This weekly brief examines the fundamentals of the HEX/iEthereum (HEX–iETH) trading pair as a candidate venue for low-volume Uniswap execution and rule-based trading bots. The lens is strictly commodity-style microstructure: liquidity depth, volatility regime, median price behavior, and the practical constraints of exchange-held balances. The question is not “direction,” but whether this pair’s structure can enable disciplined accumulation, range harvesting, and low-slippage execution consistent with iEthereum’s commodity profile.

Market Structure and Pair Dynamics. The Hex/iEthereum trading pair differs from mainstream crypto pairs in one crucial way: both assets behave as supply-constrained digital commodities with predictable issuance characteristics. This produces a slow-moving, structurally under-arbitraged pair that is unusually suitable for low-volume Uniswap environments and systematic trading bots that thrive on micro-volatility rather than directional momentum.

Liquidity on this pair is thin relative to more commonly traded pairs, which creates two simultaneous conditions:

Spread Expansion — wider gaps between bids and asks, advantageous for range-bound bots.

Low Execution Drag — minimal MEV targeting due to low global visibility.

This combination is rare in crypto markets, where visibility and volume usually invite adverse selection. Here, invisibility is the alpha.

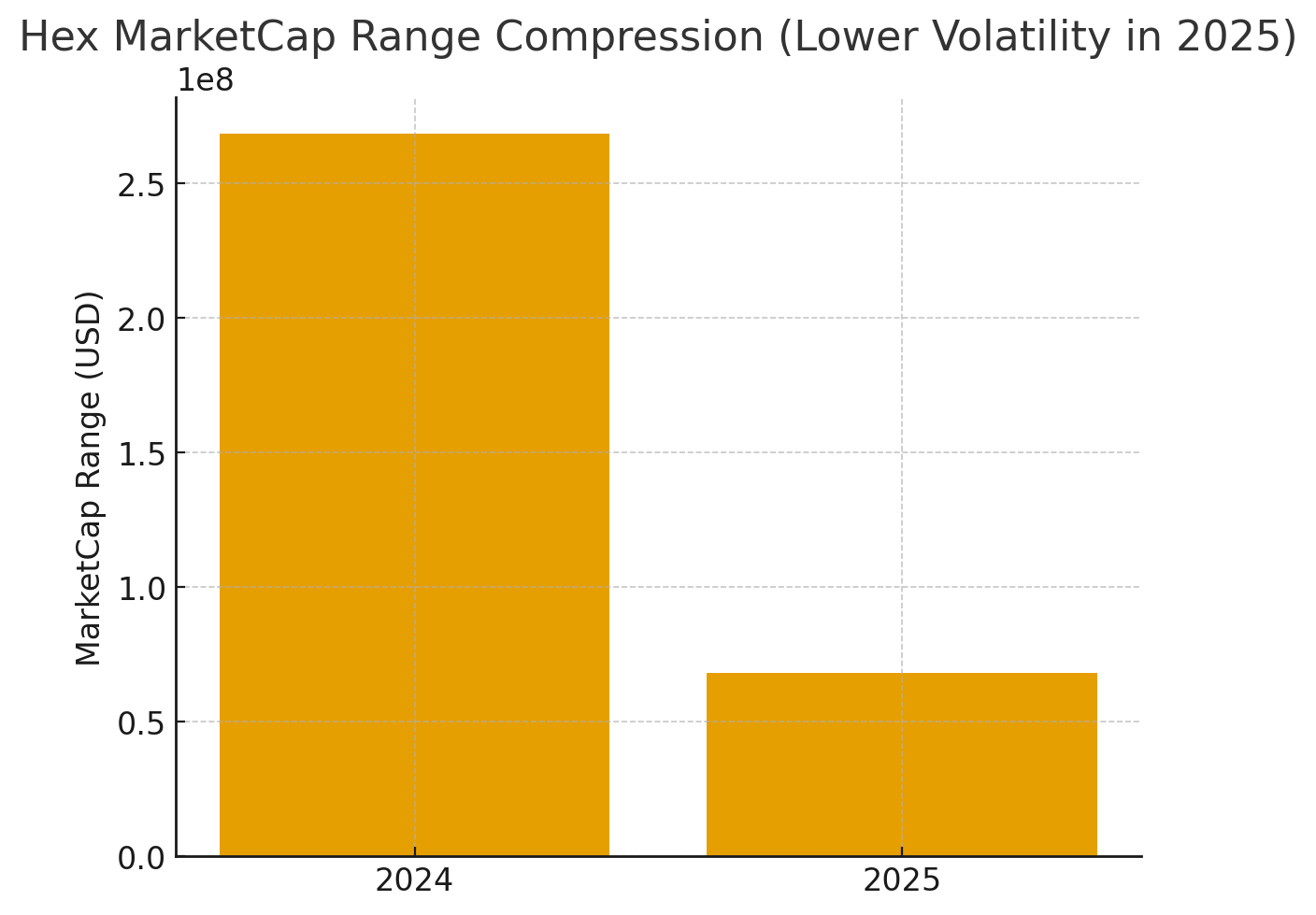

Observed regime and compression. Using the market-cap time series, the HEX aggregate range contracted sharply from 2024 to 2025. The 2024 range (max–min) was ≈ $268.5M, versus ≈ $68.1M YTD in 2025—~74.6% compression. Dispersion fell similarly: the 2024 standard deviation was ≈ $74.9M; 2025 YTD ≈ $22.5M (~69.9% lower). For practitioners, that shift implies tighter distribution around a mid-zone—fertile conditions for mean-reverting inventory strategies, tighter liquidity ranges on Uniswap v3, and lower re-hedge cadence for small bots.

Level context. Average market cap across 2024 was ≈ $151.2M; 2025 YTD averages ≈ $100.8M (~33.4% lower). A straight Jan–Oct YoY comparison is noisy due to outliers (e.g., February), but the median YoY change sits around the high negative-20s, consistent with a down-shifted yet more orderly regime. In practice: spread capture improves when dispersion shrinks faster than absolute level—precisely the profile we see here.

