I recently discovered a new site that highlights iEthereum, which I’d like to showcase here today.

Many sites are emerging that offer users a dashboard experience for analyzing specific cryptocurrencies, typically using AI methodologies. One such site is MetaScore.

iEthereum is a low- volume, relatively obscure cryptocurrency that needs support from the open-source community to provide comprehensive token details, data, metrics and information. MetaScore addresses this need by offering a detailed project description and analysis.

MetaScore provides a project description of iEthereum as a stand alone decentralized global cryptocurrency, leveraging the Ethereum framework. It facilitates instant, peer-to-peer exchange of value and payment services, spanning fiat currencies and decentralized tokens; transcending geographical and organizational boundaries. iETH represents an advanced value transfer technology that operates seamlessly across diverse currencies and asset categories.

MetaScore further explains that iEthereum provides users access to various financial activities, including payments, remittances, payroll processing, B2B transactions, supply chain financing, loyalty programs, asset management, trading, and other on-demand services, all in a fully decentralized and cost-effective manner. It seamlessly integrates with all Ethereum wallets supporting ERC20 Tokens or smart contracts utilizing the ERC20 Standard.

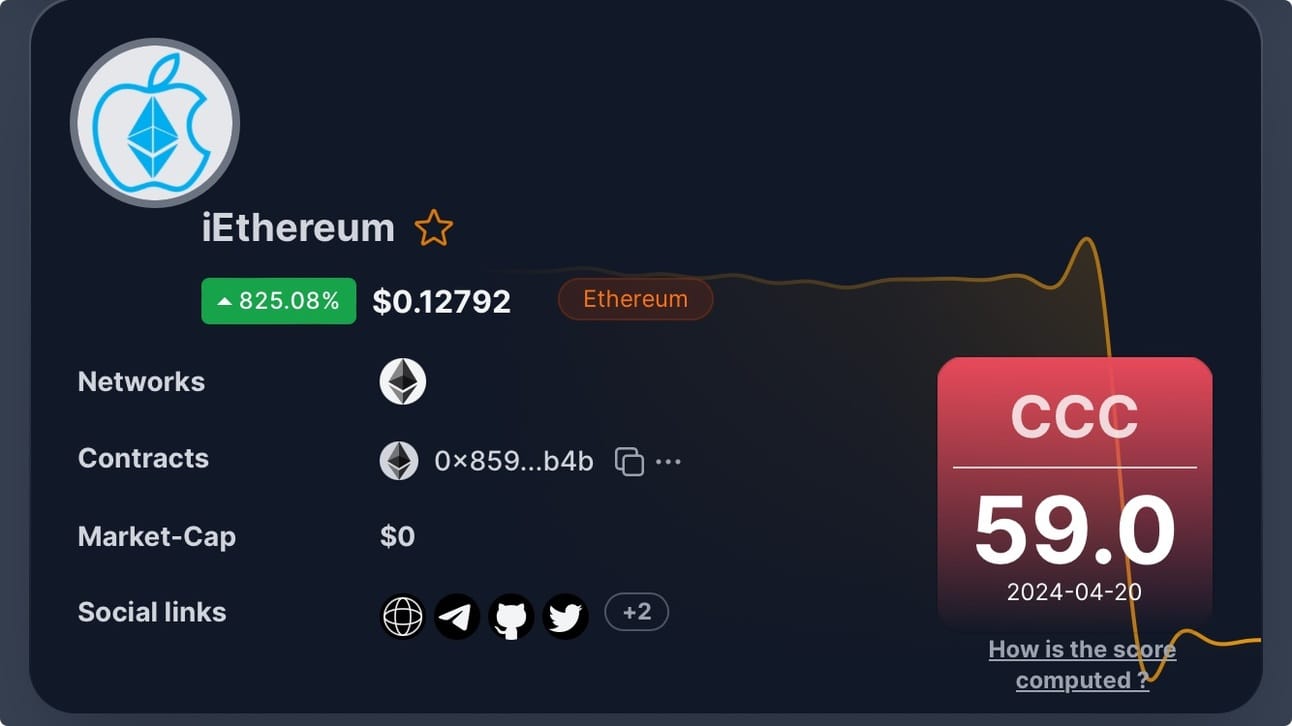

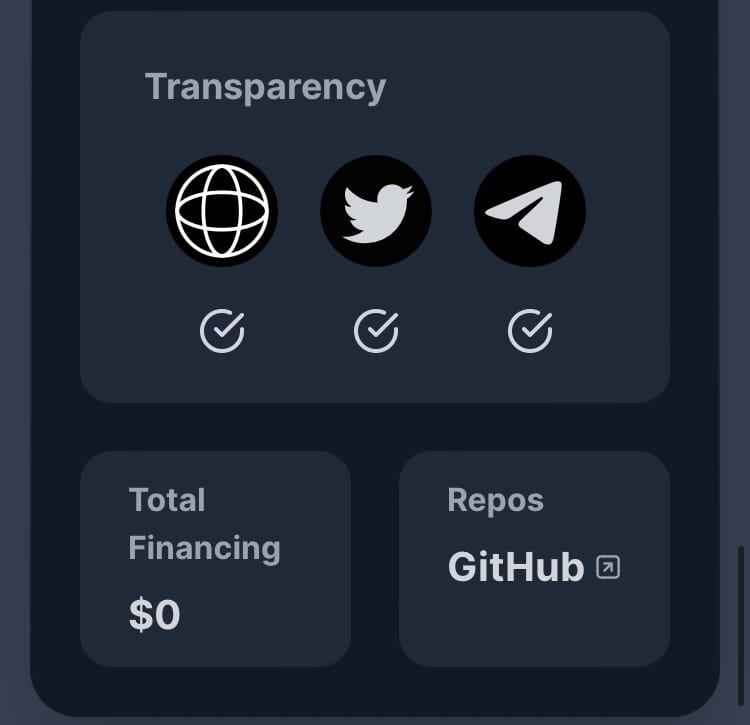

In addition to public data such as description, social links and contract information, MetaScore offers a public audit of iEthereum using their proprietary methodology.

Let's take a look at the iEthereum dashboard. The display is sleek and concise, featuring a report score of CCC 59.0 for iEthereum.

iEthereum has received an overall grade of 59, equating to a CCC rating.

MetaScore assesses iEthereum based on various criteria, integrating publicly accessible data with insights from MetaTrust's security services, specifically MetaScan and MetaScout. The final score is calculated using a carefully tuned weighted average algorithm.

MetaScore evaluates iEthereum across six data categories, each scored on a scale of 0-100:

