This week marks the inaugural publication of the iEthereum Commodity Technical Brief, a weekly analytical dispatch derived from the Monthly iEthereum Digital Commodity Index Report. Each Friday, a single technical metric is examined through the lens of digital commodity fundamentals, offering readers a distilled preview of the deeper analysis presented in the premium Index. Our focus this week is the Metcalfe Value of Network valuation model. Metcalfe’s Law provides one of the most widely recognized frameworks for estimating intrinsic value in network-based systems by asserting that network worth grows in proportion to the square of its active participants. Applied to iEthereum, a fixed-supply immutable token, the Metcalfe model evaluates address activity, participation density, and the underlying settlement substrate rather than speculative price action or governance-driven dynamics.

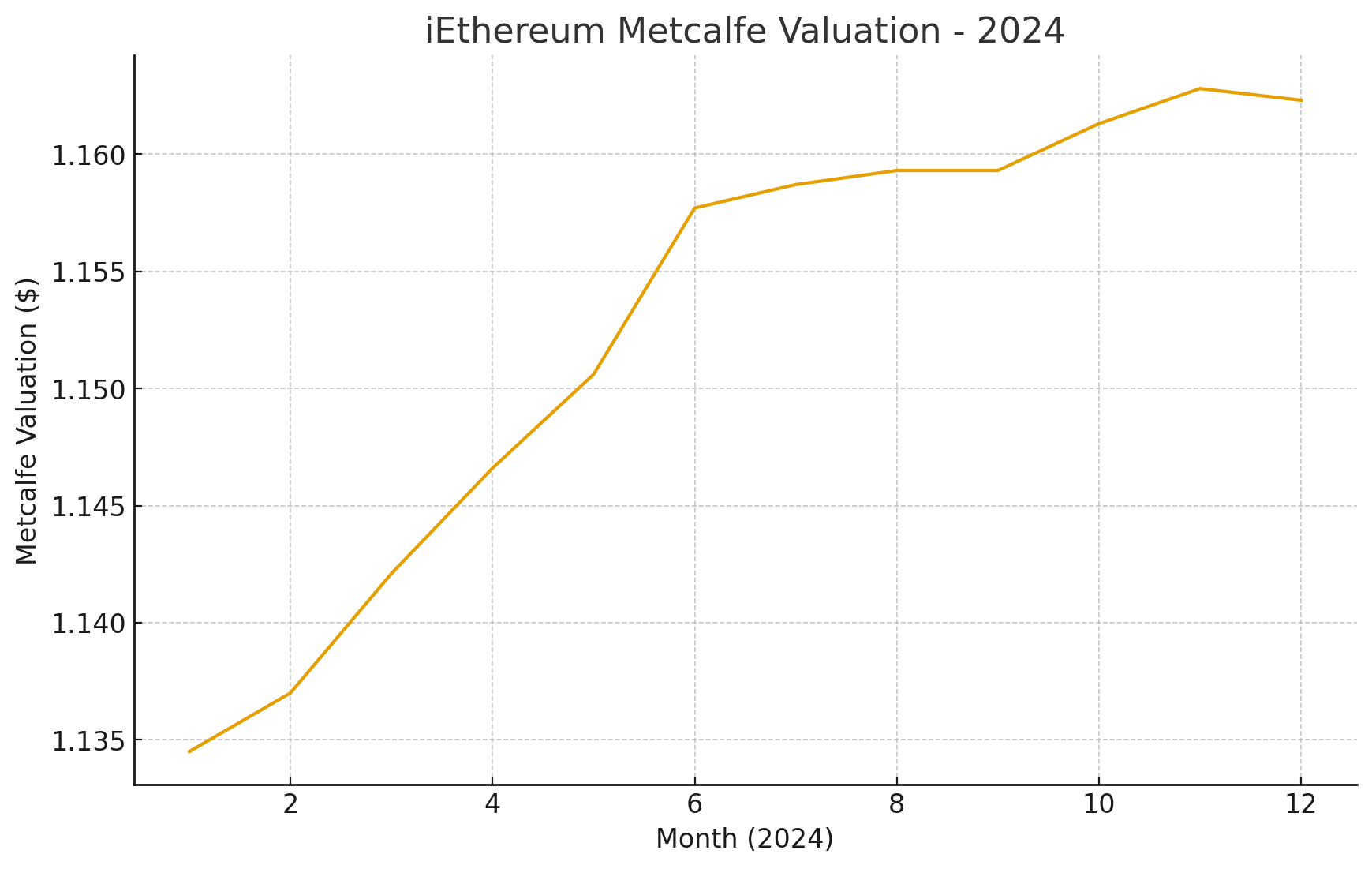

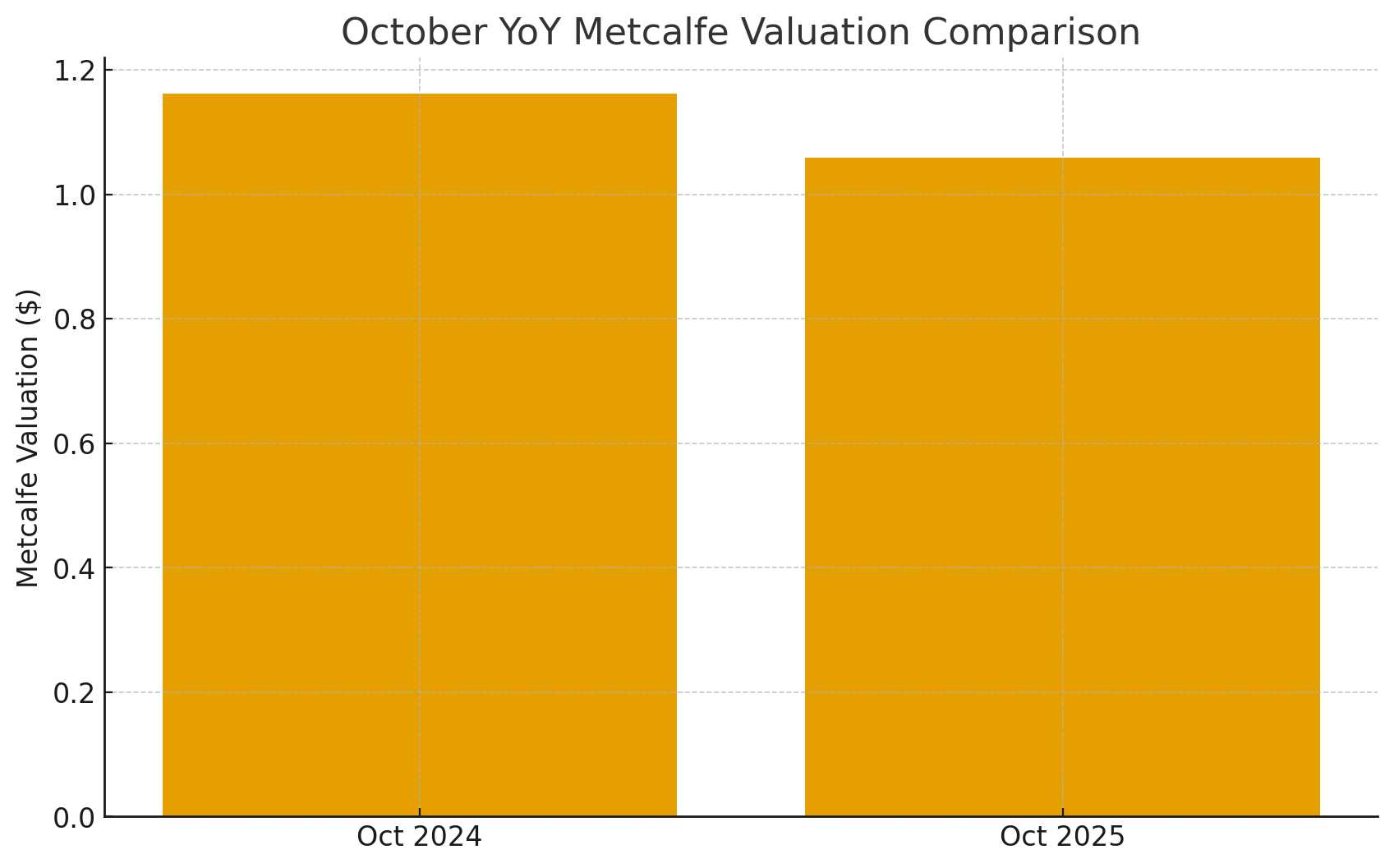

Using the Metcalfe fair-value formula—which scales active address count by an empirically derived constant before dividing by circulating supply—we can derive a monthly valuation per token and convert that to a total implied network valuation by multiplying by iEthereum’s fixed 18 million supply. Over the course of 2024, Metcalfe valuations exhibited a steady upward gradient, beginning near $1.1345 and climbing to the $1.1623 range by December. The annual average for 2024 stood at approximately $1.1534 per iEthereum, with October’s valuation of $1.1613 translating to an implied network worth of $20,903,184. This pattern reflected a year of gradual strengthening in address participation and stable circulation behavior within the ecosystem.

