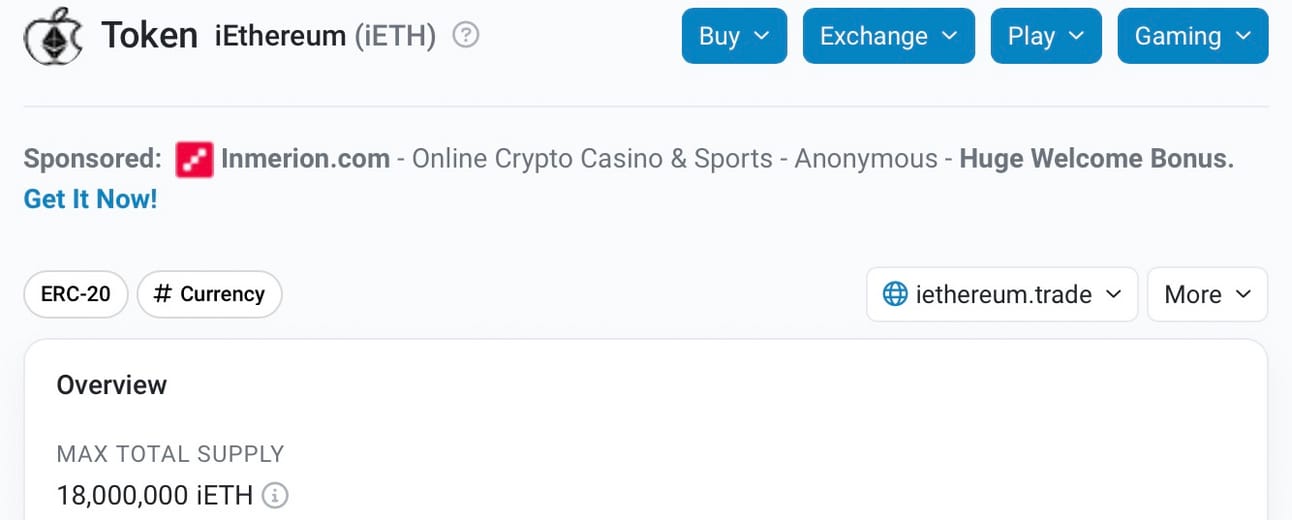

The significant value proposition that iEthereum contains within the structured immutable code is its finite supply. This makes iEthereum scarce and its circulating supply deflationary. Value proposition #1.

In these times, how could you go wrong with iEthereum that brings to the table its finite and total maximum supply of 18,000,000 tokens ever into existence.

What is the value proposition of a crypto currency that has a finite supply of 18,000,000?

The value proposition of a cryptocurrency with a finite supply, such as Bitcoin, which has a maximum supply of 21 million coins or 18 million in the case of iEthereum, is rooted in several key principles:

Scarcity and Deflationary Nature: Cryptocurrencies, with capped supplies like gold, mimic scarcity to resist inflation, safeguarding against value erosion seen in traditional fiat currencies with unlimited supplies.

Store of Value: Cryptocurrency's limited supply and scarcity enhance its perceived value store, contrasting with fiat currencies vulnerable to government manipulation, making it a potentially more stable long-term store of value.

Reduced Supply Uncertainty: Cryptocurrency's predictable, finite supply reduces uncertainty for users and investors, in contrast to traditional monetary systems where central banks' influence creates uncertainty about future economic conditions.

Censorship Resistance: A finite supply makes cryptocurrency resistant to government manipulation. Decentralized and transparent rules governing creation and distribution contribute to resistance against censorship and centralized control.

Disclaimer: While a finite supply is a key feature of certain cryptocurrencies, it does not guarantee success or immunity from challenges.

Bitcoin is the most well-known example of a cryptocurrency with a capped supply, and its success has led to the consideration of scarcity as a valuable feature in the design of other cryptocurrencies. Hence, our belief that iEthereum with its scarcity of a finite supply of 18 million tokens is very valuable and will be sought after.

I asked Chat GPT the following:

IEAT: If your goal was to invest in a cryptocurrency as a hedge against inflation as well as holding an asset with scarcity to support long term value; would you invest in a finite supply token such as BTC or iEthereum? Or a token with an infinite supply and/or complicated inflationary tokenomics?

CHATGPT: If the goal is to invest in a cryptocurrency as a hedge against inflation and to hold an asset with scarcity for long-term value, many investors tend to lean towards cryptocurrencies with finite supplies and straightforward tokenomics. Here's why:

Finite Supply (Scarcity):

Cryptocurrencies with a limited or finite supply, such as Bitcoin and iEthereum are often viewed as digital gold due to their scarcity. Limited supply can potentially create a sense of value preservation over time, especially if demand increases.

Hedge Against Inflation:

Finite-supply cryptocurrencies, such as Bitcoin and iEthereum, are often considered a hedge against inflation because their scarcity may protect against the devaluation of currency over time.

Simplicity and Transparency:

Cryptocurrencies such as Bitcoin and iEthereum, with straightforward tokenomics and clear supply limits can be more transparent and easier for investors to understand. Complex tokenomics or unlimited supplies may introduce uncertainties and complexities that could be challenging to assess.

It's important to note that there are no guarantees in investing, and all investments carry risks. Diversification, thorough research, and staying informed about market conditions are crucial regardless of the specific cryptocurrency chosen. Additionally, consulting with financial professionals can provide personalized advice based on your financial goals and risk tolerance.

iEther way, We see value!

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Follow us on X (Twitter) @i_ethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our new Youtube Channel is https://www.youtube.com/@iethereum

Follow us on Gab @iEthereum

If you are currently an iEthereum investor and you believe in the future of this open source software; please consider upgrading to a premium paid sponsorship. A $104 annual sponsorship is currently the greatest assurance your iEthereum investment has a voice in the greater crypto space.

Receive free iEthereum with a sponsorship.

For those inspired to support the cause, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the newsletter, upgrade to a premium sponsorship, and send me an email to schedule payment and appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Note: We are not the founders. iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

Do your own research. We are not financial or investment advisors!