Transaction Risk

Recent Attacks

Security Investment

Security Development

Reputation

Development Process Risk

Transaction Risk: 48.2

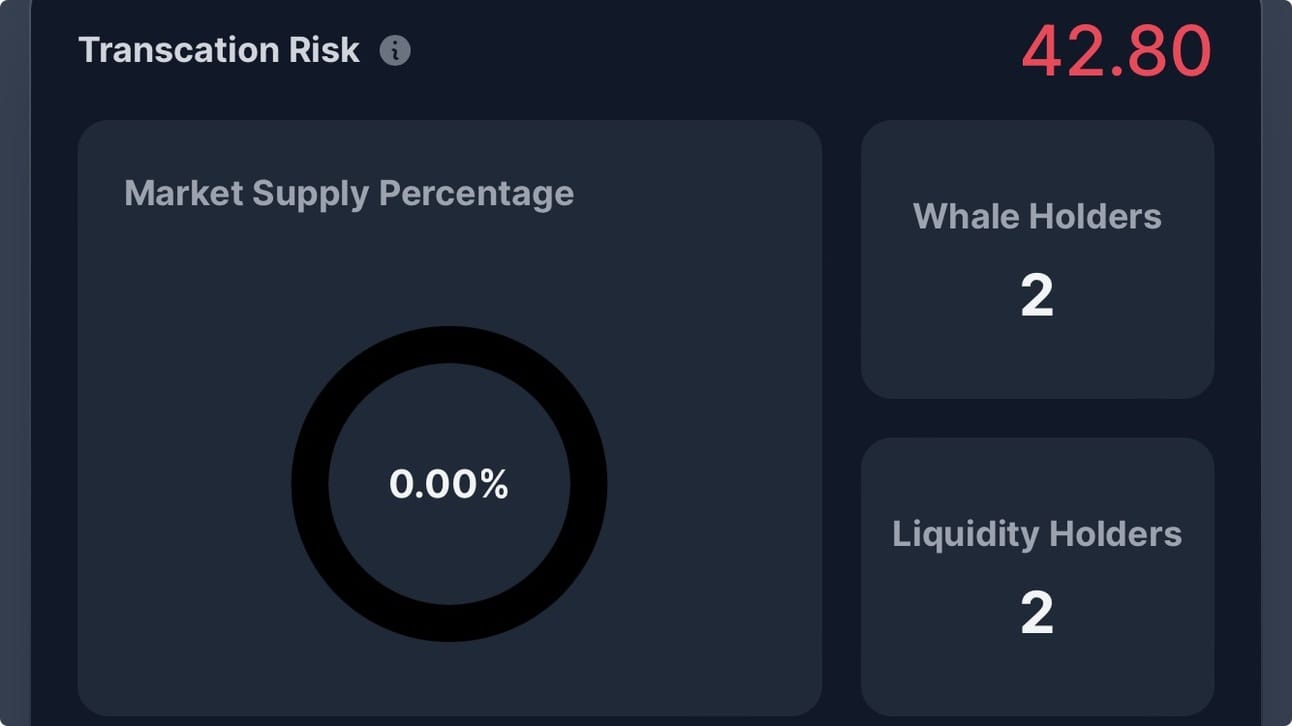

Lets start with the iEthereum Transaction Risk score of 42.8. As an iEtherean, we are not happy with this report score. If I were young again and in school, my dad would have taken me behind the wood shed for a good swat if this were on my report card. Lets figure this out— there must be some misunderstanding.

MetaScore’s scoring for iEthereum’s Transaction Risk considers several factors, including transaction verifications, pool liquidity, significant stakeholders holding over 10% shares, liquidity providers surpassing 10%, the robustness of liquidity pool reserves, market circulation and transaction volume, the number of transaction addresses and price fluctuations.

I didn’t have to promote this website. Why would I share a site that rates iEthereum at a CCC? Firstly, because we try to remain unbiased on the iEthereum topic. Our mission is to understand this coin, conduct thorough research and to report our findings honestly, whether we like them or not. Secondly, the iEthereum Advocacy Trust is committed to advocating for and earning your trust regarding iEthereum news and data. This website exists and you can find it by Googling “iEthereum MetaScore,” or by clicking the hyperlink above.

Regarding the 42.8 score given to iEthereum for its Transaction Risk Analysis; we need to highlight some details that are significantly impacting the score. This could be an AI error in the report or it may be another intentional constraint on the iEthereum technology being suppressed. We can not say for sure; we are merely reporting what is presented.

The iEthereum market supply percentage should not be stated at 0.00%. Typically, the market supply percentage represents the portion of iEthereum available for purchase compared to the total supply. According to Etherscan, 4,810,593 iEthereum, or 26.72% of the total iEthereum supply is available on the exchange books, both centralized and decentralized. This does not include current holders willing to distribute some of their holdings at a fair price not provided by the market at the moment.

