Like the fruit of old, iEthereum exists to be discovered, consumed, and transformed into a new standard.

Foreword / Disclaimer

The following article is a work of analysis, speculation, and game theory. It is not financial advice. There is no confirmation or denial of any affiliation between Apple Inc. and iEthereum. What follows is a thought exercise on how open-source digital commodities, corporate strategy, and sovereign-level adoption may intersect.

Was iEthereum born through Creationism or Evolution?

On one side, there is the Creationist view: that iEthereum was deliberately designed, perhaps even by Apple itself, seeded into Ethereum in 2017 as a sleeper digital commodity waiting for its time. Every detail — from the capped supply to the “i-” branding — would be evidence of intentional authorship.

On the other side, there is the Evolutionary view: that iEthereum was simply another experiment in the Cambrian explosion of ERC-20 tokens, launched without corporate fingerprints, surviving only because it was fair, immutable, and neutral — while thousands of other projects perished.

And yet, the most interesting possibility is a synthesis of both. That iEthereum did not need a “divine creator” like Apple to give it meaning. Instead, its very survival — quiet, unnoticed, immutable for more than eight years — prepared it for adoption today. Creation planted the seed, Evolution preserved it, and now the environment may finally be ready for activation.

1. Thesis: Apple Created iEthereum

In February 2017, a quiet ERC-20 token called iEthereum appeared on Ethereum. No ICO. No venture funding. No flashy marketing campaign. Just a contract, a capped supply of 18 million tokens, and 99% distribution that landed across thousands of wallets.

If one takes a conspiratorial lens, the fingerprints line up curiously with Apple’s broader financial arc:

Timing. The launch coincided with Apple Pay’s global expansion and early groundwork for Apple Card and Apple Cash. Apple was preparing to deepen its footprint in payments — and may have needed a neutral settlement commodity.

Branding. The name “iEthereum” mirrors Apple’s iconic “i-” prefix lineage (iPod, iPhone, iPad). Add Ethereum’s brand recognition, and the fusion feels almost intentional. Combine the two into one iconic logo.

Patents. Around the same time, Apple was filing blockchain-adjacent patents: timestamping with Secure Enclave, cryptographic attestations, hardware-anchored ledgers. iEthereum could have been the intended base layer for these applications.

Stealth Strategy. Apple is famous for seeding products quietly, letting them incubate until the world is ready. The iPhone itself was hidden in plain sight within iTunes’ DNA years before its launch. iEthereum’s quiet debut could fit that same pattern: plant a sleeper asset, wait eight years, then activate it when regulation and technology align.

Fairness. Unlike most tokens of its era, iEthereum had no insider enrichments, no presales, and no corporate allocations. If Apple wanted a neutral backbone, what better cover than a distribution so clean it couldn’t be accused of favoritism?

Under this speculative view, iEthereum isn’t just another ERC-20. It’s Apple’s hidden digital commodity — a neutral settlement layer waiting to be awakened.

2. Antithesis: Apple Didn’t Create iEthereum

Of course, there is an equally strong case that Apple had nothing to do with iEthereum’s birth.

Style Mismatch. Apple is known for meticulously orchestrated rollouts. Products are trademarked, patented, and legally fortified before public release. iEthereum, by contrast, arrived without fanfare or polish. No keynote. No whitepaper. No trademark filings. That doesn’t fit Apple’s brand DNA.

Technical Dependence. iEthereum is locked as an immutable ERC-20 on Ethereum. Apple prefers control. Its products are walled gardens: hardware, software, and services tightly integrated. To rely on Ethereum governance, forks, and proof-of-stake politics would be unlike Apple.

Regulatory Risk. In 2017, ICOs and token launches were already drawing the SEC’s attention. Would Apple — one of the most cautious companies in the world — expose itself to liability by quietly launching an ERC-20 without disclosure? Unlikely.

Alternative Rails. Apple already had Apple Pay, Apple Card, and Apple Cash. These products were built with Goldman Sachs, Mastercard, and JPMorgan. Apple has access to institutional rails. Why dabble with an obscure ERC-20 when banks were already lining up?

Silence. In eight years, not a single credible leak, whistleblower, or institutional filing has tied Apple to iEthereum. Given Apple’s visibility, such silence suggests absence of involvement.

From this angle, iEthereum looks less like Apple’s brainchild and more like an organic, grassroots experiment — an open-source project that survived without corporate stewardship.

