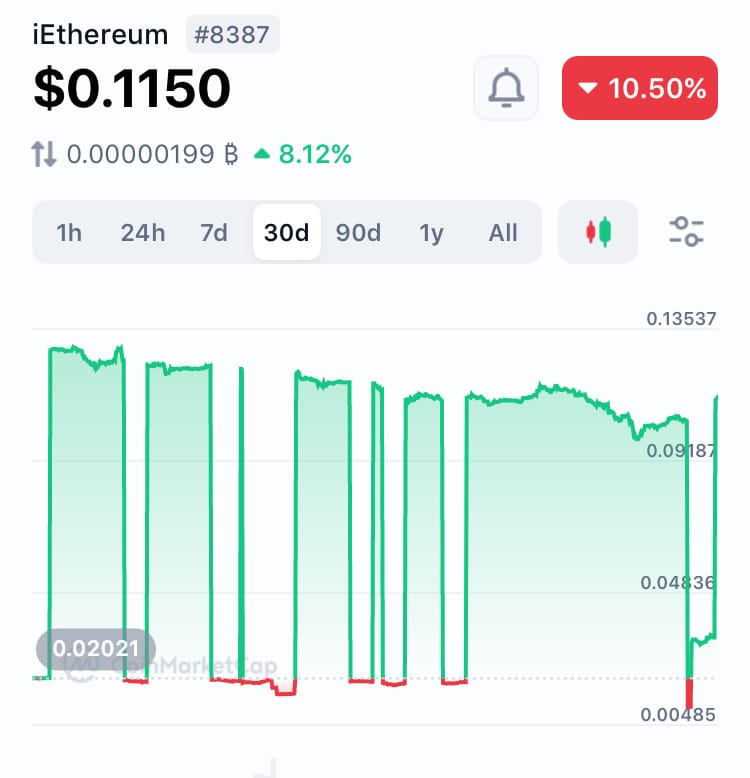

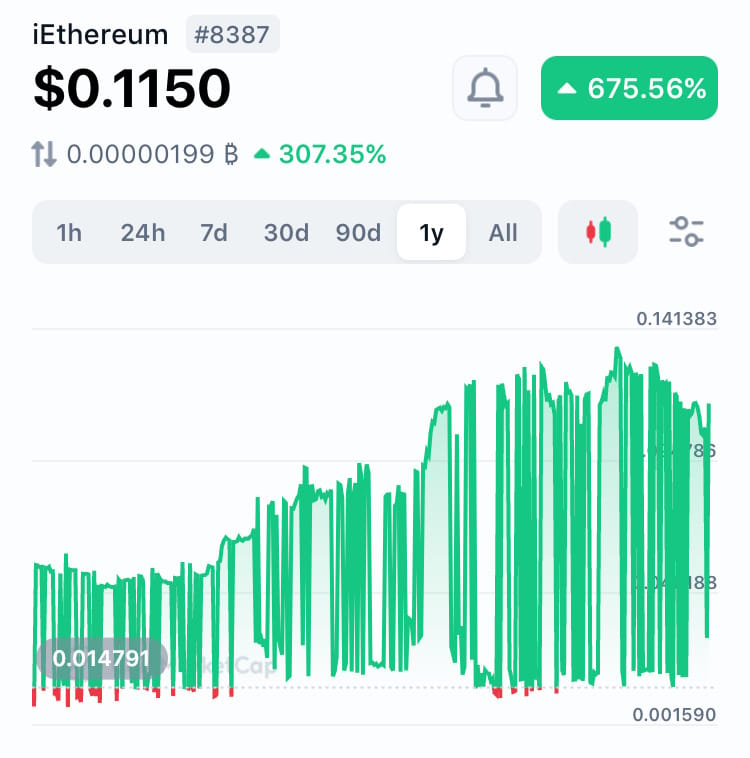

For those that haven’t been following iEthereum very closely and reading this blog for the first time, iEthereum’s price is known for its significant fluctuations on a semi-daily basis.