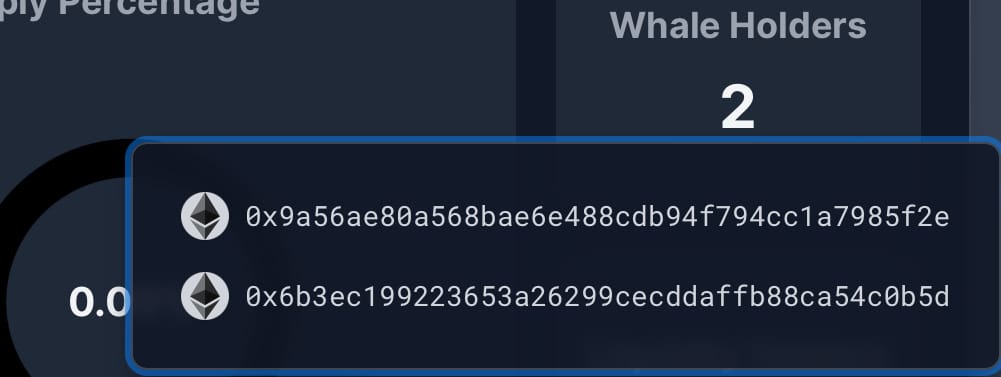

Furthermore, it states there are only two whales. The “first” whale is the Yobit exchange, holding 17.5% of the total supply of iEthereum. This likely represents several owners (clients of Yobit) who want to buy and sell on the open iEthereum exchange market. The second address Meta Score lists as a whale does not hold any “original” iEthereum. I said original iEthereum.

Another important point is the claim that there are only two liquidity holders, which is false. As mentioned earlier, 26% of the iEthereum supply is provided as liquidity across five public exchanges. The exact number of liquidity providers on the Yobit exchange is unknown. However, on Uniswap, a decentralized exchange, there are twenty liquidity providers, many of whom appear to be long- term providers.

While I don’t have access to MetaScore’s proprietary methodology algorithm, I believe the Transaction Risk Score should be higher. Personally, I would increase the score to 65, which I think is fair at this time.

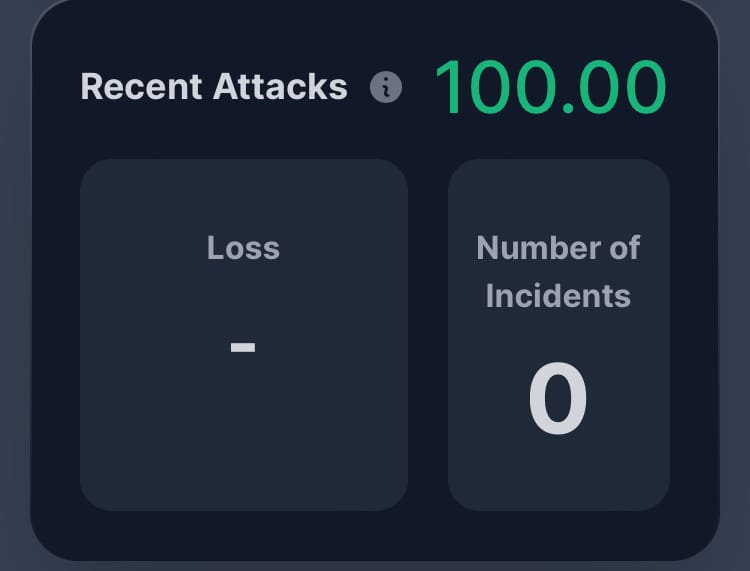

Recent Attacks: 100

To all the iEthereum skeptics out there, we are celebrating a major win. Let’s go. I want to take this moment to thank you, my managers, producers, my family, children, wife, my deceased grandparents, aunts, cousins, the nice old lady that I helped cross the street, my dog Brutus, my assistant, my god, your god, and anyone that I have forgotten. We could not have done this without you.

Now, setting humor aside, we share this proud moment as iEthereum scored a perfect 100% in the “Recent Attacks” category. This score reflects the robust security of iEthereum, highlighting the absence of security breaches and the lack of financial repercussions from such incidents. iEthereum has operated securely, safely and flawlessly for the past seven years.