By contrast, the 2025 valuations show a compression cycle during the first quarter. January began at $1.1522—nearly consistent with late 2024—but activity tapered as sector-wide liquidity tightened across the broader Ethereum environment, pushing valuations into the ~$1.055 zone for much of the year. The year-to-date average Metcalfe valuation for 2025 is approximately $1.0672 per token, representing a modest decline relative to 2024 but still highly stable for an asset with iEthereum’s characteristics. October 2025 registered a Metcalfe valuation of $1.0585, implying a total network value of $19,053,225, down roughly $1.85 million from the prior October’s level. This 8.84% year-over-year contraction in Metcalfe valuation reflects a temporary dip in address participation rather than any erosion of structural fundamentals, especially given the broader market context of L2 migration, reduced on-chain transfer activity, and the mid-cycle liquidity recession affecting digital assets throughout the year.

When these results are interpreted through a commodity lens, iEthereum continues to demonstrate characteristics expected of a fixed-supply digital commodity rather than a speculative governance asset. While top-wallet concentration appears high on-chain, much of this concentration is attributable to exchange-operated wallets that pool balances on behalf of many users. These pooled balances serve as open-market liquidity—not strategic accumulation by individual entities—and thus should not be misinterpreted as whale dominance. When adjusting for known exchange custody patterns, the network exhibits the hallmarks of thinly traded commodity markets: low velocity of funds, steady holding behavior from long-term participants, and minimal speculative churn. The stability of the Metcalfe valuations—even during a contractionary year—suggests that iEthereum’s network value is anchored more by structural scarcity and consistent participation patterns than by volatility-driven narratives.

Taken together, the path from 2024 into 2025 outlines a clear story. iEthereum experienced a year of strengthening network activity followed by a mild, market-wide contraction, after which valuations stabilized tightly around the $1.055–$1.06 region—an indication that participation found its equilibrium zone. Because Metcalfe’s Law amplifies the impact of address growth through its N² structure, even small future increases in participation could disproportionately raise the implied value of the network. With a permanently fixed supply of 18 million tokens and no inflationary mechanics, iEthereum remains highly sensitive to participation recoveries, discovery cycles, and new cohort formation within the wider Ethereum and mobile-digital ecosystem.

In summary, the Metcalfe valuation data shows that iEthereum’s network value has remained remarkably stable across both years despite macro tightening and sectoral shifts. The mild year-over-year decline is consistent with temporary participation troughs rather than structural weakness, and the underlying commodity profile—scarcity, low velocity, high-conviction holding, and exchange-provided liquidity concentration—reinforces iEthereum’s position as a maturing digital commodity. As participation trends begin to re-expand into 2026 and 2027, the Metcalfe model suggests meaningful upside potential driven not by hype but by fundamental network behavior.

This weekly brief is derived from the full iEthereum Digital Commodity Index Report. Premium subscribers receive complete valuation models, expanded datasets, macro analysis, and additional charting not included in this preview. Upgrade to access the full Monthly Index and become part of the early analytical foundation of the iEthereum commodity era.

Note: We are not the founders. We have no direct or official affiliation with the iEthereum project or team. We are independent investors.

iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Our X account @i_ethereum has been indefinitely suspended. Censorship still exists.

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

If you are currently an iEthereum investor and believe in the future of this open-source value transfer technology, please consider upgrading to one of our paid subscription tiers.

We offer 3 tiers to fit your interests:

Free: Enjoy basic and elementary articles that introduce iEthereum and initiate curiosity and conversation.

iEthereum Advocate: Stay connected with access to all premium articles and content (excluding detailed monthly and quarterly technical iEthereum Digital Commodity Index Reports).

iEthereum Investor: Access in-depth reports and market analyses tailored for serious investors.

With subscriptions ranging from free to $500 per year, there’s a tier for everyone to help shape the future of the iEthereum ecosystem.

Receive free iEthereum with a subscription tier of an annual iEthereum Advocate or iEthereum Investor.

For those inspired to support the cause via donation, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, and all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the free newsletter, upgrade to our iEthereum Advocate subscription tier or higher, and send me an email to discuss price and schedule appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Do your own research. We are not financial or investment advisors!