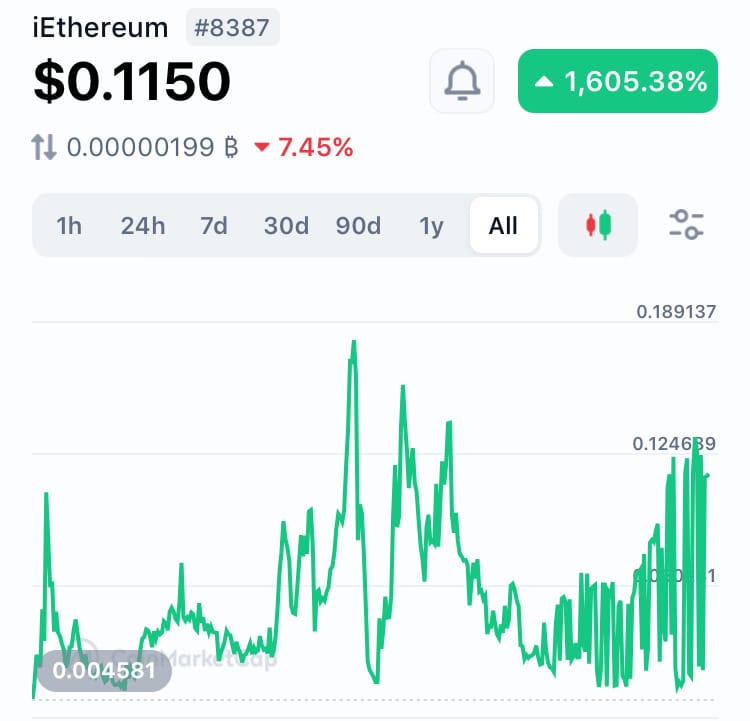

The price can rise by 600% and then fall by 80-90%. Currently, iEthereum trades within a range of $0.02 to $0.13, but as you can see in the images below, these values aren't rigid. Trading patterns still emerge, and I believe a major double-action springboard rocket ship pattern is forming.

What causes this variance? I've been exploring this question for several years and have delved into potential causes. Traders, without understanding the intricacies of the iEthereum project, often point to algorithmic bots. I tend to agree, but why don't we see these patterns in BTC, Ethereum, or other tokens? Algos run on these projects too.

I have three theories:

Low Volume Coin: iEthereum's low trading volume results in extreme price fluctuations. iEthereum is traded in pairs, mainly with BTC and ETH. If there is no trading volume at a given moment, the price remains constant in BTC or ETH terms. However, if the price of Ethereum or BTC changes, the USD price of iEthereum fluctuates accordingly. For instance, if the price of iEthereum in ETH is 0.00000613 and Ethereum drops from $4000 to $3000 USD, the iEthereum USD price will change from $0.02452 to $0.01839—a 33.33% change without any trades. Although this makes technical sense, it does not fully explain why iEthereum fluctuates between $0.02 and $0.13. The recent drastic price drop in Ethereum did change the price of iEthereum by 33.3%, but this theory alone doesn't explain the consistent fluctuations.

CoinGecko Reading Two Contracts: CoinGecko might be reading two different iEthereum contracts. This wild fluctuation from $0.02 to $0.13 could reflect the methodologies and APIs these sites use to fetch data. Even when there are no transactions on iEthereum, price fluctuations still occur. This leads me to think that CoinGecko is still interacting with both the original iEthereum and iEthereum Red contracts. In 2020, a new iEthereum (iEthereum Red) was created with the same logo as the original but with a red outline instead of blue. Until we hear further confirmation, we tend to ignore this other iEthereum. However, CoinGecko might be confusing the two, affecting the reported price. With that said, Bitcratic and iEthereum Red are no longer active, this observation is less relevant to current price fluctuations. This inconsistency led us to start our monthly reporting, capturing actual pricing via the network instead of relying on third-party intermediaries.

3) Manipulation to Constrain the Project: There might be intentional manipulation to constrain iEthereum from public view, acting as a governor to adoption.

We gained two key advantages by choosing to constrain the use case to a subset of tasks within a larger, well-known system: 1) simplicity; 2) the ready availability of knowledgeable business, technical, and cybersecurity resources

Holding the price down can deter interest and simplify monitoring and observation of a low-volume coin. I don't want to suggest a conspiracy, which implies unlawful intent. Instead, it might be a collaboration or partnership aiming to achieve a shared, legitimate goal.

Why is iEthereum undervalued? Why does its price vary so greatly? The variance could be due to coin index sites reflecting current prices via proprietary API data feeds, centralized exchanges like Yobit reporting daily trades, organic market patterns, or a combination of these factors. The exact cause remains uncertain, but these theories offer potential explanations for the significant fluctuations in iEthereum's price.

As Nikola Tesla once said:

“If Edison had a needle to find in a haystack, he would proceed at once with the diligence of the bee to examine straw after straw until he found the object of his search. I was a sorry witness of such doings, knowing that a little theory and calculation would have saved him ninety percent of his labor.”

What I see is a major double-action, ascending cup and handle, triangle with a bullish inverse head and shoulder divergent triangle pointing to a springboard rocket ship pattern forming. Squint to see in the image below.

iEther way, We see Value!

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Follow us on X (Twitter) @i_ethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our new Youtube Channel is https://www.youtube.com/@iethereum

Follow us on Gab @iEthereum

If you are currently an iEthereum investor and you believe in the future of this open source software; please consider upgrading to a premium paid sponsorship. A $104 annual sponsorship is currently the greatest assurance your iEthereum investment has a voice in the greater crypto space.

Receive free iEthereum with a sponsorship.

For those inspired to support the cause, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the newsletter, upgrade to a premium sponsorship, and send me an email to schedule payment and appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Note: We are not the founders. iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

Do your own research. We are not financial or investment advisors!