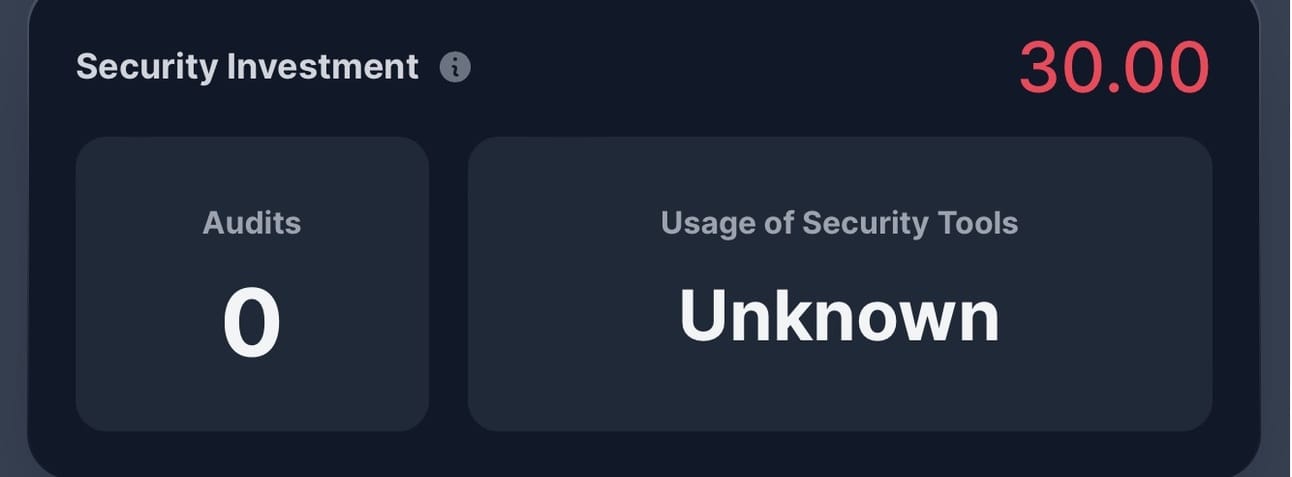

Security Investment: 30

Fellow iEthereans, sometimes we just have to take one on the chin. Do we aim for perfection across the board and pay hundreds of dollars more per iEthereum? Or do we settle for a less-than-perfect score, like a CCC rating on an AI methodology report, allowing us to purchase iEthereum for pennies or dimes on the dollar? Personally, I am content with a score of 30% on the “Security Investment” category.

This category evaluates factors such as the quantity, origin, and timing of contract audits, bug bounties, insurance coverage, utilization of security tools, alignment between audited and released versions, and the comprehensiveness of audit report coverage. Considering iEthereum’s status as an obscure crypto token with very little activity compared to others, this score seems reasonable for now.

The underlying code for the ERC20 iEthereum, ie Human Standard Token, has undergone extensive auditing and the prevailing consensus suggests its highly secure at this point. With less complexity in the code, there are fewer vulnerabilities to exploit, requiring less ongoing security investment. Development efforts in security should be directed towards other areas of the ecosystem, as highlighted in the audit category “Security Development” findings below.