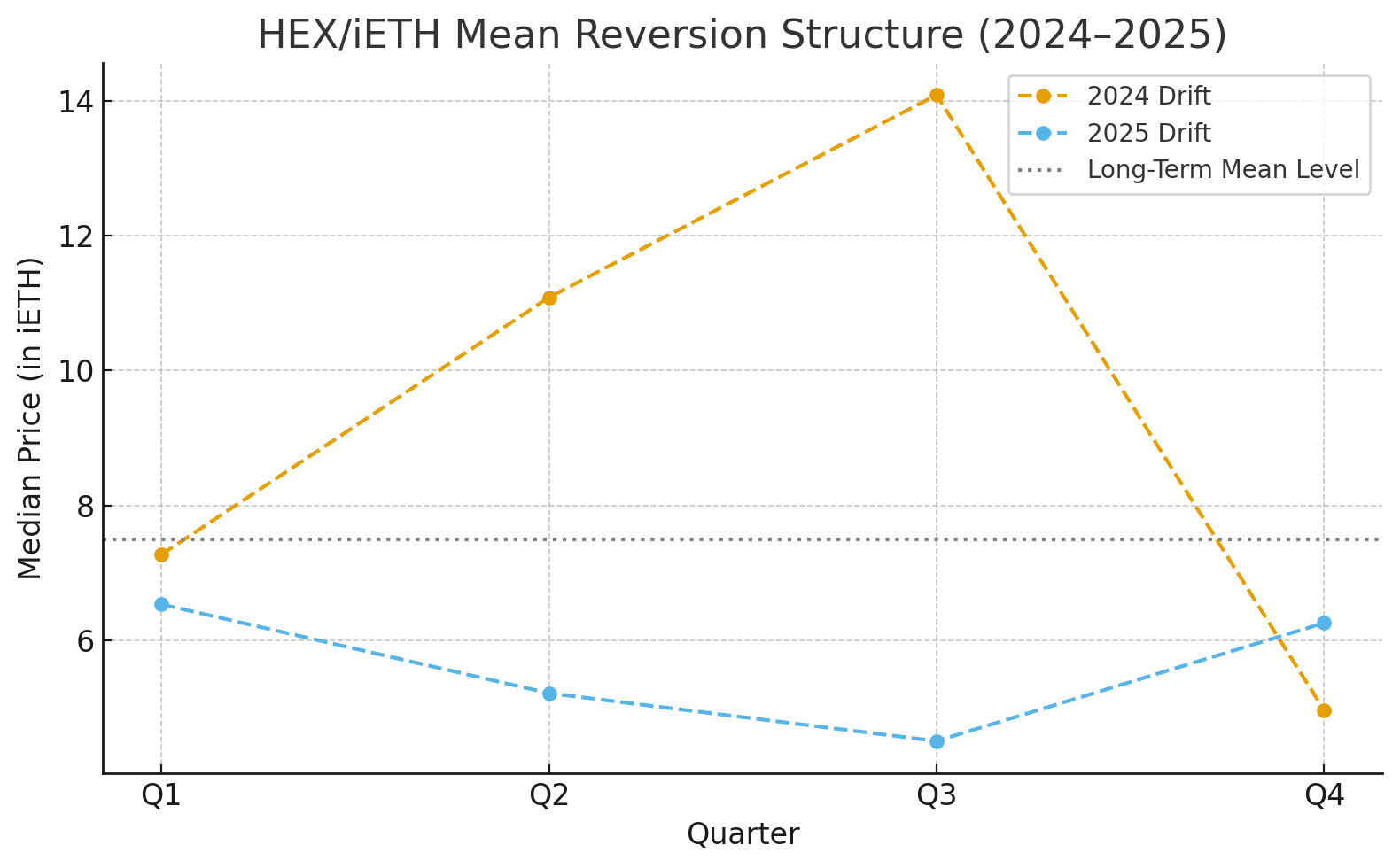

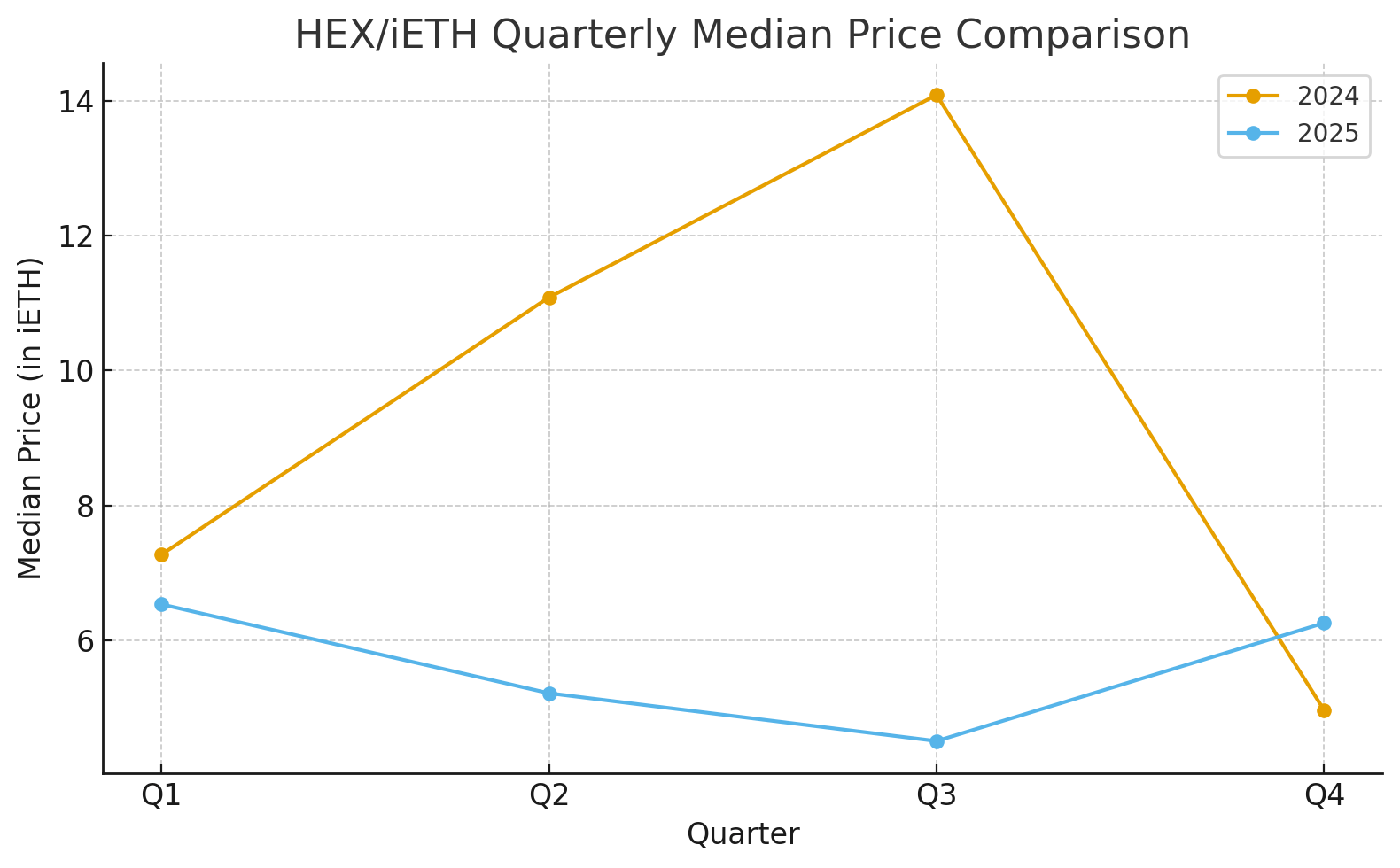

Price structure in iETH terms. The quarterly median HEX price in iETH printed 8.0354 for 2024 and 5.6290 YTD 2025 (~30% lower). Taken together, the two-year blended anchor sits near 6.83 iETH—a practical “gravity line” for range design. Quarter-by-quarter, 2024 showed escalating medians into Q3 (7.27 → 11.09 → 14.09) before resetting in Q4 (4.97). 2025 re-centered lower (6.54 → 5.22 → 4.51) then ticked up in October (6.2608 iETH), consistent with a mean-reversion bounce into a compressed band. For automated execution, these median ladders are more reliable than single-print highs/lows; they define the bands where passive liquidity earns most consistently.

Implications for Uniswap low-volume execution.

Concentrated-liquidity ranges: In a compressed regime, narrow ticks around quarterly medians (±1–2 median absolute deviations) can harvest fees with less inventory risk.

Bot design: Favor mean-reversion over breakout logic. Use small clip sizes per fill, time-weighted placement, and adaptive ranges keyed to the rolling quarterly median in iETH terms.

Slippage control: In thin pools, the path-dependency of swaps matters. Route simulators should penalize routes that traverse shallow ticks; for small funds, single-pool execution with limit-style LP provisioning often dominates multi-hop routing.

Gas discipline: Compression plus small clips can still erode net returns if gas is ignored. Schedule re-center events to coincide with material drift from median bands, not calendar cadence.

Inventory hedging: Where feasible, hedge iETH exposure at the portfolio level rather than leg-for-leg inside the pool; this preserves fee income while controlling directional drift.