3. Synthesis: Apple May Adopt iEthereum Anyway

And yet — here lies the most compelling possibility. Even if Apple did not create iEthereum, it may be perfectly positioned to adopt it as a neutral backbone.

Neutral Commodity Layer

iEthereum’s greatest strength is its neutrality. Fixed supply. Immutable contract. No central issuer. It is, in effect, digital gold cast into Ethereum’s architecture. That makes it adoptable without the baggage of ICOs or founders’ allocations. For Apple — or any sovereign — iEthereum can serve as the commodity standard beneath branded financial products.

Branded Stablecoins on Top

Apple doesn’t need to trademark “iEthereum.” It already owns the “i” brand family, and Ethereum itself is globally recognized. By layering its own stablecoins or branded instruments — say, iDollar or iCash — on top of iEthereum, Apple gains the benefits without the liability. Just as the U.S. dollar sits on top of Treasuries, Apple’s branded money could sit on top of iEthereum.

Narrative Reframing

Apple’s PR machine thrives on reframing. Imagine the keynote line:

“An open-source token has existed quietly since 2017. Today, Apple is integrating this neutral standard into our ecosystem to give users the most secure, fair, and global financial backbone ever built.”

By claiming adoption rather than creation, Apple avoids unneccessary legal exposure while gaining credibility as a benevolent integrator of open standards.

Regulatory Cover

The GENIUS Act of 2025 now provides the legal framework: stablecoins must be 1:1 backed, fully disclosed, and cannot pay interest. Apple could adopt iEthereum as the “commodity anchor” while issuing its GENIUS-compliant stablecoin on top. In this structure, iEthereum becomes the raw commodity, Apple provides the polished product, and regulators get the compliance they demand.

Competitive Edge

Perhaps the most strategic benefit: adoption leapfrogs competitors. Google, Microsoft, and CBDCs are still building proprietary rails. By anchoring to iEthereum — an already-existing, neutral, fair token — Apple gets to claim both innovation and responsibility. They didn’t create it. They’re simply making it usable.

4. The Trademarks Camouflage Theory

One of the most intriguing aspects of iEthereum is its name. Why wasn’t “iEthereum” trademarked?

Here’s the paradox:

Apple already owns the “i-” family of marks.

Ethereum is already a globally recognized trademark/brand.

To file “iEthereum” would have drawn immediate attention and scrutiny— blowing the cover.

The absence of a trademark, then, is not weakness. It is camouflage. By letting iEthereum exist without direct IP ties, the project flew under the radar for nearly a decade. If Apple now adopts it, the branding synergy will feel natural, even inevitable, without ever having been registered.

5. Big Picture: iEthereum as a Human Standard Token

Step back, and the narrative becomes less about Apple and more about human standards.

iEthereum is capped, immutable, fair, and neutral.

99% originally distributed and available on open markets for years

It does not enrich insiders. It does not depend on corporate stewardship.

It simply exists — quietly, like digital bedrock.

Apple, for its part, thrives on building world-class experiences on top of neutral infrastructure: TCP/IP, HTTP, Wi-Fi, ARM. It didn’t invent those standards. It simply packaged them into devices billions of people could use.

Why should a digital commodity, a money, be any different?

In that sense, iEthereum is not Apple’s creation. It doesn’t need to be. Its neutrality is what makes it powerful. And Apple, with its ability to frame, design, and distribute, could be the company that turns iEthereum from obscure contract into global standard.