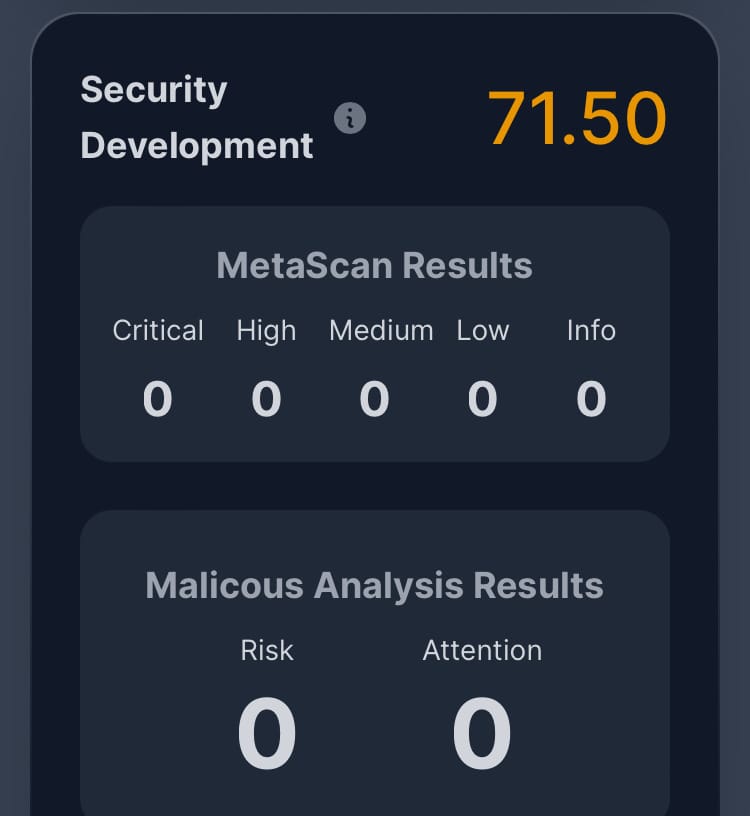

Security Development: 71.5

In MetaScore’s audit of iEthereum, the “Security Development” portion of the audit of iEthereum focuses on the safety of smart contracts, resulting in a score of 71.50%. To put this in perspective, it’s akin to a Dave Portnoy from Barstool Sports Pizza Review where reaching a perfect score of a 100% is nearly impossible, and even scoring in the 90% percentile is exceedingly challenging. Scoring in the 80% range is reserved for exceptional cases and making the 70% percentile is respectable, an above-average rating.

Interestingly, Solana on MetaScore scores an 80% despite experiencing downtime every few months. It raises questions when MetaScore’s proprietary auditing system finds 0 warnings from low to critical areas of concern for iEthereum, yet it scores lower than Solana. This prompts us to inquire: What is going on here?

MetaScore emphasizes the importance of the security of open-source code in its assessment, particularly in guarding against malicious behavior in token contracts. Given this, it seems that iEthereum should merit a higher score than 71.5%. Just saying!

Lets wrap up this category by acknowledging the need for security development, particularly in areas beyond the code itself. These essential enhancements will depend on RPCS, nodes, hardware and validators remaining updated with the requirements of the Ethereum network. Developers must continually adopt safe practices and adhere to current standards when utilizing the iEthereum token factory to create new tokens, wallets, hardware, etc. To shed light on these challenges succinctly, we have penned a few articles.