Caveats, structure, and wallet concentration. HEX supply distribution and the presence of large, programmatic wallets (including origin and exchange-operated addresses) can create abrupt, one-sided order flow. Exchange wallets frequently represent omnibus balances—liquidity concentration, not unilateral conviction—but they can still cause transient depth vacuums when inventory rotates. Execution plans should incorporate: (i) kill-switch thresholds on abnormal tick depletion, (ii) staggered liquidity across two neighboring ranges, and (iii) cool-down timers after large sweeps before re-provisioning. All metrics here are derived from the aggregates seen in the monthly iEthereum Digital Commodity Index Reports; on-chain pool tick data and live depth should be consulted before sizing real orders.

Bottom line. The HEX–iETH pair presently exhibits the traits sought by low-volume Uniswap strategies: range compression, stable medians, and manageable variance. Those characteristics support fee harvesting and disciplined accumulation, provided routing, gas, and wallet-structure risks are explicitly managed. For readers accustomed to directional theses, the opportunity here is microstructure alpha—turnover of inventory inside a controlled band—rather than narrative beta.

Commodity Behavior Interpretation. iEthereum’s fixed supply and low-velocity ownership base allow us to treat the iETH leg as a commodity-like settlement asset: scarce, slow-moving collateral against which HEX price dynamics can be benchmarked. When HEX’s dispersion compresses relative to a stable iETH unit of account, the pair exhibits commodity spread behavior—profits emerge from harvesting the spread (fees + small reversion edges), not from forecasting absolute price. This is the same logic commodity desks apply to crack spreads, calendar spreads, or basis trades: manage inventory within bands, monetize flow, and let scarcity of the quote asset (iETH) anchor valuation over time.