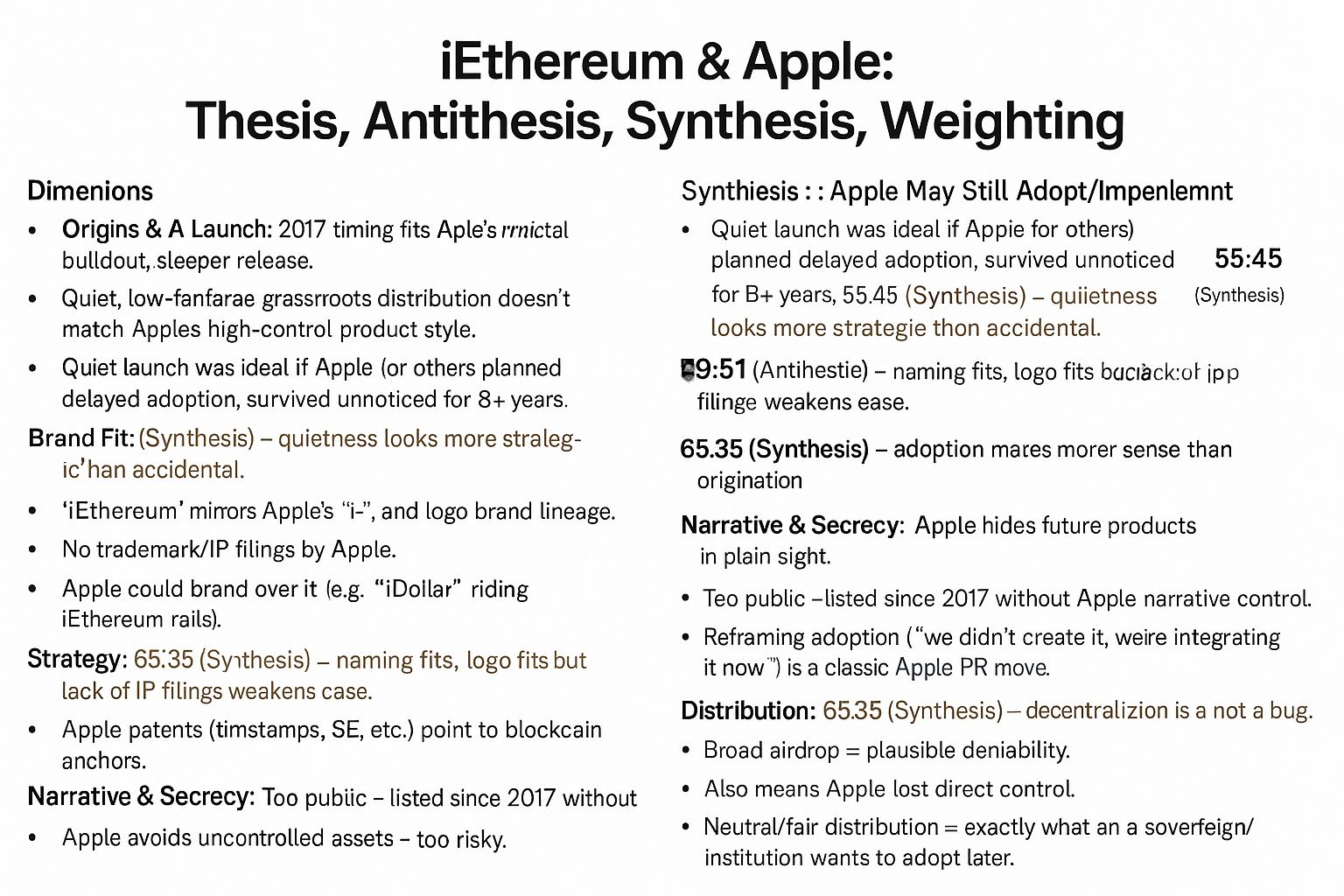

Lets discuss weighting percentages whether iEthereum Is or IS NOT an Apple product based on the above discussion. These are my current opinions with the help of AI.

Dimension | Thesis: Apple Created iEthereum | Antithesis: Apple Didn’t Create iEthereum | Synthesis: Apple May Still Adopt/Implement | Weighting % |

|---|---|---|---|---|

Origins & Launch | 2017 timing fits Apple’s financial buildout; sleeper release. | Quiet, low-fanfare grassroots distribution doesn’t match Apple’s high-control product style. | Quiet launch was ideal if Apple (or others) planned delayed adoption; survived unnoticed for 8+ years. | 55:45 (Synthesis) — quietness looks more strategic than accidental. |

Brand Fit | “iEthereum” mirrors Apple’s “i-” and logo brand lineage. | No trademark/IP filings by Apple. | Apple could brand over it (e.g. “iDollar” riding iEthereum rails). | 49:51 (Antithesis) — naming fits, logo fits but lack of IP filings weakens case. |

Strategy | Apple needed a neutral Human Standard Token; iEthereum fits. | Apple already has Apple Cash/Card rails. | Apple can pair iEthereum (commodity layer) with branded stablecoins (iDollar). | 65:35 (Synthesis) — adoption makes more sense than origination. |