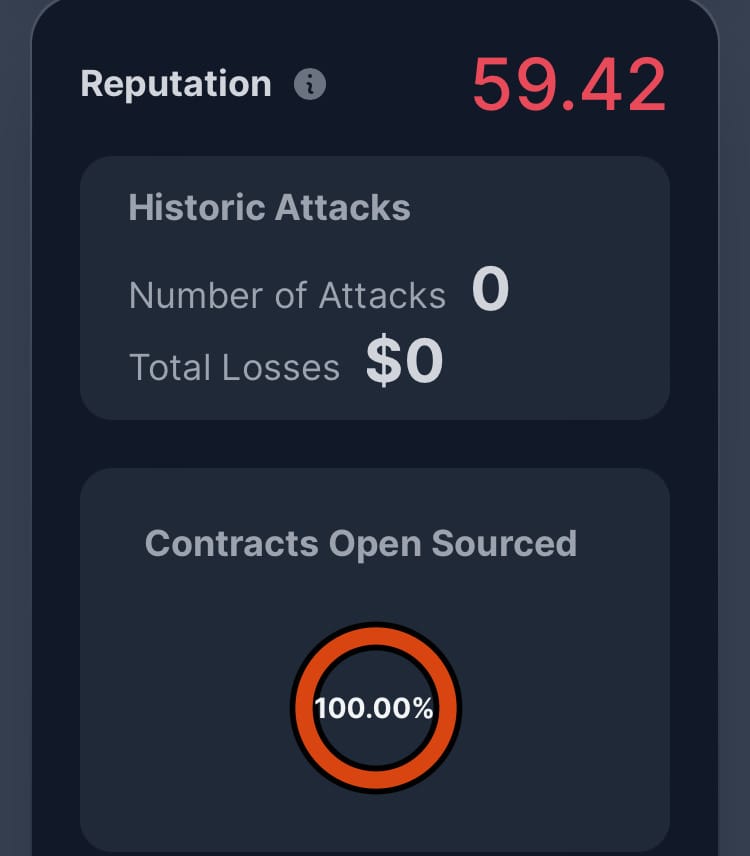

Reputation: 59.42

The reputation of iEthereum is like a trojan horse- underrated, in my opinion. Despite this, it scores a modest 59.42%. Notably, there have been zero attacks on iEthereum in its seven years of existence; boasting flawless operation and 100% uptime, resulting in zero dollar losses from non-existent attacks. This audit also acknowledges that iEthereum is entirely open source.

The reputation category evaluates various factors including valuation, white paper quality, total financing, historical attack records and vulnerabilities on the official website, open-sourcing of contracts and code repositories and transparency of critical information. While I am unsure of the algorithm’s weight on each of these category, I can concede that iEthereum’s whitepaper is lacking and appearing to be underfunded with numerous typos. The original website is defunct and the Github repository currently holds minimal content. Whether these shortcomings warrant a failing score is open to interpretation. However, rather than being surprised by the low score, I view it as an opportunity for improvement.