This weekly brief is comprised of data from the full iEthereum Digital Commodity Index Report. Premium Investor Tier members receive complete Monthly and Quarterly Reports, valuation models, commodity research, and full datasets. Upgrade today or sign up for an Annual Investor Subscription to receive a discounted rate and immediate premium access.

Note: We are not the founders. We have no direct or official affiliation with the iEthereum project or team. We are independent investors.

iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

If you are currently an iEthereum investor and believe in the future of this open-source value transfer technology, please consider upgrading to one of our paid subscription tiers.

We offer 3 tiers to fit your interests:

Free: Enjoy basic and elementary articles that introduce iEthereum and initiate curiosity and conversation.

iEthereum Advocate: Stay connected with access to all premium articles and content (excluding detailed monthly and quarterly technical iEthereum Digital Commodity Index Reports).

iEthereum Investor: Access in-depth reports and market analyses tailored for serious investors.

With subscriptions ranging from free to $500 per year, there’s a tier for everyone to help shape the future of the iEthereum ecosystem.

Receive free iEthereum with a subscription tier of an annual iEthereum Advocate or iEthereum Investor.

For those inspired to support the cause via donation, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, and all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the free newsletter, upgrade to our iEthereum Advocate subscription tier or higher, and send me an email to discuss price and schedule appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Do your own research. We are not financial or investment advisors!