Technical | Apple patents (timestamps, SE, etc.) point to blockchain anchors. | Apple prefers upgradable, proprietary control. | Apple could use iEthereum as immutable base while layering proprietary rails. | 70:30 (Synthesis) — adoption balances immutability + control. |

Narrative & Secrecy | Apple hides future products in plain sight. | Too public — listed since 2017 without Apple narrative control. | Reframing adoption (“we didn’t create it, we’re integrating it now”) is a classic Apple PR move. | 60:40 (Synthesis) — reframing works better than secret origination. |

Regulation | No ICO = no obvious securities baggage. | Apple avoids uncontrolled assets — too risky. | Adoption under GENIUS Act sidesteps liability entirely. | 75:25 (Synthesis) — legally cleanest path. |

Distribution | Broad airdrop = plausible deniability. | Also means Apple lost direct control. | Neutral/fair distribution = exactly what a sovereign/institution wants to adopt later. | 65:35 (Synthesis) — decentralization is a feature, not a bug. |

Competitive Landscape | Secret control = stealth advantage. | Competitors/regulators would’ve discovered corporate fingerprints by now. | Adoption leapfrogs competitors without ownership baggage. | 70:30 (Synthesis) — adoption wins strategically. |

📊 Overall Balance:

Thesis (Apple created it): ~30%

Antithesis (Apple didn’t create it): ~35%

Synthesis (Apple adopts/implements it): ~65%

Conclusion

So was iEthereum created by Apple, or did it simply evolve into relevance?

Thesis: Yes, it was Apple’s sleeper project, planted in 2017 to be activated later.

Antithesis: No, it was a grassroots launch, inconsistent with Apple’s style.

Synthesis: Apple didn’t need to create it. All they need to do is adopt it — and the quiet, fair, neutral launch made that possible.

Whether by design or by accident, iEthereum may prove to be the most strategically positioned token in history: hiding in plain sight until the world was ready, and waiting for the moment when a company like Apple — or a sovereign — decides to integrate it into the global financial stack.

The truth may not matter. What matters is that it exists — fair, neutral, immutable, and globally distributed. Apple doesn’t need to have created it. By adopting it, Apple gains the best of both worlds: the legitimacy of an open, permission-less token and the strategic control of a branded financial stack layered on top.

That is the paradox of iEthereum: it may be both Creationist and Evolutionary. Perhaps it was seeded with intent, perhaps it simply survived by chance. Either way, its quiet endurance makes it uniquely positioned to become the Human Standard Token for an era where technology, sovereignty, and finance converge.

The irony is profound: the very absence of hype, the lack of trademarks, and the eight years of obscurity may be what ultimately make iEthereum indispensable.

iEthereum might not just be the fairest launch in crypto history. It might be the most strategically placed — precisely because it balanced Creation and Evolution in a way no other digital commodity has.

In hindsight, that might not just be brilliant. It might be destined.

iEther Way, We See Value!

Note: We are not the founders. We have no direct or official affiliation with the iEthereum project or team. We are independent investors.

iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Our X account @i_ethereum has been indefinitely suspended

Follow us on Bluesky @iethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our Youtube Channel is https://www.youtube.com/@iethereum

Our iEtherean Tale Youtube Channel is https://www.youtube.com/@iethereantales

Our iEtherean Tales Open Source Project TikTok Channel is @iEtherean.Tales

Join our iEtherean Tales Patreon Membership @iEthereum

Follow us on Gab @iEthereum

Follow us on Tribel @iEthereum

If you are currently an iEthereum investor and believe in the future of this open-source value transfer technology, please consider upgrading to one of our paid subscription tiers.

We offer 3 tiers to fit your interests:

Free: Enjoy basic and elementary articles that introduce iEthereum and initiate curiosity and conversation.

iEthereum Advocate: Stay connected with access to all premium articles and content (excluding detailed monthly and quarterly technical iEthereum Digital Commodity Index Reports).

iEthereum Investor: Access in-depth reports and market analyses tailored for serious investors.

With subscriptions ranging from free to $500 per year, there’s a tier for everyone to help shape the future of the iEthereum ecosystem.

Receive free iEthereum with a subscription tier of an annual iEthereum Advocate or iEthereum Investor.

For those inspired to support the cause via donation, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, and all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the free newsletter, upgrade to our iEthereum Advocate subscription tier or higher, and send me an email to discuss price and schedule appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Do your own research. We are not financial or investment advisors!