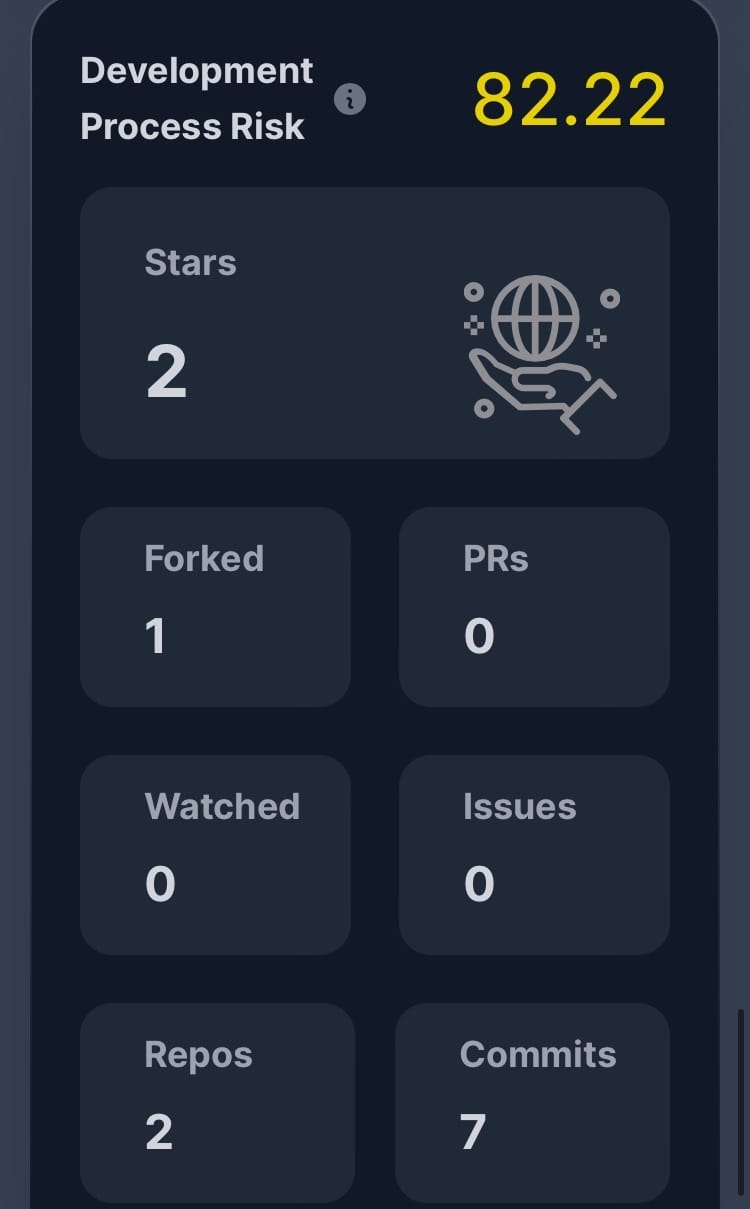

Development Process Risk: 82.22

While I acknowledge that the 59.42% score for iEthereum may be justified, particularly considering the potential impact of a lack of Github activity; I must emphasize that the “Development Process Risk” score of 82.22% is noteworthy. This score is heavily influenced by factors such as the number of followers, people, repos, issues, PRs, commits, stars, forks, and watches for open-source projects.

While it’s true that not all of these factors rely soley on Github; a significant portion of them do. Metrics such as repositories, issues, commits, stars and forks are all primarily associated with activity on the Github platform. Given this, I believe a B score for this category is fair.

MetaScore offers a comprehensive and transparent assessment of iEthereum, bringing to light both its strengths and areas needing improvement. As a decentralized global cryptocurrency leveraging the Ether framework, iEthereum facilitates a wide array of financial activities in a seamless and cost-effective manner. Despite its current obscurity and low transaction volumes, the insights provided by MetaScore are invaluable for both the iEthereum community and potential investors.

The detailed breakdown of iEthereum's performance across various categories—Transaction Risk, Recent Attacks, Security Investment, Security Development, Reputation, and Development Process Risk—paints a nuanced picture. While the triple C rating and specific low scores, like the 42.8% in Transaction Risk and 30% in Security Investment, highlight critical areas needing attention, high marks in other areas such as Recent Attacks (100%) and Development Process Risk (82.22%) demonstrate the project's potential and stability.

This balanced approach underscores the importance of continuous improvement and community engagement. By addressing identified issues and leveraging the transparency of platforms like MetaScore, iEthereum can enhance its standing and better serve its users. The open-source community’s involvement remains crucial in driving these improvements, ensuring that iEthereum evolves to meet the demands of the decentralized financial landscape.

In essence, while there are challenges to overcome, the future for iEthereum looks promising, particularly with the support of detailed analytical platforms and a dedicated community.

iEther way, We see Value!

If you see value in our weekly articles and the work that we are doing; please sign up for our free subscription and/or share this article on your social media.

Follow us on X (Twitter) @i_ethereum

Follow us on Truth Social @iethereum

Follow us over at Substack for additional fun, fictional iEtherean Tales and more technical iEthereum articles at https://iethereum.substack.com

Follow our casts on Warpcast at @iEAT

Our new Youtube Channel is https://www.youtube.com/@iethereum

Follow us on Gab @iEthereum

If you are currently an iEthereum investor and you believe in the future of this open source software; please consider upgrading to a premium paid sponsorship. A $104 annual sponsorship is currently the greatest assurance your iEthereum investment has a voice in the greater crypto space.

Receive free iEthereum with a sponsorship.

For those inspired to support the cause, the iEthereum Advocacy Trust provides a simple avenue – a wallet address ready to receive donations or sponsorships of Ethereum, Pulsechain, Ethereum POW, Ethereum Fair, all other EVM compatible network cryptocurrencies, or any Ethereum-based ERC tokens such as iEthereum.

Please consider donating or sponsoring via Ethereum address below 0xF5d7F94F173E120Cb750fD142a3fD597ff5fe7Bc

If you are interested in an iEthereum consultation, please sign up for the newsletter, upgrade to a premium sponsorship, and send me an email to schedule payment and appointment.

Feel free to contact us at iEthereum@proton.me with any questions, concerns, ideas, news and tips regarding the iEthereum project.

Thank you

Note: We are not the founders. iEthereum is a 2017 MIT Open Source Licensed Project. We are simply talking about this project that nobody else is while it is publicly listed on several coin indexes.

Do your own research. We are not financial or investment advisors!